-

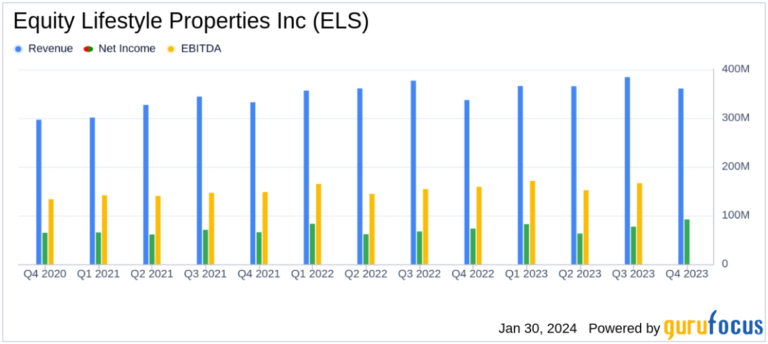

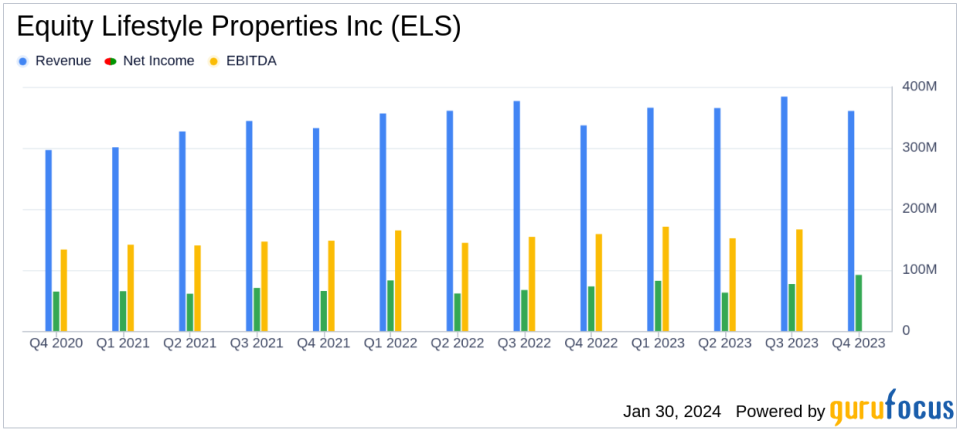

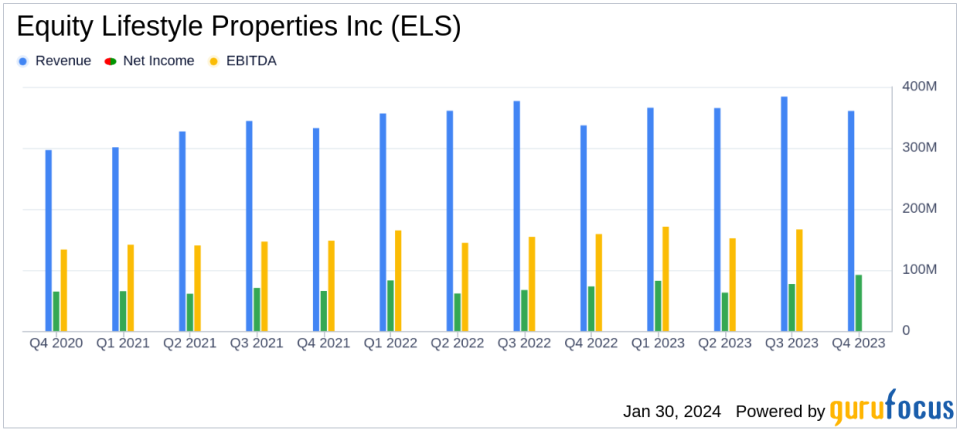

total income: Increased from $340.6 million in Q4 2022 to $360.6 million in Q4 2023.

-

Net income: Earnings to common stockholders for the fourth quarter of 2023 were $91.9 million, up from $73 million in the prior-year period.

-

FFO and normalized FFO: In the fourth quarter of 2023, FFO per share increased to $0.76 and normalized FFO per share increased to $0.71.

-

dividend increase: Announced a 6.7% annual dividend increase in 2024 to $1.91 per common share.

-

Core portfolio growth:In the fourth quarter of 2023, core real estate operating revenue increased by 6.6% and revenue from real estate operations increased by 5.2%.

On January 29, 2024, Equity Lifestyle Properties, Inc. (NYSE:ELS) filed an 8-K detailing the company's fourth quarter and full year financial results ended December 31, 2023. The report was published. ELS is a residential real estate investment trust (REIT). ) reports on his portfolio of 451 properties in the United States and British Columbia, focusing on homes, residential vehicle communities, and marinas, with a significant presence in retirement destinations.

Financial highlights and performance

ELS' financial results for the fourth quarter of 2023 showed strong growth in total revenue, increasing to $360.6 million from $340.6 million in the prior year period. Net income available to common stockholders also increased significantly, reaching $91.9 million ($0.49 per common share) compared to $73 million ($0.39 per common share) in the fourth quarter of 2022. Did.

The company's funds from operations (FFO) per common stock and operating partnership (OP) unit increased to $0.76 and normalized FFO per common stock and operating partnership (OP) unit increased to $0.71. These metrics are especially important for REITs because they provide a clearer picture of a company's operating performance by excluding the effects of depreciation and amortization, which can obscure the true profitability of a real estate investment.

Challenges and industry background

Despite the positive results, ELS recognizes the need to effectively manage the challenges and expenses posed by the inflationary environment. The company's ability to integrate and operate recent acquisitions and execute expansion in the face of supply chain delays also remains a critical factor for sustained growth. These challenges are significant because they can impact a company's operational efficiency and profitability.

Dividend increases and core portfolio performance

Reflecting confidence in ELS' financial stability and commitment to shareholder returns, ELS's Board of Directors has approved an increase in the annual dividend rate for 2024 to $1.91 per common share, which will increase in 2023. This corresponds to an increase of 6.7% from the dividend rate. This decision highlights the importance of dividend growth as a component of total shareholder return, especially for income-focused investors in the REIT sector.

The company's core portfolio, excluding properties not owned or operated, showed solid growth from 2022 to 2023. In the fourth quarter of 2023, compared to the same period last year, core real estate operating revenue increased by 6.6%, and revenue from real estate operations excluding property management increased by 5.2%.

For the future

ELS provided 2024 guidance that predicts continued growth and operational success. The company is well positioned for the future with its strategic focus on attractive retirement destinations and solid core portfolio performance. However, investors should consider the forward-looking nature of the guidance, which is subject to various risks and uncertainties that could cause actual results to differ materially from expectations.

In conclusion, Equity Lifestyle Properties' fourth quarter results demonstrate a strong financial position and commitment to delivering shareholder value. The company's focus on managing challenges and leveraging the performance of its core portfolio bodes well for its 2024 outlook. For more detailed information, investors are encouraged to review his full 8-K filing.

For more information, see Equity Lifestyle Properties Inc's full 8-K earnings release here.

This article first appeared on GuruFocus.