If you want to spot potential multibaggers, there are often underlying trends that can provide clues. First, you want to identify what is growing. return In addition to capital employed (ROCE) continues to increase base of capital employed. If you see this, it usually means the company has a good business model and plenty of opportunities for profitable reinvestment. So when we saw Elevance Health (NYSE:ELV) and its trending ROCE, we really liked what we saw.

Return on Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's annual pre-tax profit (return) on the capital employed in the business. This formula for Elevance Health is:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.15 = USD 9.9 billion ÷ (USD 109 billion – USD 42 billion) (Based on the previous 12 months to December 2023).

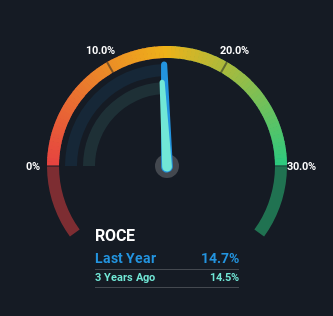

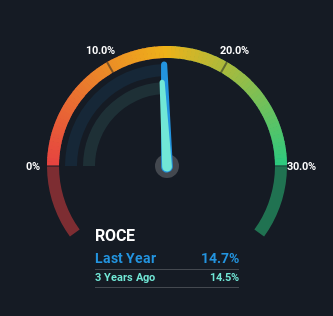

therefore, Elevance Health's ROCE is 15%. In absolute terms, this is a satisfactory return, but compared to the healthcare industry average of 11%, it's much better.

Check out our latest analysis for Elevance Health.

In the chart above, we've measured Elevance Health's previous ROCE against its previous performance, but the future is probably more important. If you want, check out forecasts from the analysts covering Elevance Health. free.

What do Elevance Health's ROCE trends tell us?

We love the trends we're seeing from Elevance Health. Over the past five years, the return on capital employed has increased significantly to 15%. It is worth noting that the company has virtually increased its return per dollar of capital employed, and the amount of capital has also increased by 35%. Increasing returns due to increased capital is common for multibaggers, which is why we're impressed.

The conclusion is…

A company that can generate strong returns on capital and continually reinvest in itself is a highly sought after trait, and Elevance Health has that. It's safe to say that investors are starting to recognize these changes, as the company's stock has returned a solid 88% to shareholders over the past five years. That said, we still think promising fundamentals mean the company requires further due diligence.

Finally, we discovered that 1 warning sign for Elevance Health We think you should know.

For those who like investing, solid company, check this out free List of companies with strong balance sheets and high return on equity.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.