Most readers would already know that the NCT Alliance Berhad (KLSE:NCT) share price has increased by a significant 31% in the last month. Considering the company's impressive performance, we decided to take a closer look at its financial metrics, as a company's financial health over the long term usually drives market results. In this article, we decided to focus on NCT Alliance Berhad's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder as it indicates how effectively their capital is being reinvested. In other words, ROE shows the profit generated per dollar of a shareholder's investment.

Check out our latest analysis for NCT Alliance Berhad

How is ROE calculated?

ROE can be calculated using the following formula:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, NCT Alliance Berhad's ROE is:

6.2% = RM38m ÷ RM610m (Based on trailing 12 months to December 2023).

“Return” refers to a company's earnings over the past year. One way he conceptualizes this is that for every RM1 of shareholders' equity, the company made a profit of MYR0.06.

What is the relationship between ROE and profit growth rate?

It has already been established that ROE serves as an indicator of how efficiently a company will generate future profits. We are then able to evaluate a company's future ability to generate profits based on how much of its profits it chooses to reinvest or “retain”. Assuming all else is equal, companies with both higher return on equity and higher profit retention typically have higher growth rates when compared to companies that don't have the same characteristics.

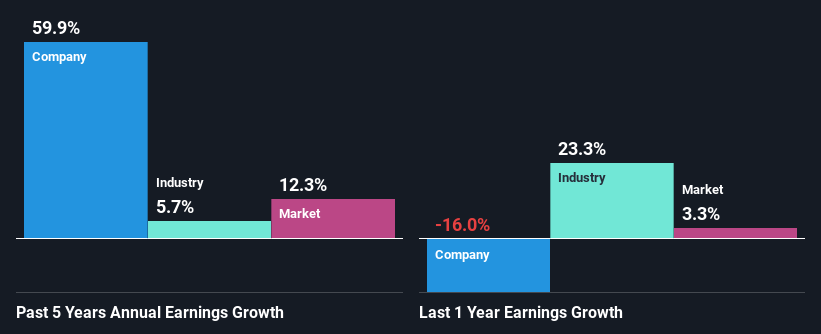

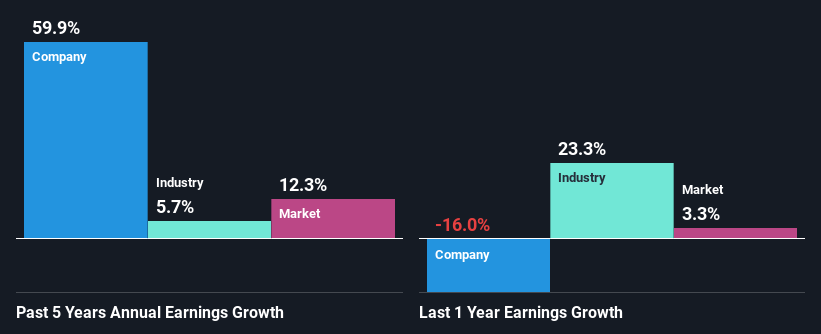

NCT Alliance Berhad's earnings growth and ROE 6.2%

At first glance, NCT Alliance Berhad's ROE does not seem to be very promising. However, the fact that the company's ROE is higher than the industry average ROE of 4.2% is certainly interesting. Especially considering NCT Alliance Berhad's exceptional 60% growth in net profit over the past five years. That being said, his ROE for the company is a little low to begin with, but it's just that it's higher than the industry average. Therefore, there may be other reasons for the increase in revenue. Companies with high earnings retention rates or in high-growth industries.

As a next step, we compared NCT Alliance Berhad's net income growth with its industry. We're pleased to note that the company's growth rate is higher than the industry's average growth rate of 5.7%.

Earnings growth is a big factor in stock valuation. Investors should check whether expected earnings growth or decline has been factored in in any case. By doing so, you can find out if the stock is headed for clear blue waters or if a swamp awaits. If you're wondering about NCT Alliance Berhad's valuation, check out this gauge of its price-to-earnings ratio compared to its industry.

Is NCT Alliance Berhad using profits efficiently?

NCT Alliance Berhad currently pays no dividends, which essentially means that it reinvests all of its profits back into the business. This definitely contributes to the high profit growth rate discussed above.

summary

Overall, I'm pretty satisfied with NCT Alliance Berhad's performance. In particular, we like that the company reinvests heavily in its business at a reasonable rate of return. Unsurprisingly, this led to impressive profit growth. If the company continues to grow its revenue as it has, this could have a positive impact on the stock price, given how earnings per share affect the stock price over the long term. Remember that the price of a stock also depends on its perceived risk. Therefore, investors should always be informed about the risks involved before investing in a company. To learn about the 1 risks he has identified for NCT Alliance Berhad, please visit our risks dashboard for free.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.