Disney (DIS) once embraced the opportunity to expand into India. It is now going backwards.

Five years ago, a $71 billion deal with media giant 21st Century Fox gave it access to Indian television network Star, which hosts dozens of sports and entertainment channels, and its streaming service Hotstar. Ta.

But the House of Mouse is now scaling back its domestic ambitions and taking a backseat to local companies. Last month, Disney announced it would merge Star, once considered the crown jewel, with Indian telecoms giant Reliance Industries in a joint venture estimated at $8.5 billion. Disney will become a minority shareholder in the company.

Analysts told Yahoo Finance that the decision highlights the challenges posed by India's entertainment market despite its attractive growth potential. While there is an opportunity to reach millions of viewers in India, competition is fierce and success requires significant investment, and U.S. media companies tackling the cord-cutting challenge in the country are prepared. may not have been completed.

India, with a population of over 1.4 billion people, has become a media hotspot, with TV and streaming revenue expected to grow by 11% in 2024. That's compared to much slower growth in other developing countries, according to analytics firm Ampere Analysis. .

However, this market has been difficult for American media companies to break into. First of all, Indian consumers rely primarily on mobile phone companies for access to streaming services due to their limited broadband infrastructure, which makes it easier for companies to connect directly with Indian consumers. Building relationships is difficult.

Indian consumers are also relatively less willing to pay for streaming platforms due to the free ad-supported model and rampant piracy by local content providers.

Local content providers (top four being Star India, Viacom18, Sony, and Zee Entertainment) have largely been able to serve India's vast population across different languages and dialects. Reliance has leveraged the success of its burgeoning telecom business to add yet another layer of competition to India's diverse television market.

“The media landscape is quite fragmented,” Neil Anderson, senior analyst at Ampere Analysis, told Yahoo Finance, adding that local companies have strong entertainment and sports production capabilities, as well as He pointed out that the company has a large advertising business.

It's not just local competitors that are stealing market share. Mihir Shah, vice president at a research firm, said that the two biggest tech giants, Netflix (NFLX) and Amazon (AMZN), which have significantly higher free cash flow levels than traditional media, are able to do so by offering localized content. He said that the company is making inroads into high-income consumers in India. Media Partners Asia.

“The real story in India is the growth of middle-income to high-income consumers,” Shah said. “This is a segment that many technology platforms address [like] Netflix and Prime Video really dominate. ”

But as income levels fall and more investment is needed to overcome them, the challenge will be to reach the next 50 million households, he said.

All of this made for a tough time for Disney. The company lost the rights to stream Indian Premier League cricket matches via Hotstar to Reliance in 2022.

In another setback, Hotstar lost popular HBO content, including top shows such as “Succession,” “Game of Thrones” and “The Last of Us.” HBO's parent company, Warner Bros. Discovery (WBD), has instead made the content available through JioCinema, the Indian streaming service owned by Viacom18.

For its latest fiscal year ending in September, Disney reported 37.6 million Hotstar subscribers, a significant 39% decrease compared to the same period last year.

In addition to headwinds for subscribers, currency exchange is also an issue.

For example, the value of the Indian rupee has fallen by about 20% since Disney's acquisition of Fox in 2019. This is impacting metrics such as average revenue per user (ARPU) for Hotstar subscribers, which is only 1 cent on the dollar compared to the current state of the metric. For Disney subscribers based in the United States.

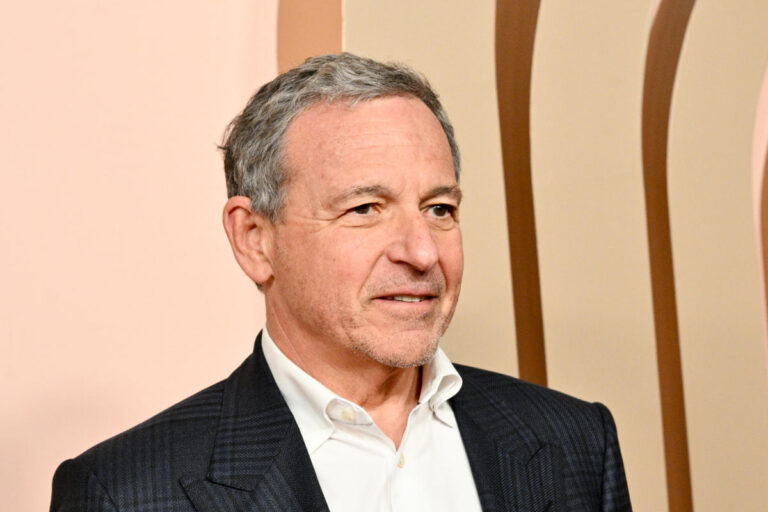

Disney CEO Bob Iger acknowledged challenges in the Indian market during an earnings call in November, but said the company “wants to stay,” adding that its linear business in India “is actually very weak.” It's going well,” he said.

Industry sources told Yahoo Finance that issues Disney is facing in its core business likely influenced the company's decision to exit.

In the years since the Fox merger, Disney's parks business has slowed, its linear TV division has declined, and its streaming business, which launched in late 2019, is still unprofitable. Meanwhile, activist Nelson Peltz reiterated his call for a shake-up of Disney's board after the company's stock hit a multi-year record low last year.

“The first thing you have to do is put on your oxygen mask and think, 'What is the core of our business?'” said David Wisnia, partner and managing director of media and entertainment at consulting firm Alvarez & Marsal. is important,” he told Yahoo Finance.

Disney is not the only US media giant to change course towards India recently. Just two weeks after the Disney joint venture announcement, Paramount Global (PARA) announced it would sell a 13% stake in Indian media company Viacom18 to Reliance for approximately $517 million.

“These companies need to focus on the 'core' of streaming,” Wisnia said. “So before you invest in something that is not going to be profitable for years to come, you need to fix it first and make sure it is a profitable business.”

That may mean that fast-growing markets like India are not a priority today for an industry already under immense pressure.

“Legacy companies don't have the luxury of time,” Wisnia emphasized. “Their priority is immediate return.”

Still, Disney seems willing to play this long game.

“Disney is still choosing to have skin in the game,” said Media Partners Asia's Shah, noting that the company holds a 37% stake in a joint venture partnership with Reliance. . “They have a good reputation and can use the proceeds to realign their operations in the domestic market.”

alexandra canal I'm a senior reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, Email alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance