Given that venture capital as a whole had its worst fundraising quarter since 2016, the numbers on climate tech are riding the wave of the Inflation Control Act and other policy incentives, with both brand new funding and other policy incentives This suggests that there is a growing coalition of investors willing to make long-term bets on Start-ups and more advanced companies looking to build commercial-scale climate technology factories and clean energy farms. But the wave has probably peaked. Unless more climate technology companies can prove their worth to early investors, the sector's financial wheels could grind to a halt.

“We're hearing from many fund managers, first-time investors, institutional investors and PE managers that raising capital is now more difficult than ever,” said Kim Zou, CEO and co-founder of Sightline. he said.

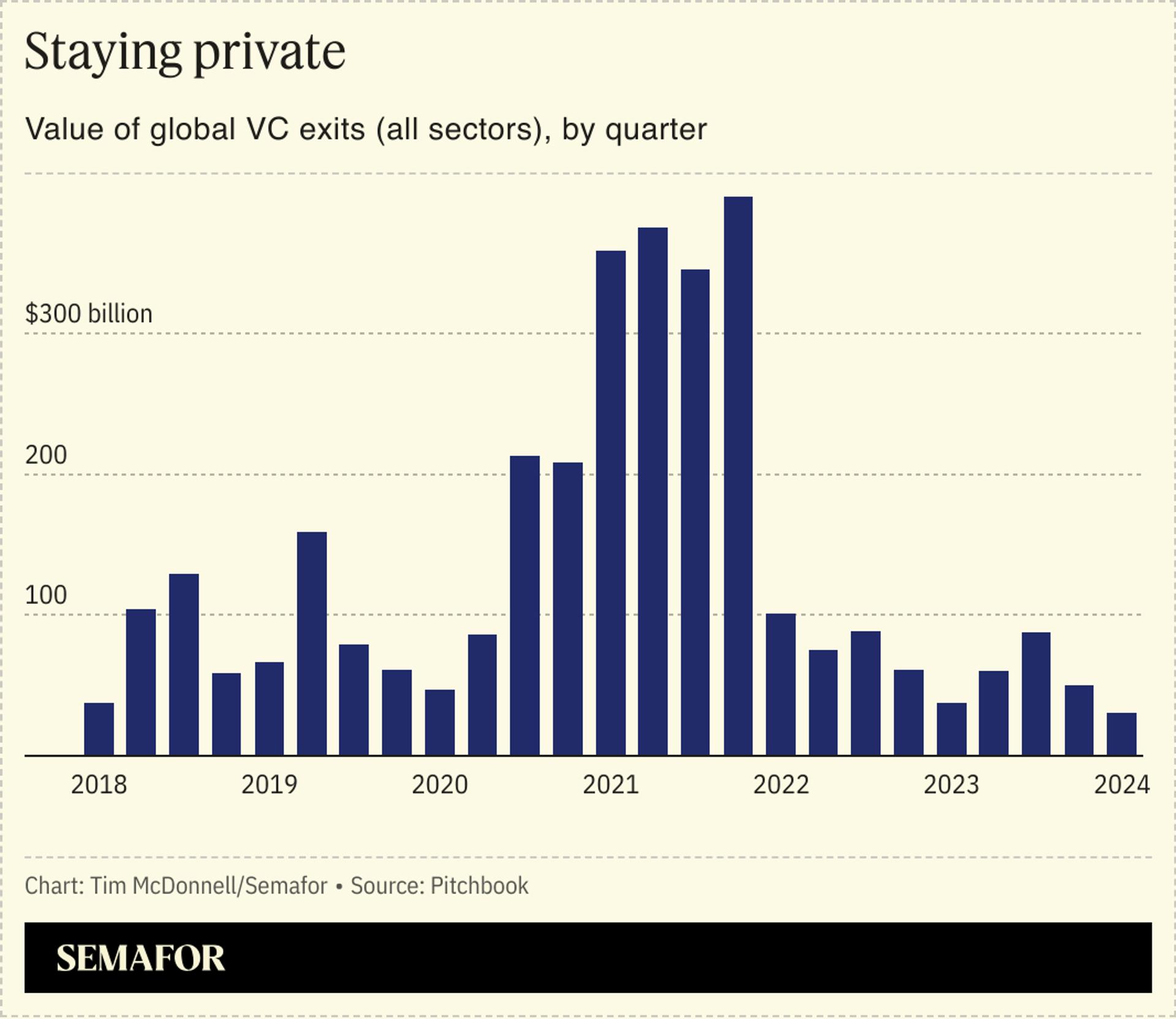

Stubbornly high interest rates are one obstacle. But a more serious challenge is that most climate change technology companies don't go public or sell, typically the type of company that returns money to the startup's original investors and recycles the money to other startups. It is an “exit”.

“The focus is on an IPO in 2024,” said Ari Newman, co-founder of Colorado venture firm Massive. “There is so much liquidity locked up in private companies right now, and unless that is released, unless we break the deadlock, where is the money going to come from?”

IPOs overall have slowed, particularly for climate technology startups. Following the dismal performance of many climate tech companies that went public via SPACs around 2021, other companies and their investors are looking to gather further evidence of profitability before going public. And the fact that 80% of climate change technology acquisitions are private, according to Sightline, shows that the terms of companies selling out to large corporations or PE firms are usually not something to brag about.

None of this is all that surprising. Climate change technology is about to implement large-scale and costly changes to the global economy, but in most cases it is still too young to have many candidates for a splashy exit. The overall increase in 'dry powder' in climate change technologies hides critical funding gaps, making it difficult to reach that level of maturity, especially for mid-stage companies working on their first large-scale projects. It has become.

Last year, there were some notable examples of successful exits from climate-changing technologies. Nextracker's stock price has doubled since the solar panel hardware company's $638 million IPO in February 2023. Carbon capture company Carbon Engineering was acquired by Occidental Petroleum in August for $1.1 billion, illustrating how climate change technology is competing with wealthy individuals with deep pockets. Buyers of carbon companies.

The problem is that investors need more exits, not just to put money back into circulation, but to gather concrete evidence of what works. Without more such investments, many potential investors will stay away, said Ben Walkon, a partner at New York venture firm MUUS Climate Partners. We are taking a very cautious approach.”