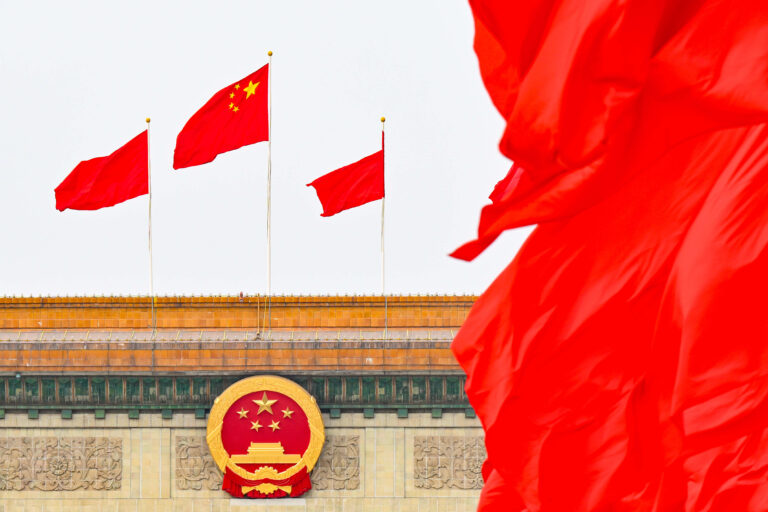

BEIJING, CHINA – MARCH 4: The second meeting of the 14th Chinese People's Political Consultative Conference (CPPCC) National Committee opened on March 4, 2024 in Beijing, China, with the Chinese national flag displayed at the Great Hall of the People. fluttering. (Photo courtesy of VCG/VCG, Getty Images)

Video Visual China Group | Getty Images

China has tightened its grip on consumer finance companies, raising capital limits for non-bank financial companies that offer small personal loans.

The measures announced by the National Financial Supervisory Administration on Tuesday will come into effect from April 18.

It comes at a time when the Chinese government is tightening its grip on the financial sector.

The new rules stipulate that businesses eligible to provide consumer loans (excluding those for home and car purchases) must have a minimum registered capital of 1 billion yuan ($139 million). . That's three times the minimum amount previously required under the 2014 rules, Reuters reported.

According to the statement, investors in consumer finance companies are divided into major investors and general investors. The main investor must hold at least his 50% stake.

According to the regulator, financial institutions that are major investors must have total assets of at least 500 billion yuan ($69.45 billion) or equivalent assets in freely convertible currencies by the end of their most recent fiscal year. I need to be there.

According to NFRA, large investors who are non-financial institutions must have operating profits of at least 60 billion yuan ($8.3 billion) in the most recent fiscal year.

In recent years, China has sought to curb the rapid growth of non-bank debt, particularly bonds issued by shadow banks outside the formal banking system.

The country's slowing growth is also weighing on creditworthiness across the Asia-Pacific region.

Moody's said the rating agency lowered the outlook for China's government's credit rating from stable to negative in early December, saying Beijing's support measures to strengthen the financial sector could weaken fiscal, economic and institutional strength. I pulled it down.

Earlier this month, at a two-session meeting, China set a GDP growth target of around 5% for 2024 and announced the issuance of “very long-term” special bonds for major projects.

—CNBC's Evelyn Cheng and Clement Tan contributed to this article.