David Golden, Chief Financial Officer of Booking Holdings (NASDAQ:BKNG), sold 500 shares of the company's stock on February 15, 2024, according to a recent SEC filing. The transactions were conducted at an average price of $3,738.64 per share, giving him a total value of $1,869,320.

Booking Holdings Inc is an online travel company with operations around the world. The company serves approximately 230 countries and territories through a variety of consumer brands, including Booking.com, Priceline, Agoda, KAYAK, Rentalcars.com and OpenTable. The company provides a wide range of travel and restaurant reservations and related services to consumers and local partners.

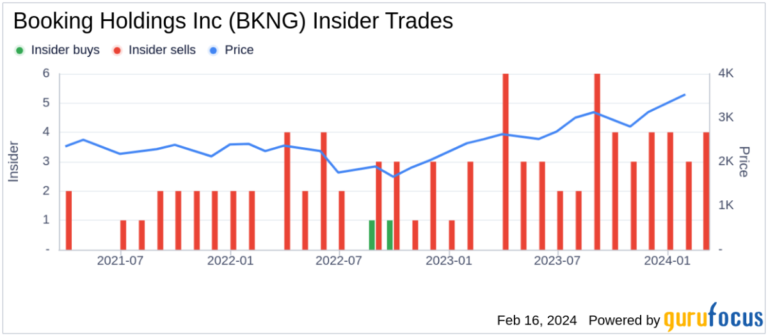

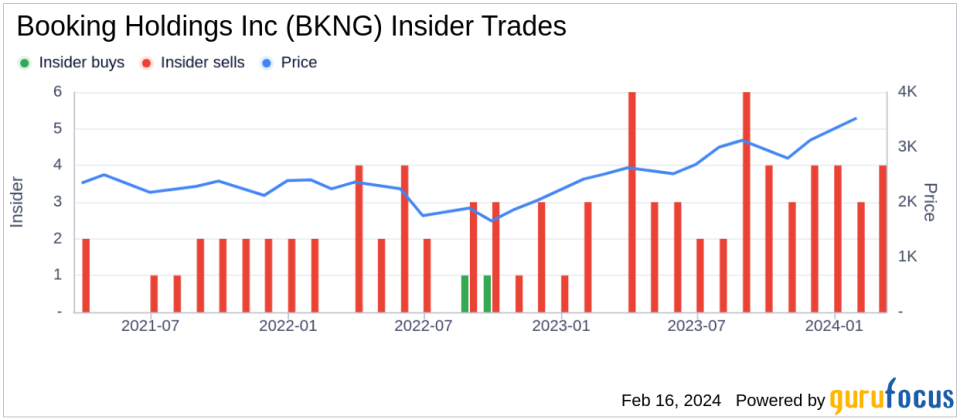

Over the past year, insiders have sold a total of 7,500 shares of Booking Holdings stock, but didn't buy any. The recent sale further strengthens the trend of insider selling we've observed at the company.

Booking Holdings Inc.'s insider trading history shows a selling pattern with 0 insider buys and 45 insider sells over the past year.

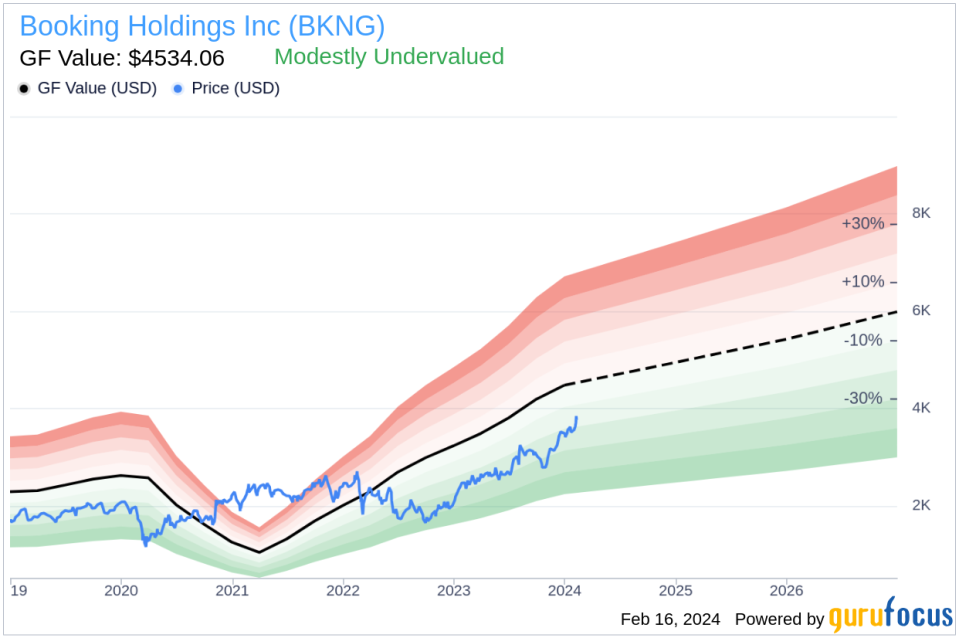

In terms of valuation, on the day of the insider sale, Booking Holdings stock was trading at $3,738.64, giving the company a market capitalization of $129.719 billion. The price-to-earnings ratio of 25.88 is higher than the industry median of 20.65, but lower than the company's historical median price-to-earnings ratio.

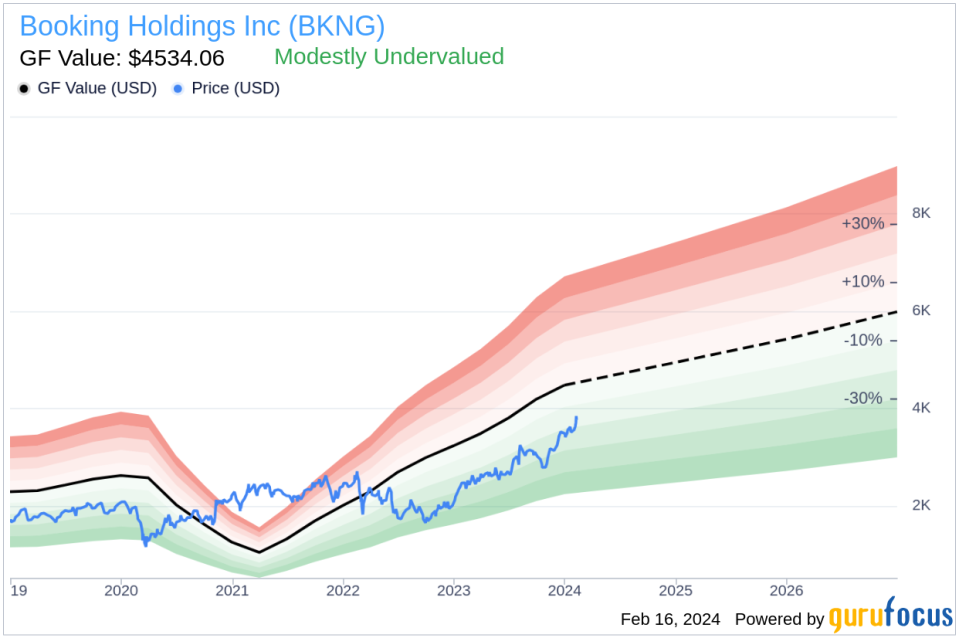

According to the GuruFocus Value chart, with a stock price of $3738.64 and a GuruFocus Value of $4534.06, Booking Holdings Inc.'s Price to GF Value ratio is 0.82, which means the stock is considered to be moderately undervalued.

GF Value is calculated based on historical trading multiples, GuruFocus adjustment factors related to the company's past performance, and future performance estimates provided by Morningstar analysts.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.