Fox News contributor Liz Peek, National Review reporter Caroline Downey, and author Batya Unger-Sargon criticize President Biden for claiming on 'Kudlow' that climate change is worse than nuclear bombs. It's reacting.

Investment management firm BlackRock said in an annual filing with the Securities and Exchange Commission that Chief Executive Officer Larry Fink's advocacy of environmental, social and governance policies (ESG) has hurt the firm's “reputation.” acknowledged that there is a possibility of harm and loss of profits.

“BlackRock's business, size, and investments have received significant media coverage and increased attention from a wide range of stakeholders,” the filing, filed late last month, said. “This increased scrutiny has resulted in, and may continue to result in, negative publicity and adverse actions against BlackRock.”

Furthermore, “BlackRock's perceived or actual actions, or lack thereof, or perceived lack of transparency with respect to matters subject to scrutiny, such as ESG, may be viewed differently by various stakeholders. “This could adversely affect BlackRock's reputation and business, including through redemptions and redemptions.” Customer Termination, Legal and Government Actions and Investigations. ”

Mr. Fink has advocated investing in clean energy, but has come under intense scrutiny from conservatives, including many Republican attorneys general.

BlackRock says 'megaforces' like AI, green energy transition are driving economic structural changes

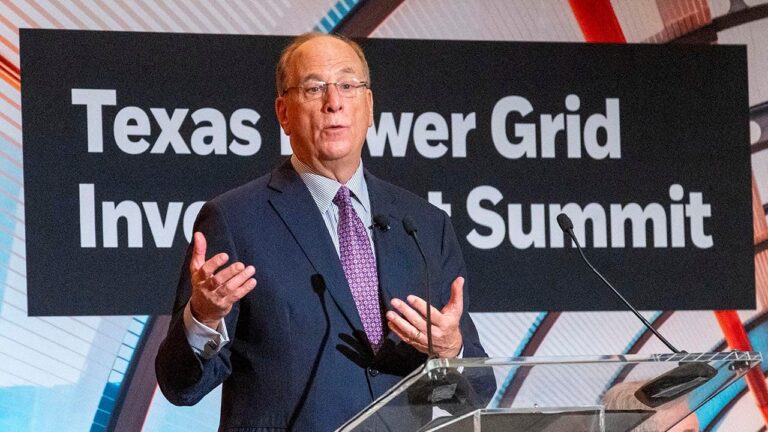

Larry Fink met with Republican lawmakers at a summit in Houston last month after being blacklisted by the state over BlackRock's ESG advocacy. (Kirk Side/Houston Chronicle via Getty Images/Getty Images)

“The overlapping personal and business relationships between directors of major mutual funds and BlackRock raise red flags about potential conflicts of interest,” Virginia Attorney General Miyares said last year. “This raises further questions about the flawed investment strategy that was carried out in its name.” In a release, the state of Virginia announced it would join a coalition of states demanding answers from BlackRock.

Tennessee Attorney General Scumetti said last year while announcing a lawsuit against BlackRock over ESG:[s]Some indicate companies that focus solely on return on investment, while others indicate companies that specifically consider environmental factors. Ultimately, we want to ensure that businesses, regardless of their size, treat Tennessee consumers fairly and honestly. ”

BlackRock said it has dismissed the claims in the lawsuit.

BlackRock, State Street Face Subpoenas Participate in Internal ESG Probe

And last month, Texas blacklisted the company over its ESG policies, prompting Fink to reach out to Lieutenant Governor Dan Patrick and other Republican officials at an energy investment summit in Houston. Ta.

According to the New York Post, BlackRock has about $10 trillion in assets, of which ESG accounts for about $700 billion.

As the discussion around ESG deepens, other companies are also being affected.

Bank of America appears to have reneged on its 2021 pledge not to fund new coal projects, with the December Environmental and Social Risk Policy Framework submitted at the end of the year stating that Projects such as oil drilling in the North and the Arctic Circle will be implemented in the future, he said. Faced with “enhanced due diligence.”

Some states, including New Hampshire, Texas, and West Virginia, have enacted laws that prohibit banks from denying loans to coal projects, criminalizing so-called “environmental, social, and governance” principles within companies. It was even reported that he was trying to become York Times.

A conservative backlash against environmental considerations in business has also led other companies to withdraw from certain environmentally friendly initiatives.

Earlier this year, a coalition of 12 Republican state agriculture commissioners sent a letter to six large U.S. banks, including Bank of America, over their net-zero ambitions and a backlash against what they called “woke investing.” opened a new front. This fight has been largely spearheaded by state attorneys general and treasurers.

All six banks are members of the Net Zero Banking Alliance (NZBA).

Click here to read more on FOX Business

Fox Business has reached out to BlackRock for comment.