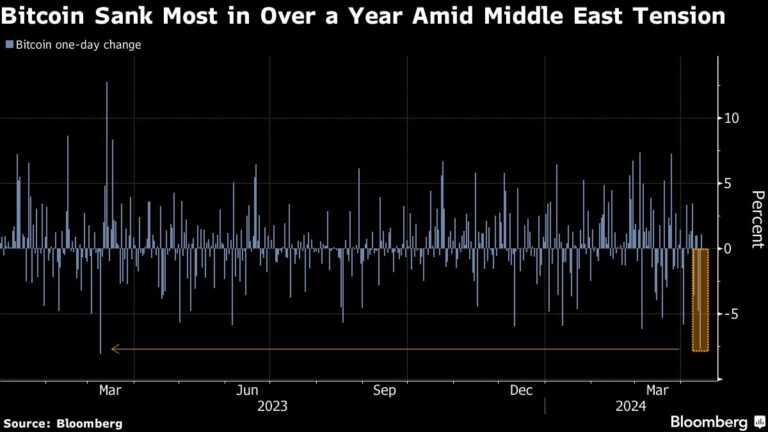

(Bloomberg) — Bitcoin has rebounded from its sharpest decline in more than a year, a sign of impending volatility across asset markets as investors digest the prospect of military escalation in the Middle East. It is shown that.

Most Read Articles on Bloomberg

The largest cryptocurrency rose as much as 5.9% and was trading at around $64,600 as of 11:40 a.m. Sunday in London. Smaller coins such as Polkadot and Uniswap rose more than 10%, while Ether rose 5%.

Iran has launched attack drones and missiles against Israel in apparent retaliation for an attack in Syria that killed a top Iranian military official, pushing the region's conflict into a dangerous new phase. Because Iran's actions took place while most markets were closed, crypto traders found themselves in the unusual position of being among the first to react to significant geopolitical events.

Read more: Middle East enters dangerous new phase after Iran attack on Israel

“More investors than usual may be choosing to express their market views through cryptocurrencies,” said David Rowant, head of research at FalconX.

Tensions hurt stocks Friday, pushing bonds and other safe havens like the dollar higher as Israel braced for an attack. About $1.5 billion in bullish crypto bets through derivatives were liquidated on Friday and Saturday, according to Coinglass data, making it one of the largest two-day liquidations in at least the past six months. .

Ebtikar said the digital asset's leverage has been “completely overwhelmed in the last three days, which has caused a significant deterioration in prices.”

Most Middle East stock markets were in the red on Sunday. As of 8:36 a.m. London time, Israeli stocks had given up earlier gains and were slightly lower.

Read more: Israel and allies nearly thwart unprecedented attack from Iran

A major military escalation between Israel and Iran will test the concept of Bitcoin and other crypto assets as a haven in times of turmoil. This idea is often expressed by promoters of the asset class. When Russia invaded Ukraine in early 2022, cryptocurrencies were in the early stages of a market meltdown that lasted until the end of the year.

Bitcoin has fallen from its mid-March record of $73,798. Demand for the dedicated U.S. exchange-traded fund, which debuted in January, drove the token to all-time highs, but net inflows into the product have slowed in recent days.

Cryptocurrency speculators are awaiting the so-called Bitcoin halving, when the new supply of tokens will be cut in half, expected around April 20th. Historically, halvings have been a tailwind for prices, but there are growing questions about whether they are likely to repeat. Given that Bitcoin recently reached a historic peak.

(Updates to add Ether in second paragraph.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP