pixel image

Bain Capital Specialty Finance Co., Ltd. (New York Stock Exchange:BCSF) is a well-managed BDC with substantial excess dividend coverage that could provide significant excess cash return potential in 2024.

BDC raised its dividend twice last year, but its investment portfolio With higher payments and headwinds to origination in a high interest rate environment, Bain Capital Specialty Finance's net investment income is more than sufficient to enable a significant dividend increase this year.

Passive income investors can also take advantage of the 11% discount to net asset value, so BCSF offers a covered yield of 11.4%, as well as the possibility of rerating.

My evaluation history

Bain Capital Specialty Finance improved its dividend payout metrics last year, in part because its variable rate loan exposure increased BDC's net investment income in 2023.

This was the reason for me To change my stock classification to buy. Given that Bain Capital Specialty Finance continued its strong performance with dividend coverage in the fourth quarter, I think BCSF has a fair chance of delivering a number of dividend increases to shareholders in his 2024.

portfolio review

Bain Capital Specialty Finance suffered from 2023 origination headwinds posed to BDCs by central banks that aggressively raised short-term interest rates in the first half of 2023.

As a result, Bain Capital Specialty Finance experienced a decline in new investment funds and an increase in repayments, leading to a decline in the company's portfolio value throughout 2023.

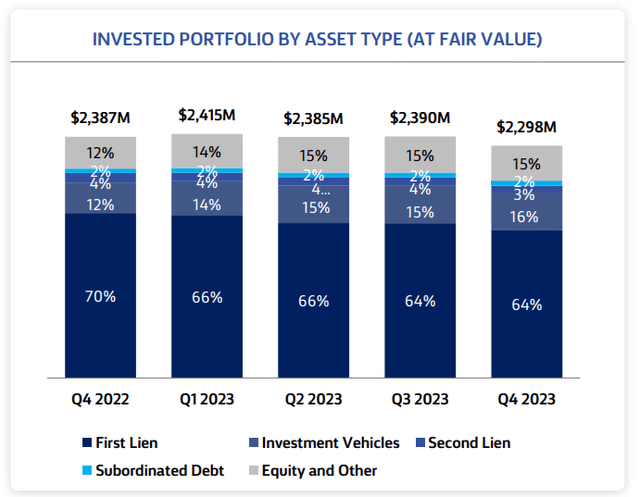

As of December 31, 2023, the total fair value of Bain Capital Specialty Finance's loan portfolio was $2.3 billion, a decrease of 3.7% from the prior year. The portfolio consisted primarily of first and second liens, which together represented 80% of Bain Capital Specialty Finance's loan investments.

BDC also maintained a significant investment allocation in equity investments, representing 15% of its total investments, as a means of increasing its total returns.

Investment portfolio by asset type (Bain Capital Specialty Finance)

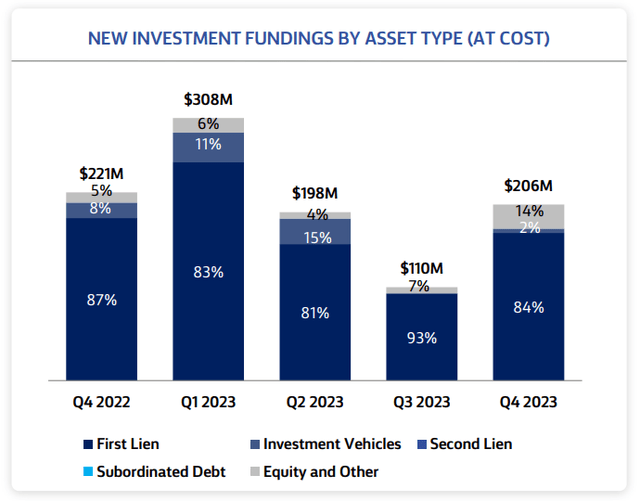

Bain Capital Specialty Finance raised a total of $822 million in new investment funding in 2023. A whopping $691 million of that is related to the first lien investment category. Sales and repayments totaled $924 million, resulting in a net decrease in investing activity of $103 million in 2023.

However, these trends may change slightly in 2024 as central banks consider lowering short-term interest rates if inflation cools.

New investment funds by asset type (Bain Capital Specialty Finance)

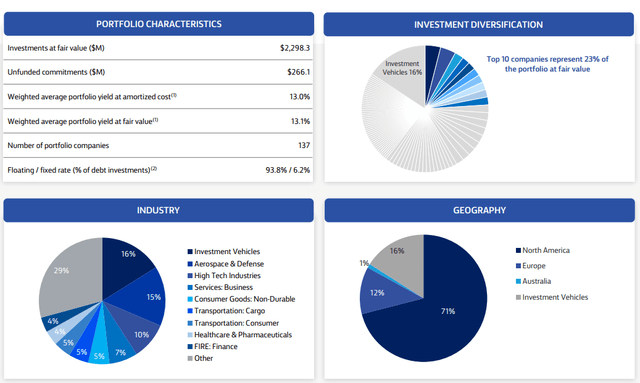

Bain Capital Specialty Finance's portfolio is strongly diversified by industry as well as geography, with investments outside the United States to improve the BDC's diversification profile. The current portfolio setup yields a fair value yield of 13.1%, and the portfolio is primarily comprised of variable rate loans (93.8%).

Portfolio overview (Bain Capital Specialty Finance)

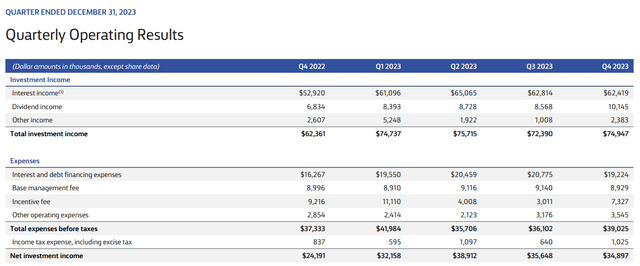

Bain Capital Specialty Finance's high excess dividend coverage ratio is driven by a significant increase in BDC's net investment income due to increased interest income. BDC's interest income surged 18% YoY to $62.4 million in Q4 2023 due to interest rate tailwinds from the central bank.

Bain Capital Specialty Finance's net investment income increased 44% year over year to $34.9 million, giving BDC enough cash to raise its dividend in 2024.

Quarterly results (Bain Capital Specialty Finance)

Possibility of dividend increase in 2024

Bain Capital Specialty Finance increased its regular dividend twice in 2023, and we expect shareholders to see a further increase in 2024 as BDC has significant excess dividend coverage.

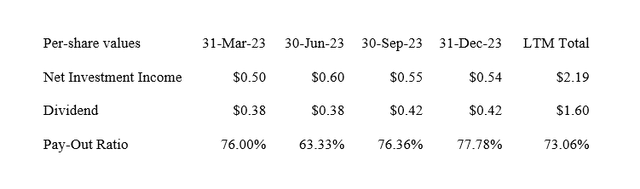

Bain Capital Specialty Finance had net investment income of $0.54 in the fourth quarter. In contrast, his dividend per share was $0.42. This results in a payout ratio of 78% for the fourth quarter of 2023 and a payout ratio of 73% for the 12-month period.

Bain Capital Specialty Finance announced a special dividend of $0.12 per share in February, with the same amount to be paid in 2024. In my view, passive income investors could see one or two more regular dividend hikes this year.

dividend (Table created by author using BDC information)

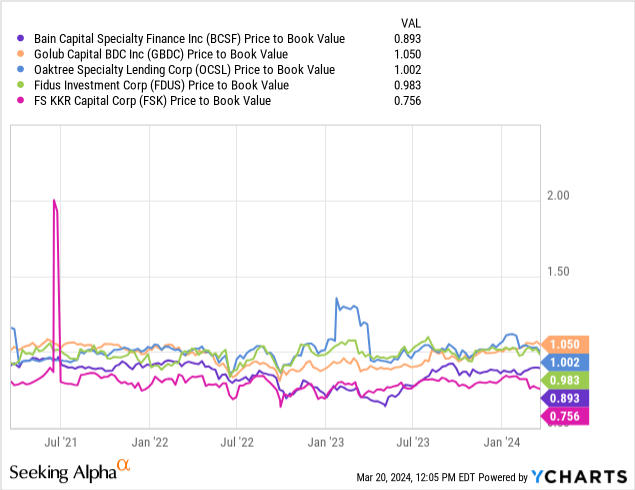

Sold at 0.90x NAV, possibility of revaluation

BCSF is still selling at an 11% discount to net asset value, which we don't take for granted. Bain Capital Specialty Finance's net asset value as of December 31, 2023 was $17.60, an increase of $0.31 per share from the same period last year.

BDCs are required to mark their loans at fair value, so the NAV of $17.60 represents my intrinsic value estimate. With dividends so well covered by net investment income and net asset value increasing, BCSF could revalue to net asset value in 2024, especially if BDC announces one or two more dividend increases. I think there's a good chance it will happen. .

With BDC stock currently offering a dividend yield of 11.4%, I think passive income investors could potentially capture an additional 10% in capital appreciation.

Why investment theory doesn't work

Bain Capital Specialty Finance is a floating rate BDC and therefore dependent on the central bank for its net investment return potential. Recent inflation statistics make it very clear that inflation remains at around 3% and that some of the rate cuts that markets were expecting have been delayed.

Although currently unlikely, a return to a more “normal” interest rate environment sooner than expected would likely have a negative impact on Bain Capital Specialty Finance's net investment income growth in 2024.

my conclusion

Bain Capital Specialty Finance is a highly diversified BDC that experienced sector-specific headwinds in 2023 as central bank rate hikes weighed on BDC origination activity and led to higher loan repayments. Ta.

Nevertheless, Bain Capital Specialty Finance has increased its regular dividend twice in 2023, and BDC maintains a fairly high excess dividend coverage ratio, so there is potential for significant dividend growth or special dividends in 2024. there is.

I think the 11.4% dividend yield here is pretty safe, and I wouldn't be surprised to see two generous dividend increases in 2024 as well.

BCSF is still selling at an 11% discount to net asset value, so we think passive income investors will have a decent margin of safety here as well. buy.