Summary of recent trades for Baillie Gifford (Trades, Portfolio)

On December 1, 2023, renowned investment management firm Baillie Gifford (Trade, Portfolio) reduced its holdings in Wayfair Inc. (NYSE:W), an e-commerce giant in the household goods sector. With this transaction, the company reduced its position by 277,940 shares, resulting in a transaction impact on the portfolio of -0.01%. After this transaction, Baillie Gifford's (Trades, Portfolio) remaining stake in Wayfair Inc is his 7,428,995 shares, representing his 0.4% of the portfolio and his 8.05% of the company's stock. The stock was sold at a price of $58.53 per share.

Baillie Gifford Profile (Trading, Portfolio)

Baillie Gifford (Trades, Portfolios) has over a century of investment management experience and is known for her commitment to long-term, bottom-up investing. Her firm's investment philosophy is centered around fundamental analysis and her proprietary research, with the goal of identifying companies with above-average sustainable growth potential. Baillie Gifford (Trades, Portfolios) manages the assets of some of the world's largest professional investors with a focus on quality of service and integrity of investment strategies.

Wayfair Inc's business model

Wayfair Inc operates a vast e-commerce platform primarily in the United States, offering more than 40 million products from more than 20,000 suppliers. Since his IPO on October 2, 2014, Wayfair has expanded its reach to include a variety of brands and a wide range of home furnishings and decor. Despite offering a wide range of products, the company's financial performance has been poor, with a market capitalization of $6.63 billion and a current stock price of $56.17, making it moderately undervalued according to GF Value. is showing.

Trade analysis and portfolio impact

The recent sale of Wayfair stock by Baillie Gifford (Trades, Portfolio) was done at $58.53, above the current market price of $56.17, suggesting a timely decision. The transaction slightly reduced the company's exposure to Wayfair, which now represents a smaller portion of the company's diversified portfolio. This move is consistent with Baillie Gifford's (Trade, Portfolio) strategy to maintain a focus on long-term growth potential and portfolio optimization.

Wayfair Stock Indicators and Ratings

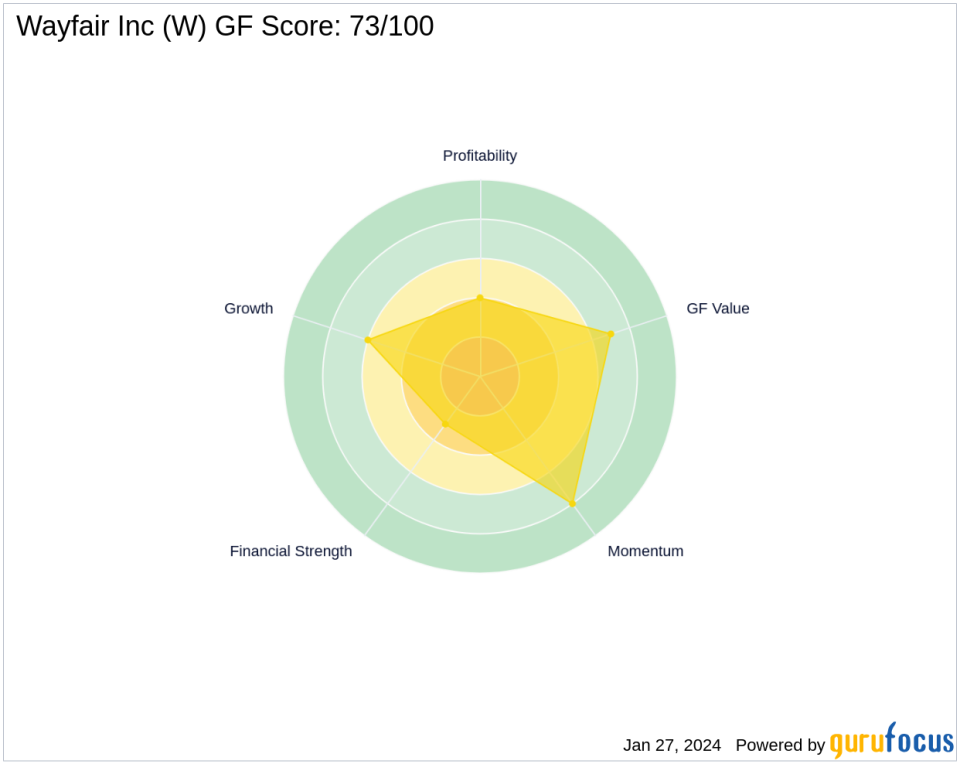

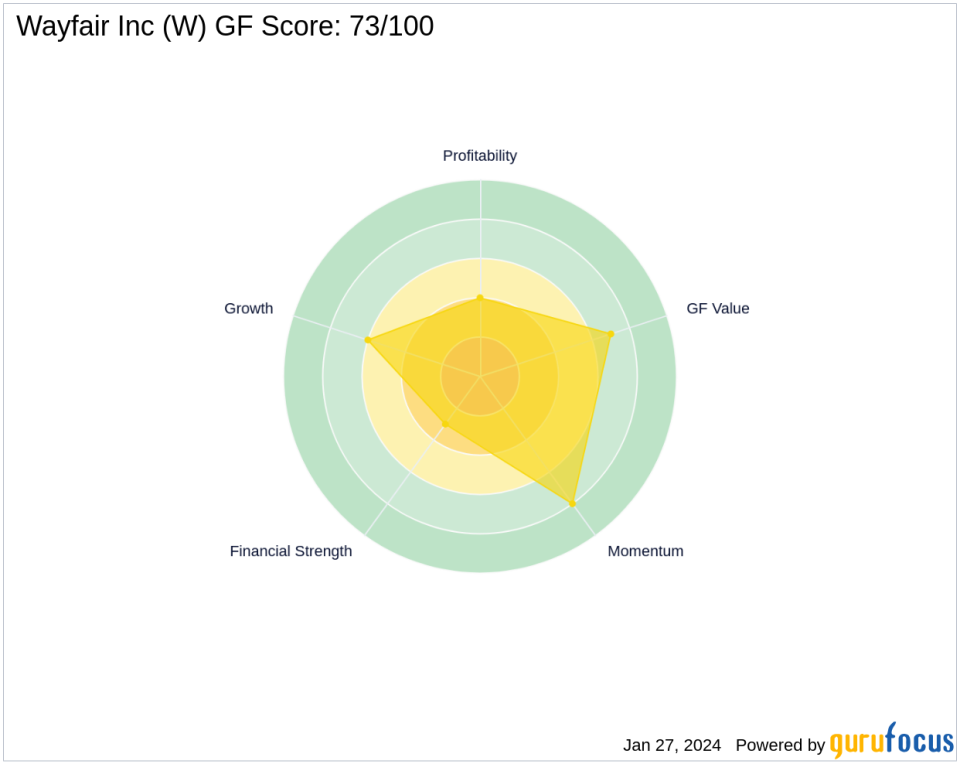

Wayfair's stock is currently rated as “Moderately Undervalued” with a GF Value of $68.06 and a Price to GF Value ratio of 0.83. Since this transaction, the stock’s price change has been -4.03% and -4.46% year-to-date. Wayfair's GF score is 73/100, indicating average performance potential. The company's financial strength and profitability are a concern, with a financial strength rank of 3/10 and a profitability rank of 4/10. However, the growth rank and GF value rank are favorable at 6/10 and 7/10 respectively.

Sector and market background

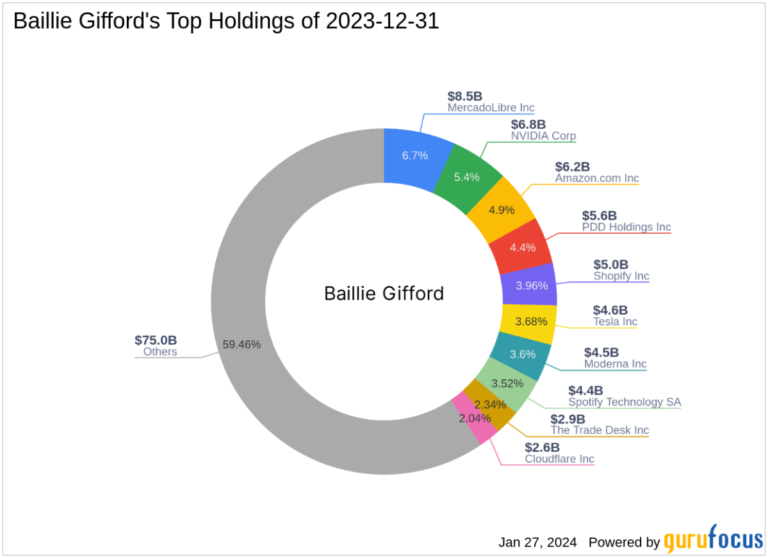

Baillie Gifford (Trades, Portfolio)'s top sectors include Technology and Consumer Cyclicals, with major holdings such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA) . Wayfair operates within a highly competitive retail circulation industry and must continually innovate to maintain its market position.

Other notable investors in Wayfair

Leucadia National is currently Wayfair's largest shareholder, and other notable investors include Joel Greenblatt (Trades, Portfolio). These investments reflect the continued interest in the e-commerce space by savvy market players.

conclusion

Baillie Gifford (Trades, Portfolios)'s recent write-down of Wayfair Inc stock is a strategic move that reflects the company's investment philosophy and market outlook. Although Wayfair's current market position poses some challenges, its modest undervaluation and growth outlook may still provide an opportunity for value investors. Wayfair's future prospects depend on its ability to improve its profitability and remain competitive in the dynamic e-commerce industry.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.