(Bloomberg) — Asian stocks fell on Monday as the yen strengthened and Japanese stocks fell on growing expectations that the country's central bank would raise interest rates.

Most Read Articles on Bloomberg

Japan's TOPIX index suffered its biggest single-day decline since October, weighed down by the tech sector. Chip stocks within the benchmark fell, with Nvidia Inc. down 5.6%, in a move that echoed the pressure on AI stocks seen in the U.S. on Friday.

Shares in Australia and South Korea also fell, pushing down regional stock benchmarks that had risen for three days. U.S. futures fell following last weekend's selloff on Wall Street, with both the S&P 500 and Nasdaq 100 falling.

Japan's economic growth expanded in the fourth quarter, confirming expectations that the Bank of Japan will raise interest rates for the first time since 2007 this month. The decline in Japanese stocks partly reflects the strong yen, which is usually a headwind for Japanese stocks.

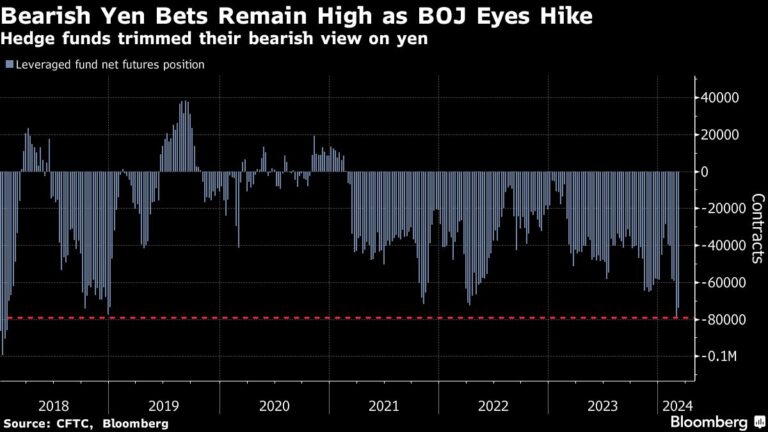

The yen rose against the dollar, extending last week's 2% rise against the greenback and posting its best weekly gain since July. Japan's 10-year real government bond yield was heading for its highest level in three weeks.

“Japan is probably finally coming out of this deflationary spiral, which could have a significant impact on Japanese assets,” said Paresh Upadhyaya, director of fixed income and currency strategies at Amundi Asset Management. He explained that the money would be used to support the yen through remittances. Flow, mostly towards stocks.

Chinese stocks rose against the dark clouds. The rise was supported by consumer prices rising for the first time since August. The 0.7% rise in the CPI in February exceeded consensus expectations and was welcome news for investors worried about deflation in the world's second-largest economy.

The rise came despite a series of lackluster announcements from the National People's Congress, which many China watchers see as a missed opportunity to shore up confidence.

“There hasn't been much progress on the social safety net, so households don't feel they need to save as much as they currently do,” Charlene Zhu, a China macro financial analyst at Autonomous Research, said on Bloomberg TV. . She said the measures would “help address some of the consumption issues” that are weighing on confidence.

soft landing

Tuesday's U.S. Consumer Price Index figures will dominate this week's economic data. The core price index in February is expected to rise 0.3% month-on-month and 3.7% year-on-year, which would be the smallest annual increase since April 2021.

Further restraint in U.S. prices would support the disinflation narrative, which has largely held in place despite a reduction in the number of Federal Reserve rate cuts expected this year. Based on swap pricing, three rate cuts are expected in 2024, down from six at the beginning of the year.

U.S. jobs data released last week did little to change that outlook. Despite the higher-than-expected increase in new jobs, the unemployment rate was at its highest level in two years. Mixed signals point to a gradual cooling of the labor market, supporting expectations for a soft landing for the US economy for now.

E*Trade's Chris Larkin said the jobs report “wasn't necessarily a 'perfect' signal for the Fed, but it also doesn't seem to derail its rate cut plans.” From Morgan Stanley.

Australian yields were almost flat on Monday, reflecting solid trading in US Treasuries in Asia. The dollar index fell after falling 1% last week, its worst weekly reading since December.

In commodities, crude oil posted losses on Monday ahead of this week's reports from the Organization of the Petroleum Exporting Countries (OPEC) and the IEA, which will provide clues about the demand outlook.

This week's main events:

-

Tuesday's CPI report for Argentina, Brazil, Germany, India, and the United States

-

UK unemployment insurance claims, unemployment rate, Tuesday

-

Japan PPI, Tuesday

-

Indian industrial production Tuesday

-

Mexico's international reserves, industrial production, Tuesday

-

philippine trade tuesday

-

Türkiye's industrial production, current account balance, Tuesday

-

EU finance ministers meet in Brussels on Tuesday

-

ECB Executive Board member Robert Holzmann speaks on Tuesday

-

Eurozone, UK industrial production, Wednesday

-

indian trade wednesday

-

South Korea's unemployment rate, Wednesday

-

ECB Executive Board member Giannis Stournaras speaks on Wednesday

-

First Deputy Governor and Deputy Governor of the Riksbank speak on Wednesday

-

Saudi Arabia, Spanish CPI, Thursday

-

US PPI, Retail Sales, New Unemployment Insurance Claims, Business Inventories, Thursday

-

Australian Finance Minister Jim Chalmers delivers pre-Budget speech on Thursday

-

Canadian housing starts Friday

-

Chinese real estate prices Friday

-

France, Italy, Poland CPI, Friday

-

Indonesia trade, Friday

-

Japan tertiary index, Friday

-

New Zealand PMI, Friday

-

Philippine overseas remittance, Friday

-

Sri Lanka GDP

-

US Industrial Production, University of Michigan Consumer Sentiment, Empire Manufacturing, Friday

-

Japan's largest federation of labor unions announces results of annual wage negotiations on Friday

The main movements in the market are:

stock

-

S&P 500 futures were little changed as of 12:02 p.m. Tokyo time.

-

Nikkei 225 futures (OSE) fell 2.5%

-

Japan's TOPIX fell 2.3%

-

Australia's S&P/ASX 200 falls 1.6%

-

Hong Kong's Hang Seng rose 1%

-

The Shanghai Composite fell 0.2%.

-

Euro Stoxx50 futures fall 0.5%

-

Nasdaq 100 futures fell 0.2%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro remained unchanged at $1.0939.

-

The Japanese yen rose 0.1% to 147 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.1996 yuan to the dollar.

-

The Australian dollar fell 0.2% to $0.6612.

cryptocurrency

-

Bitcoin fell 1.5% to $68,374.82.

-

Ether fell 1.8% to $3,838.62.

bond

-

The 10-year government bond yield was almost unchanged at 4.07%.

-

Japan's 10-year bond yield rose 3 basis points to 0.760%.

-

The Australian 10-year bond yield fell two basis points to 3.95%.

merchandise

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP