Shareholders may have noticed Front Door Co., Ltd. (NASDAQ:FTDR) filed its annual results this time last week. Initial reaction was not positive, with shares falling 5.6% to $31.14 last week. The results were positive overall. Revenues of US$1.8 billion were in line with analyst forecasts, but Frontdoor was surprised to find that he achieved statutory profits of US$2.12 per share, slightly above expectations. Analysts typically update their forecasts with each earnings report, and we can use their forecasts to determine whether their view of the company has changed or if there are any new concerns to be aware of. . So we've gathered the latest post-earnings statutory consensus forecasts to see what's in store for next year.

Check out our latest analysis for Frontdoor.

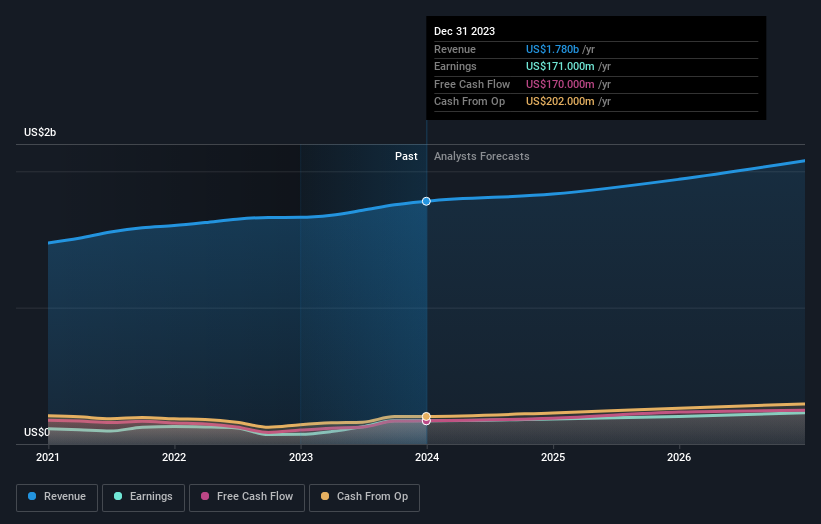

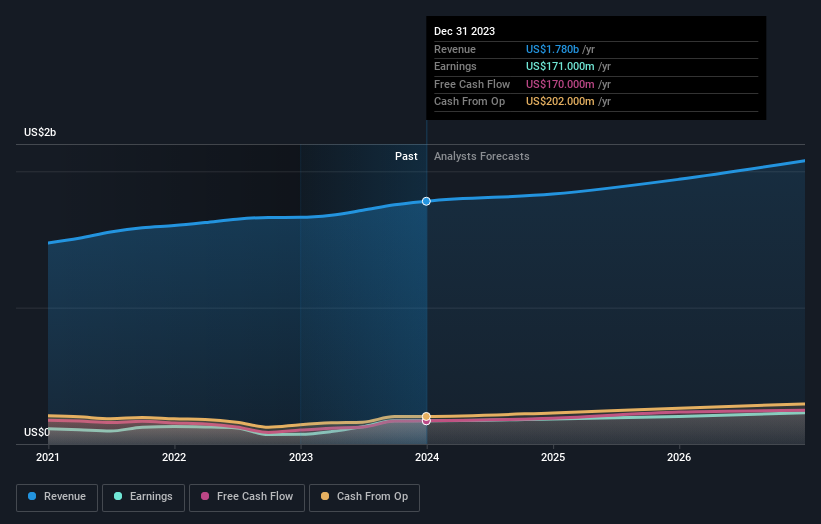

Taking into account the latest results, the consensus forecast from Frontdoor's 7 analysts is for revenue of US$1.83b in 2024. This reflects a 3.0% improvement in revenue compared to the trailing twelve months. Statutory earnings per share are expected to increase by 6.2% to US$2.32. Ahead of this report, analysts had been modeling 2024 revenue of US$1.88 billion and earnings per share (EPS) of US$2.30. The consensus seems to be perhaps a little more pessimistic, with the company revising its revenue forecast downwards even after the latest results. However, there was no change to the EPS forecast.

The consensus price target of $40.20 was reaffirmed, indicating that analysts do not expect the decline in next year's earnings estimates to have a material impact on Frontdoor's market value. However, this is not the only conclusion that can be drawn from this data, as some investors like to consider the dispersion of analyst forecasts when assessing price targets. There are mixed views on Frontdoor, with the most bullish analyst valuing it at $45.00 per share, and the most bearish valuing it at $31.00 per share. This shows that there is still some variation in forecasts, but analysts don't seem to be completely divided on whether the stock is going to be a success or a failure.

Looking at the bigger picture now, one way to understand these forecasts is to see how they measure up against both past business performance and industry growth estimates. It's clear that Frontdoor's revenue growth is expected to slow significantly, with revenue expected to grow at an annualized rate of 3.0% through the end of 2024. This compares to a historical growth rate of 6.8% over the past five years. Compare this to other companies in the industry, which are expected to have a combined annual revenue growth of 12% (analyst forecasts). Considering the expected growth slowdown, it's clear that Frontdoor is also expected to grow slower than other industry participants.

conclusion

The most obvious conclusion is that there haven't been any significant changes to the company's business outlook recently, with analysts keeping their revenue estimates unchanged from previous estimates. Unfortunately, they've also revised down their revenue estimates, and our data shows it underperforming compared to the broader industry. Still, he cares more about earnings per share for the intrinsic value of the business. Still, revenue is more important to the core value of a business. There was no material change to the consensus target price, suggesting that the intrinsic value of the business has not changed significantly at the latest estimate.

With this in mind, we think the long-term trajectory of the business is far more important for investors to consider. His forecasts out to 2026 from multiple Frontdoor analysts are available to view for free on our platform here.

Note that Frontdoor is still visible. 1 warning sign in investment analysis you should know…

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.