The fact that there are multiple Ameriprise Financial Co., Ltd. (NYSE:AMP) Insiders have sold a significant amount of stock over the past year, which may raise some eyebrows among investors. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying than to know whether they are selling. Because the latter sends an ambiguous message. However, shareholders should be wary if multiple insiders sell shares over a certain period of time, as that could be a red flag.

While we never say investors should base their decisions solely on the actions of a company's directors, we believe it would be foolish to ignore insider trading entirely.

Check out our latest analysis for Ameriprise Financial.

Ameriprise Financial Insider Transactions in the Past Year

We can see that the biggest insider sale over the last year was by Chairman & CEO James Cracchiolo for US$8.9m worth of shares (about US$409 per share). This means that insiders wanted to cash out some of their shares, even if the stock price was below the current price of $436. If an insider sold below the current price, it suggests they thought the downside was fair. With that in mind, I'm curious what they think about the recent (higher) valuation. However, while insider selling can sometimes be discouraging, it can only be a weak signal. This one sale of his was only his 12% of James Cracchiolo's stock.

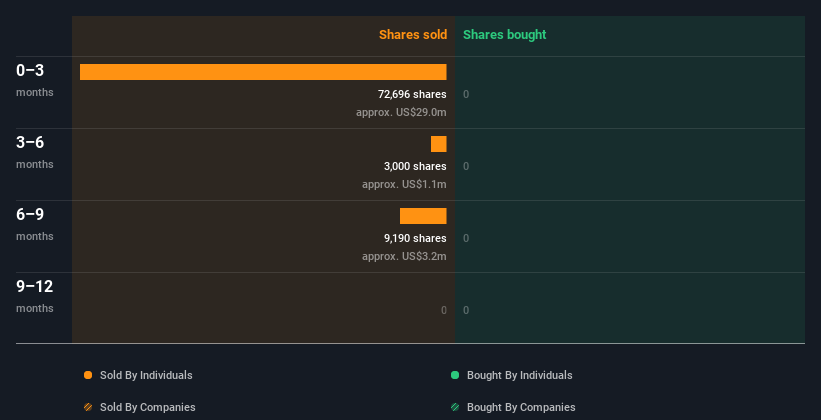

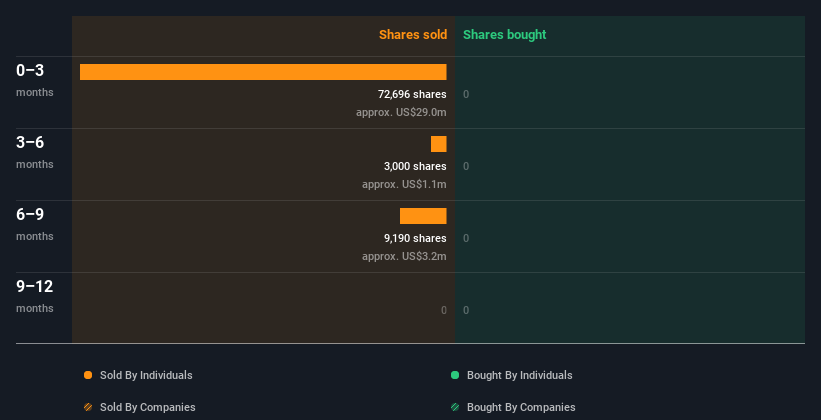

Ameriprise Financial insiders didn't buy any shares in the last year. The graph below shows insider transactions (by companies and individuals) over the last year. Click on the chart to see all individual trades, including stock price, individual, and date.

If you like to buy stocks that insiders are buying, rather than selling, you might like this free List of companies. (Hint: Insiders are buying them).

Ameriprise Financial insiders recently sold stock.

Over the past three months, Ameriprise Financial has experienced significant insider selling. Insiders sold a total of US$29m worth of shares during this time, and the company kept no record of their purchases. With this in mind, it's hard to say that all insiders think the stock is a bargain.

Insider ownership in Ameriprise Financial

Another way to test the alignment between a company's leaders and other shareholders is to look at the number of shares they own. We think it's a good sign if insiders own a significant number of shares in the company. Ameriprise Financial insiders own approximately US$77m worth of shares. This is equivalent to 0.2% of the company. Certainly, we've seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and other shareholders.

What can we tell from insider trading at Ameriprise Financial?

Insiders have recently sold shares, but not bought them. And no purchases made us feel safe last year. Insiders own shares, but they don't own a ton of shares and they keep selling them. Therefore, make your purchase only after careful consideration. We like to know what's going on with insider ownership and transactions, but we also always consider what risks a stock faces before making any investment decisions.For example, Ameriprise Financial 1 warning sign I think you should know.

of course Ameriprise Financial may not be the best stock to buy.So you might want to see this free There are many high-quality companies here.

For the purposes of this article, insiders are individuals who report their transactions to the relevant regulatory body. The Company currently only accounts for open market transactions and private dispositions of direct profits, and does not account for derivative transactions or indirect profits.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.