alumina market

DUBLIN, April 17, 2024 (Globe Newswire) — Added 'Alumina – Global Strategic Business Report' ResearchAndMarkets.com Recruitment.

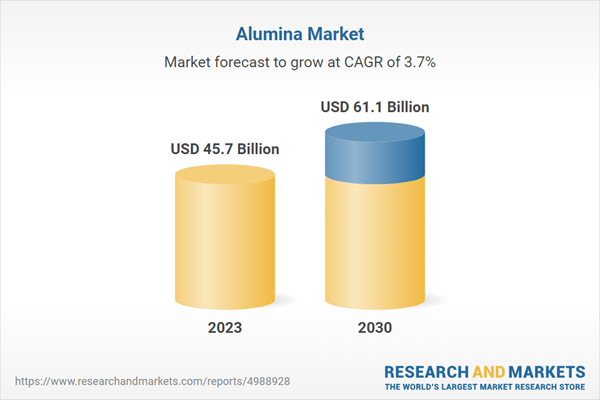

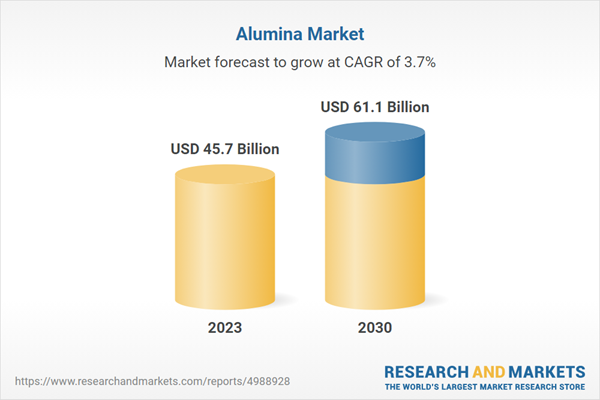

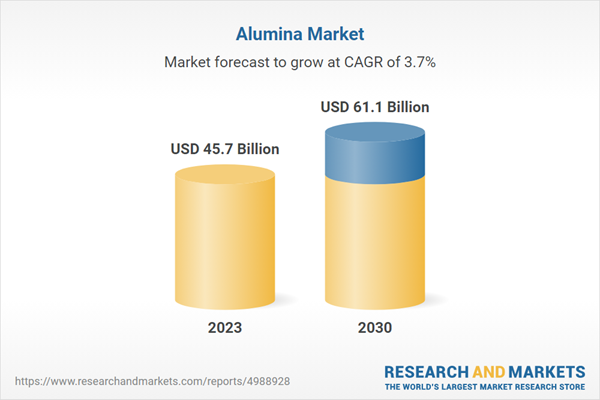

Recent insights on the Alumina industry reveal the growth trajectory of the global Alumina market. Current valuations place the market at USD 45.7 billion in 2023. Industry forecasts are optimistic, with a revised size expected to grow to US$61.1 billion by 2030. This represents a steady compound annual growth rate (CAGR). It was 3.7% over the 7-year analysis period.

Segment Spotlight

The alumina smelting sector is on a solid growth path within the overall market. Analysts predict this segment to grow at a CAGR of 3.8%, reaching a valuation of USD 52.7 billion by the end of the analysis period in 2030. The chemicals segment is not far behind and is expected to grow at an estimated CAGR of 2.7% over the next eight years. .

Geographic market dynamics

The US alumina market is robust, reaching USD 12.4 billion in 2023. In parallel, China, the world's second-largest economy, is aiming for a significant upward trajectory. According to forecasts, the Chinese market is expected to grow at a CAGR of a commendable 6.2% from 2023 to 2030, potentially reaching USD 12.8 billion. Other regions, including Japan and Canada, are also projected to experience significant growth with a CAGR of 1.9% and 3.1%, respectively, over the same period. Growth is forecast for Europe, with Germany expected to see a CAGR of approximately 2.4%.

Report highlights

Industry growth is supported by comprehensive market research, providing innovative capabilities for deep understanding and strategic planning. Notable highlights include access to collaborative research platforms and engagement tools designed to extract domain knowledge in an integrated way. Additionally, a focus on peer collaboration platforms facilitates the exchange of strategic insights between companies.

Customers benefit from one year of free updates, including competitor information and market share analysis of the leading players in the sector. Analytical tools, including market presence analysis of players across different regions, help in strategic decision making.

future economic situation

The economic outlook for 2024 appears to be littered with challenges and opportunities. Concerns about geopolitical tensions, monetary policy tightening, and climate-related disasters come against the backdrop of potential positive developments, including signs of disinflation, normalization of supply chains, and fluctuations in energy costs. Market participants are encouraged to remain agile with a strategic focus on exploiting volatility and ensuring sound investment decisions.

Our competitors include 76 leading companies, including major industry leaders such as Alcoa Corporation, Alumina Limited, and Rio Tinto Alcan, Inc. These powerful companies have contributed significantly to the global market landscape and continue to shape the dynamics of the alumina industry.

As the global alumina market sets its course towards 2030, this outlook suggests a period of healthy growth driven by innovation, strategic investments, and adaptive business strategies. Stakeholders across the value chain are likely preparing to take advantage of what appears to be a period of sustained market expansion.

Key attributes:

|

report attributes |

detail |

|

number of pages |

399 |

|

Forecast period |

2023-2030 |

|

Estimated market value in 2023 (USD) |

$45.7 billion |

|

Projected market value to 2030 (USD) |

$61.1 billion |

|

compound annual growth rate |

4.2% |

|

Target area |

global |

Main topics covered:

Market overview

-

Latest information on the world economy

-

competitive scenario

-

Alumina – Market Share Percentage of Global Major Competitors in 2023 (E)

-

Competitive Market Presence – Strong/Active/Niche/Mediocre (E) for Players Worldwide in 2023

-

Global market outlook and outlook

-

Global Alumina Market by Application (2023 & 2030): Sales percentage breakdown of aluminum production and non-aluminum production

-

Increasing popularity of sustainable and cost-effective technologies drives demand for alumina-based products

-

Challenges and future prospects

-

Analysis by grade

-

Global Alumina Market by Grade (2023 & 2030): Percentage Breakdown of Sales to Smelters and Chemicals

-

regional analysis

-

Global Alumina Market: Breakdown of Sales Percentage in Developed and Developing Regions in 2023 and 2030

-

Global Alumina Market – Geographic Regions Ranked by CAGR (Revenue) from 2022 to 2030: China, Asia Pacific, Latin America, Middle East, Africa, Canada, United States, Europe, Japan

-

China's alumina market witnesses oversupply

-

Alumina: Product overview

-

Prelude to bauxite: the most important mineral for producing alumina

-

Alumina: Mainly used in the production of aluminum

-

Alumina Market Segment: Applications in Various Fields

-

Alumina manufacturing process

-

Bauxite and alumina global production and reserves scenario

-

Recent market activity

-

Select global brand

Focus on carefully selected players (76 players in total)

-

Alcoa Co., Ltd.

-

Armatis GmbH

-

Alum SA

-

Alumina Limited

-

China Aluminum Co., Ltd.

-

Cabot Corporation

-

glencore company

-

Hindalco Industries Limited

-

NATIONAL ALUMINUM COMPANY LIMITED.

-

Nippon Light Metal Co., Ltd.

-

Norsk Hydro ASA

-

Queensland Alumina Limited (QAL)

-

Rio Tinto Alkane Co., Ltd.

-

Sasol Co., Ltd.

-

south 32 limited

-

United Company Rusal

Market trends and drivers

-

Current trends in the alumina market

-

Aluminum production: the main growth driver for alumina

-

End use of aluminum products

-

Aluminum Overview – Major End Users

-

The automotive sector remains a major driver of aluminum use

-

Rising demand for alumina from the automotive sector bodes well for market growth

-

Transition to lightweight vehicles bodes well for alumina market

-

Increased demand for aluminum due to the spread of EVs

-

Rising demand for electric vehicles drives aluminum and alumina market

-

Global annual electric vehicle (EV) sales in 2020, 2022, 2024, and 2026 (thousands)

-

Record production volumes and backlog bode well for aluminum in the aerospace market

-

Recovering civil aviation industry brightens outlook for aluminum market

-

Global airline industry scheduled passenger numbers from 2018 to 2023 (in million)

-

Packaging and containers: major end users of aluminum

-

Architecture and construction sector driving growth

-

Refractories and Abrasives: Key Segments of the Non-Metallurgical Market

-

Global Abrasive Products Market by End-Use (2023): Sales Percentage Breakdown of Metalworking, Machinery, Construction, Electronics & Electrical, Automotive, Others

-

Alumina found to be increasingly used in non-metallurgical applications

-

Alumina hollow balls have various benefits

-

Aluminum oxide very suitable for abrasive blasting

-

Use of alumina trihydrate in flame retardants and pharmaceuticals to drive market growth

-

Multiple uses of activated alumina to drive market growth

-

Increasing demand for activated alumina from the oil and gas sector

-

Activated alumina for lithium purification and remediation applications

-

Calcined alumina is used in the refractory, abrasive and ceramic industries

-

White fused alumina: the key to several refractory applications

-

ChemX's HiPurA technology benefits the battery supply chain

-

Alumina price trends

-

Sanctions against Russia are expected to benefit China in the short term

For more information about this report, please visit https://www.researchandmarkets.com/r/rw14t7.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900