(Bloomberg) — Alibaba Group Holding Ltd. will buy back another $25 billion in stock aimed at allaying investors worried about the growth of the Chinese e-commerce pioneer as it faces new rivals such as PDD Holdings Inc. gave the go-ahead.

Most Read Articles on Bloomberg

The Internet company's board of directors approved an expansion of its existing buyback program, which became the nation's largest and covered about $9.5 billion last year alone. However, in Hong Kong, the company's shares fell by as much as 6.1%. One reason for this is that investors remain concerned about China's consumption collapse and falling spending per user.

Alibaba is still grappling with fundamental questions about what was once the dominant internet company: a barometer of demand in China. The company's results highlighted the loss of market share to rivals such as PDD and ByteDance. The company's December quarter sales rose 5% to 260.3 billion yuan ($36.2 billion), less than expected and well below the pace of a year ago. Net profit decreased by 70%.

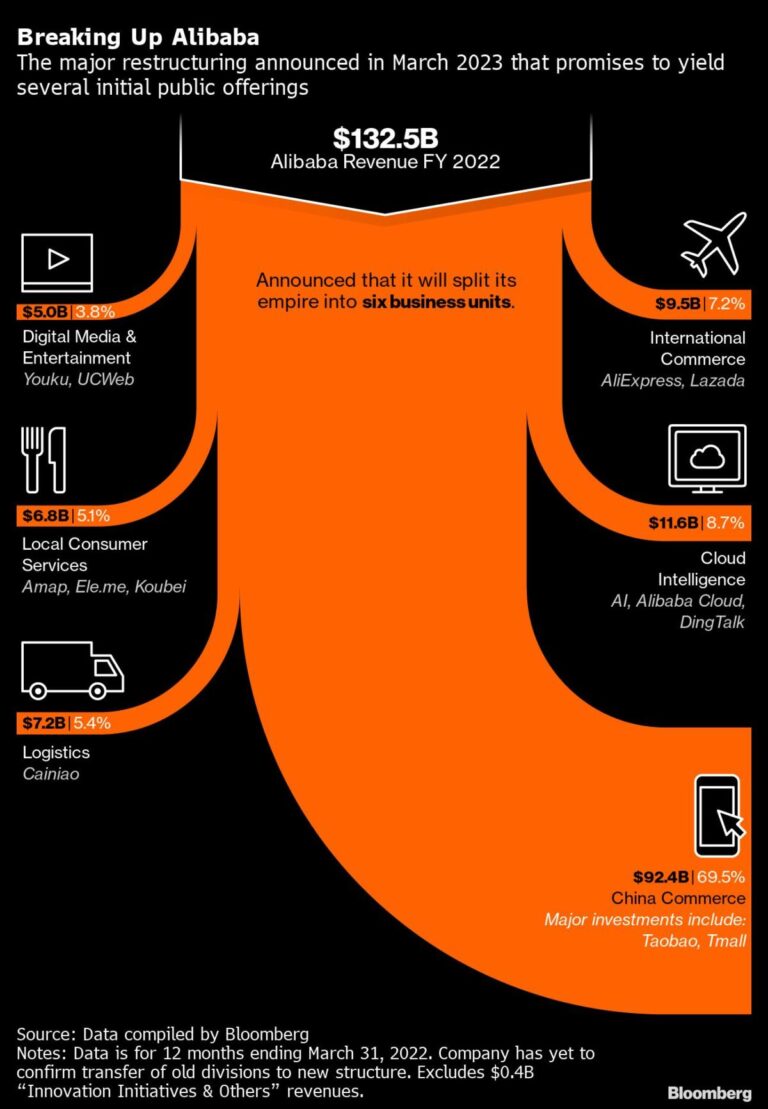

Fueling the uncertainty, the company has launched several separate businesses and is moving ahead with a complex multi-pronged breakup aimed at rejuvenating the national symbol. The company last year outlined plans to launch logistics units for grocery chains Freshippo and Cainiao, but Chairman Joseph Tsai on Wednesday said difficult market conditions prevented those businesses from getting fair value. was withdrawn. After years of investment frenzy, Alibaba, which now manages a vast portfolio of assets, is now actively looking to sell some of its non-core holdings, he added. The company is looking for ways to reduce the burden on its Intime department store chain and other retail operations, Bloomberg News reported.

“We have a number of traditional brick-and-mortar retail businesses on our balance sheet. And these are not our core focus. It makes sense to exit these businesses.” Tsai told analysts on a conference call. “Given the challenging market environment, this will take time, but we will continue to work on it.”

Several analysts, including Goldman Sachs Group's Ronald Kung, lowered their price targets for Alibaba stock in light of management issues.

Read more: Alibaba collapses as core business weakens, offsetting share buybacks: Street Wrap

Alibaba is making a comeback after years of brutal government punishment and strategic missteps that stripped the e-commerce operator of its position as the country's tech industry leader. Co-founder Jack Ma urged the company to change course in November.

After the glory days, a thorough reduction in personnel is underway. It will likely retreat to a more modest strategy of focusing on its core e-commerce and cloud computing businesses as it sells assets and spins off adjacent businesses. Executives reiterated their dual focus on Wednesday's conference call.

“If you buy Alibaba stock, it's like buying 10-year U.S. Treasuries to take advantage of the rising stock price,” Tsai said.

Click here to see the numbers and live blog of the conference call.

Mr Ma's longtime confidants, Chief Executive Officer Eddie Wu and Chief Executive Officer Tsai (Mr. Tsai), took over the reins following the sudden resignation of former chief executive Daniel Chan, now in a multi-pronged split. He is being held responsible for influencing the The ultimate goal is to beat out startups like ByteDance's Douyin and PDD while charting a new path for Alibaba to become a major player in artificial intelligence and cloud.

It requires streamlining and big moves. Mr. Wu is seeking ways to unload assets and roll back Mr. Zhang's long-held “new retail” ambitions, while appointing younger executives to revive the core Taobao and Tmall platforms. At the same time, Alibaba must find an answer for Douyin, which captivated shoppers and grew sales faster during last year's Singles' Day shopping festival.

In addition to the stock buyback, Alibaba executives have pledged to aggressively return funds to shareholders. They aim to buy back 3% of their outstanding shares annually, at a cost of about $12 billion annually. This will reduce the number of shares and increase earnings per share.

“This buys time for Alibaba to find ways to reinvigorate its core commerce business and accelerate AIDC's growth,” said Ivy Yang, founder of consultancy Wavelet Strategy and former Alibaba manager. “Investor confidence in the restructuring has been shaken, especially after the news that the cloud business will not be spun out.”

Competition “will continue to be centered around building market share at low prices,” Kenneth Fung, head of China internet research at UBS, said before the results were released. “Price competition between platforms is likely to continue even if the macroeconomic recovery occurs.”

Bloomberg intelligence statement

Alibaba's third-quarter results Taobao/Tmall group profit margin beat expectations, dropping 19 bps year-on-year versus consensus decline of more than 2 percentage points, as company fends off email attacks This suggests that profits should not be sacrificed. China's commercial rival this year. The division's third-quarter adjusted profit beat expectations by 2%, even though sales were down 3%.

– Katherine Lim and Trini Tan, Analysts

Click here for research.

Alibaba is also keen to strengthen its foothold in overseas markets. Divisions such as Lazada and Aliexpress power the global e-commerce business, making it one of the fastest growing sectors today despite upstarts such as PDD's Temu and Shein.

Like most major technology companies, Alibaba counts AI among its long-term priorities. He has made multiple investments in startups such as Zhipu AI and Baichuan, while developing his own ChatGPT-like services.

AI efforts initially stalled. Last year, Alibaba surprised investors by calling off the spinoff and IPO of its $11 billion cloud division, citing U.S. regulations that cut off access to Nvidia Inc.'s vital AI accelerator chips. It's unclear what steps management will take to revive the company, which was once one of the engines of growth but has lost market share to state-owned companies in recent years.

“This is still in the early testing stages, but we think there is potential there,” Wu said on a conference call.

–With assistance from Vlad Savov, Sarah Zheng, Debby Wu, Peter Elstrom, and Helen Sun.

(Updated share in 2nd paragraph)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP