-

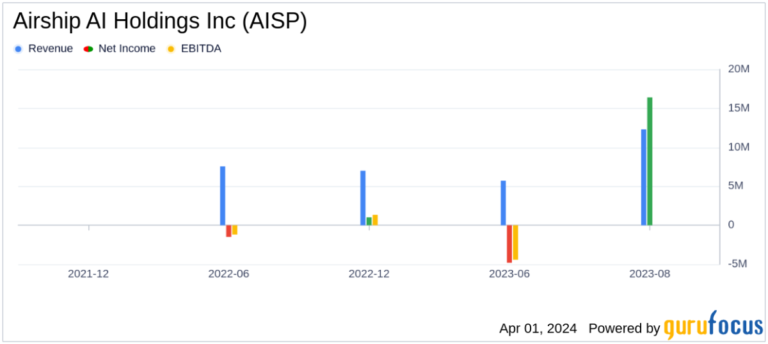

Revenue: FY2023 sales are reported at $12.3 million, with strong pipeline expected to result in significant growth in FY2024.

-

gross profit: Achieved $5.8 million, reflecting an annual gross margin of 47%.

-

Operating loss: Recorded an operating loss of $6.6 million, primarily due to stock-based compensation expense.

-

Net income: Net amount of $16.4 million was supported by other income from warrants and earnout debt modification.

-

Cash position: Cash and cash equivalents ended the year at $3.1 million.

-

Number of shares outstanding: As of December 31, 2023, the total number of outstanding common shares is 22,812,048 shares.

Airship AI Holdings Inc (NASDAQ:AISP) filed an 8-K filing on April 1, 2024 reporting comprehensive financial results for the fiscal year ended December 31, 2023. US-based technology company specializing in AI-driven video, sensors and data management monitoring platform announced annual revenue of $12.3 million and with a strong pipeline of $140 million, it expects to grow in 2024. Triple-digit revenue growth and positive cash flow are expected for the fiscal year.

Airship AI, which completed its merger and began trading on the Nasdaq under the ticker “AISP” on December 22, 2023, reported a backlog of approximately $11.8 million. This increase was driven by demand from Fortune 500 customers and U.S. federal and Department of Defense agencies focused on advanced technology to enhance border security.

Financial performance and challenges

The company's fiscal 2023 financial results included gross profit of $5.8 million and gross profit margin of 47%. His operating loss for the year was $6.6 million, primarily due to $2.9 million in stock-based compensation. Despite the operating loss, Airship AI achieved a net income of $16.4 million, primarily due to her $23 million in other income from gains from changes in warrant debt and earn-out debt. The company also noted that net cash used in operating activities increased to $3.3 million, primarily due to operating losses and increased expenses related to going public.

These financial results are important for investors to understand the company's current position and future potential. The reported net income and strong order backlog suggest Airship AI is on a growth path despite the challenges of operating losses and costs associated with transitioning to a public company.

Operational highlights and future prospects

During fiscal year 2023, Airship AI released the next generation Outpost AI edge appliance and multiple new AI models, transitioned to a new cloud business management suite, and launched new turnkey solutions for government customers. These efforts are part of the company's strategy to improve delivery times and gross margins by transitioning its hardware product line to new suppliers and expanding its federal customer base.

Airship AI projects triple-digit revenue growth and positive cash flow into 2024, supported by orders from DHS and DOJ and a strong pipeline of mature opportunities. The company plans to leverage its position as a newly public company to make strategic investments across its sales and business development organization.

“Our robust enterprise and edge AI platforms are well-positioned to meet the rapidly growing demand for artificial intelligence-based solutions that support real-time intelligence requirements in the homeland security and law enforcement sectors,” said Airship AI. said Paul Allen, president of .

Allen's comments highlight the company's strategic focus on providing advanced AI solutions to government agencies and businesses, which is expected to drive growth and revenue next year.

For more information regarding Airship AI Holdings Inc.'s financial performance and future prospects, investors and interested parties are encouraged to visit the company's website and review its full 8-K filing.

For more information, please see the full 8-K earnings release from Airship AI Holdings Inc here.

This article first appeared on GuruFocus.