Knightswift says it cannot cut rates any further. (Photo: Jim Allen/FreightWaves)

Knight Swift Transportation management expects weak demand to continue through the first quarter and expects normal improvement by spring. The company reported worse-than-expected fourth-quarter results on Thursday, as a slightly positive trend at the beginning of the period worsened in the final weeks.

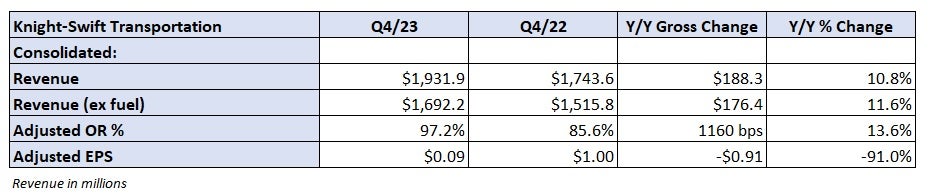

Knight Swift (NYSE: KNX) reported fourth-quarter 2023 net loss of 7 cents per share. Excluding acquisition costs, legal fees and impairment charges related to the sale of equipment, adjusted earnings per share were just 9 cents, compared with the consensus estimate of 44 cents and the prior-year result of $1.

“Overcapacity in the full truck market and customer efforts to reduce inventory levels are contributing to a challenging operating environment,” said Dave Jackson, president and CEO. “

The period included a $71.7 million operating loss from providing third-party insurance, which pushed the number down by 30 cents. Knight Swift said it has begun the process of exiting the business due to continued unfavorable claims trends among the smaller airlines it brokers. Throughout the recession, the division also struggled to collect insurance premiums from some carriers.

All outstanding liability insurance will be canceled and the division will be dissolved during the first quarter. Nightswift still has some claims exposure, but it's likely much less than what it has experienced in recent quarters.

Analysts lowered their fourth-quarter numbers ahead of the tape, given weaker industry-wide activity in the last two weeks of December.

Using regular tax rates, the increase in net interest expense (from acquisitions) resulted in a headwind of 8 cents compared to the prior year, while the decrease in gains on equipment sales resulted in a headwind of 1 cent.

The company only provided guidance for the first half of 2024, compared to the full-year outlook it typically provides in its annual fourth-quarter report. Knight Swift expects adjusted earnings per share to range from 90 cents to 98 cents for the current period (39 cents at the midpoint of that range in the first quarter and 55 cents at the midpoint in the second quarter).

Management said bad weather led to double-digit revenue declines in the first two weeks of the year, which was part of the reason for the shortened outlook.

The new guide assumes continued weakness in the trucking business in the first quarter, but some seasonality in the second quarter. The contract rate is expected to remain stable going forward. Sub-truckload demand is expected to remain strong due to improved yields.

The first-half guidance (midpoint) of 94 cents is less than half the consensus estimate of $2.08 at the time of publication. Most analysts expect TL's fundamentals to accelerate at least to some extent in the second half of this year.

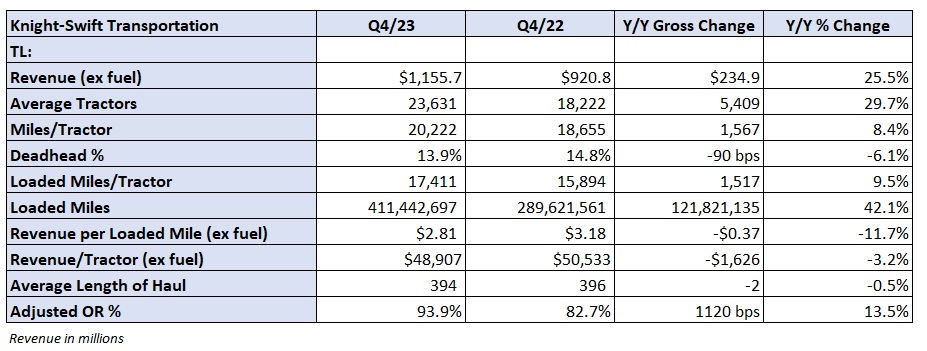

The TL segment saw revenue (excluding fuel surcharges) increase 26% year-over-year to $1.16 billion as average tractors in service increased 30% and revenue per tractor decreased 3%. reported. The year-over-year comparison also includes the acquisition of US Xpress, which was completed on July 1st.

Revenue per mile loaded (excluding fuel) was down 12% year over year, resulting in lower margins. Adjusted occupancy rate was 93.9%, a decline of 1,120 basis points compared to the same period last year. US Xpress posted an operating profit on an adjusted basis after multiple quarters of losses. However, this fleet was a 250bp drag on the overall segment.

Mr Jackson said only a “small number” of customers were currently looking to lower prices. As costs continue to rise, there remains little room for concessions, he noted.

“At this point we are not in a position to lower rates through bidding,” Jackson said.

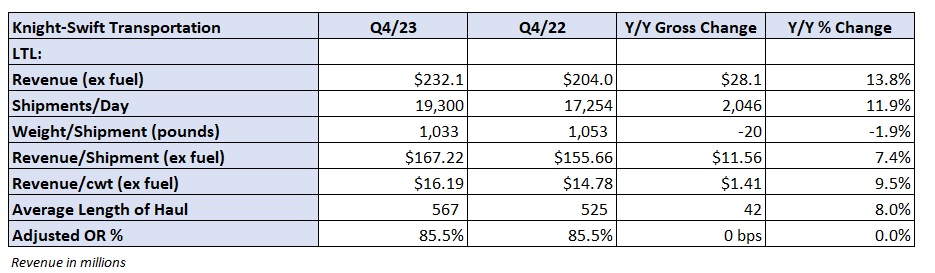

The LTL segment recorded sales (excluding fuel) of $232 million, an increase of 14% year over year. Shipments increased 12% year-over-year and revenue per shipment increased 2% (7% excluding fuel). Revenue per hundredweight excluding fuel increased by 10%.

Knight Swift added 14 LTL devices to its network in 2023. The company announced it would add a total of 25 terminals in 2024, some of which were previously occupied by Yellow. It will take 60 to 90 days from launch to completion of the new terminal. Service centers begin recording break-even results.

LTL units recorded an adjusted OR of 85.5% over the same period, flat year-over-year.

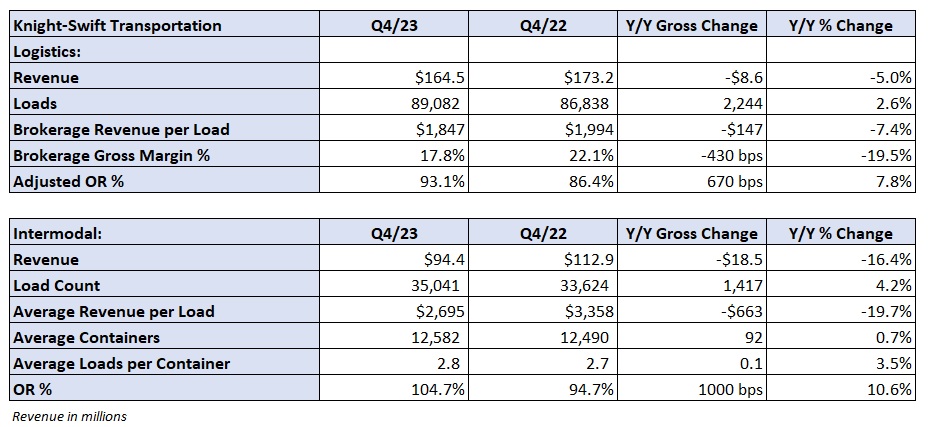

The Logistics division recorded a 5% year-over-year revenue decline despite the addition of US Xpress. Revenue per load decreased 7%, and the segment recorded an adjusted OR of 93.1%. This was 670 bps worse year-over-year.

The intermodal division posted three consecutive quarters of losses. Revenue decreased 16% year over year as revenue per load decreased by 20%, partially offset by a 4% increase in volume. The 104.7% OR worsened by 1,000 bps year over year.