-

Net income: Net income for the fourth quarter was $44.5 million, stable from the related quarter but down from the year-ago period.

-

Net interest margin (NIM):NIM fell 10 basis points quarter-on-quarter to 4.23%.

-

Total loan amount: Increased $267.3 million in the fourth quarter, an annualized increase of 10%.

-

Total deposit amount: Increased $266.5 million in the fourth quarter and 12% for the year.

-

Return on Average Assets (ROAA): 1.23% in the fourth quarter, adjusted to 1.28% excluding the FDIC special assessment.

-

Tangible book value per share: Increased 9% quarterly to $33.85.

-

asset quality: The ratio of non-performing assets to total assets was 0.34% at the end of 2023, up from 0.08% at the end of 2022.

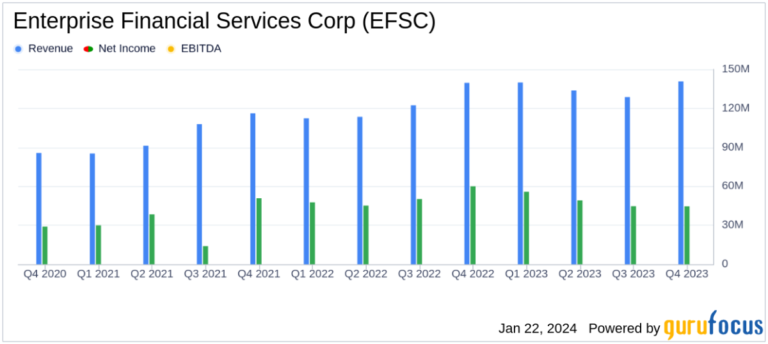

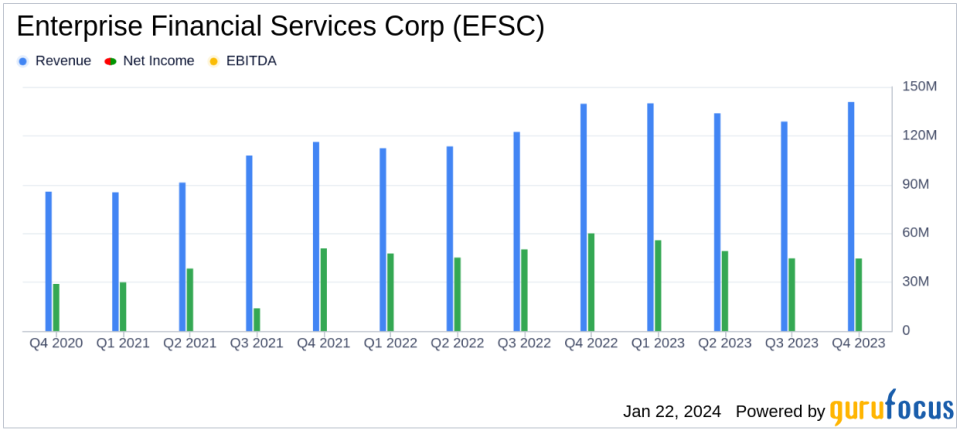

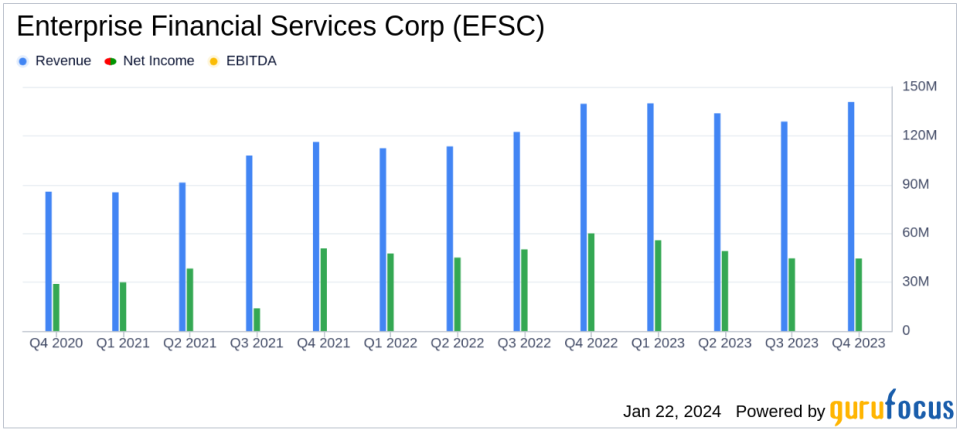

On January 22, 2024, Enterprise Financial Services Corporation (NASDAQ:EFSC) released its 8-K report detailing its fourth quarter and full year 2023 financial performance. EFSC is a financial holding company that provides a wide range of banking and wealth management services. , reported fourth-quarter net income of $44.5 million, equivalent to $1.16 per diluted common share. Adjusted for the FDIC special assessment of $2.4 million, diluted earnings per common share were $1.21.

Although net income was stable sequentially, it decreased from the prior year period primarily due to higher charge-offs, including a significant one related to a single agricultural relationship. President and CEO Jim Lally noted that this was an individual issue and expressed overall satisfaction with the company's strong finish to the year.

Annual achievements and challenges

For the full year, EFSC reported net income of $194.1 million ($5.07 per diluted share), down slightly from $203 million ($5.31 per diluted share) in 2022. reported. The company's net interest income increased by $88.7 million and gross loans increased by $88.7 million. Deposits increased by 12% each. ROAA for the year was 1.41%, adjusted to exclude FDIC special assessments of 1.42%. Return on average tangible common equity (ROATCE) was reported as 16.25%, or 16.40% adjusted for FDIC special assessments.

Despite these positive indicators, EFSC faced challenges such as non-performing assets increasing as a percentage of total assets from 0.08% to 0.34% at the end of 2022. Net charge-offs also rose from 0.04% of average loans to 0.37% in 2023. The allowance for credit losses decreased to 1.24% of total loans at the end of 2023 from 1.41% at the end of 2022, primarily due to the write-off of certain non-performing loans and expected improvement in economic factors.

Financial highlights and metrics

EFSC's net interest margin contracted slightly in the fourth quarter at 4.23%, and net interest income decreased $0.9 million to $140.7 million. The company's total loans amounted to $10.9 billion, which reflects an increase of $267.3 million in the quarter, or an annual growth rate of 10%. Total deposits followed suit, increasing by $266.5 million to $12.2 billion. The ratio of tangible common stock to tangible assets was 8.96%, and tangible book value per share increased 9% to $33.85.

These indicators are critical in assessing EFSC's financial health and operational efficiency, especially in the competitive banking industry where profitability, asset quality and capital adequacy ratios are key indicators of performance.

I'm looking forward to

CEO Jim Lally expressed optimism about leveraging growth opportunities to strengthen the company as it looks to 2024. The company is focused on organic asset growth and managing net interest income amid changes in market interest rates and aims for continued success.

EFSC's earnings report reflects a company navigating a challenging environment with a focus on growth and asset quality management. While full-year net interest income growth and loan and deposit growth are encouraging signs for investors, rising non-performing assets and charge-offs will be areas to watch next year.

For a detailed analysis of EFSC's financial performance, including reconciliations of non-GAAP financial measures, please see the entire 8-K filing.

For more information, see Enterprise Financial Services Corp's full 8-K earnings release here.

This article first appeared on GuruFocus.