extreme photographer

summary

We recommend purchasing DICK'S Sporting Goods, Inc. ().New York Stock Exchange:DKS), as the business is well-positioned to navigate the current macro environment and has scope for further margin expansion. DKS' past financial performance and capital performance The returns also lend credence to the company's ability to weather this difficult period. I expect DKS to follow a revenue growth trajectory similar to the subprime era, which accelerated its growth.

Business content

DKS is a leader in the U.S. sporting goods retail industry. Its strategy is to offer a wide product assortment that caters to the mass market and is priced at an affordable price point. As of fiscal 2022, it boasts the largest revenue scale of over $12 billion, accounting for approximately 11% of the industry's revenue share.

DKS is well-positioned to survive This weak macro environment

The concern regarding the sale of consumer products today is that the spending environment is clearly weak, primarily because consumers have less disposable income due to rising interest rates and an inflationary environment. While this is a bad situation for many retailers, I think it's a real positive for DKS from multiple perspectives.

- DKS products are priced at an affordable price point and will not be affected as much as other retailers with higher prices. This is evidenced by DKS' recent results, where the business continued to record positive growth.

- As the largest player in the industry, DKS is able to maintain margins by avoiding inflationary pressures on consumers. This is evident from his gross profit margin, which remains in the mid-30% range.

- Due to the weak consumer spending environment and high cost of capital (high interest rates), many retailers closed their doors and DKS sold its dollar shares to acquire retailers. Economically, DKS was well-positioned to consolidate its market share when other players exited.

Regarding point 1, DKS' recent results speak for themselves. In Q3 2023, comp sales were reported to have increased by his 1.7% due to both transaction volume and ticket size. The company shows no signs of a trade down, and management said DKS customers are holding up well. They also said that all income groups across the portfolio increased. One notable qualitative observation is that the company's management observed an increase in customer spending per trip. Additionally, the company continued to gain market share in core categories. These demonstrate that DKS' products and price points resonate with consumers. This movement is happening across all categories, so it's safe to say that this trend is across the entire consumer population, rather than just one group.

To conclude this section, DKS has survived the last two major economic downturns (dot-com and subprime), so it has an experience advantage over new players that have recently entered the industry. This experience is critical as it provides the management team with knowledge on how to set the right price range, offer the right types of products, manage inventory, and calculate gross margins.

There is room for further improvement in margins

DKS expects the earnings growth momentum to continue in the short term. His DKS gross margin increased by 88 bps to 35.1% in Q3 2023 due to lower supply chain costs and improved merchandise margins. I believe the strength of this margin expansion indicates that DKS is fully done and dusted with respect to the inventory issues it previously faced (inventory was marked down and expectations reset). Masu. Basically, DKS solves the inventory problem and has a new set of inventory to meet the current demand. Looking ahead to FY25, we see fewer shrink headwinds (lower theft rates as management does more to combat headwinds), better inventory assortment, and improved merchandise margins (due to COVID-19 (up 50% from pre-pandemic levels), we expect gross margins to improve due to lower transportation costs. .

To be clear, without the contraction headwinds, our product margin would have increased by more than 70 basis points. Combating theft remains a top priority and we continue to invest in efforts to keep our stores, teammates, and athletes safe.Source: Q3 2023 Earnings

The improved gross margin should translate well into the EBIT line as DKS continues to manage its operating costs. There should be more room to leverage SG&A expenses as DKS continues to optimize its support center capabilities and its outdoor specialty business by integrating the Public Lands and Moosejaw teams. While the impact is difficult to quantify, management expects a positive impact.

Overall, this, coupled with further SG&A deleveraging from productivity improvements, should improve gross margin prospects and drive EBIT expansion.

strong financial performance

No discussion of DKS would be complete without mentioning its past financial performance, which lends credibility to its ability to execute. DKS has been a formidable force for the past 23 years and has never shown negative annual growth except for 2019. Even during the subprime crisis, the business only experienced slow growth and no negative growth. The same was true for profitability performance. DKS has never reported a loss on an annual basis, generating his FCF that is positive most of the time (negative numbers in only 4 of his 23 years). DKS's balance sheet has also remained net cash for much of the recent decade. The good thing here is that DKS is returning cash to shareholders, either through dividends or share buybacks. In recent years, management has increased the pace of share buybacks, with the number of shares decreasing from 100 million in 2014 to just 58 million as of Q3 2023. This is a massive 42% reduction over his nine years. This equates to approximately 3+% per year, and including the dividend yield of approximately 2% over the same period, DKS effectively returned 5%+% per year to shareholders.

This historically strong performance is a testament to DKS' ability to withstand economic fluctuations, and I believe that management has shareholder interests in mind. These should support stock market sentiment in today's capital market environment.

evaluation

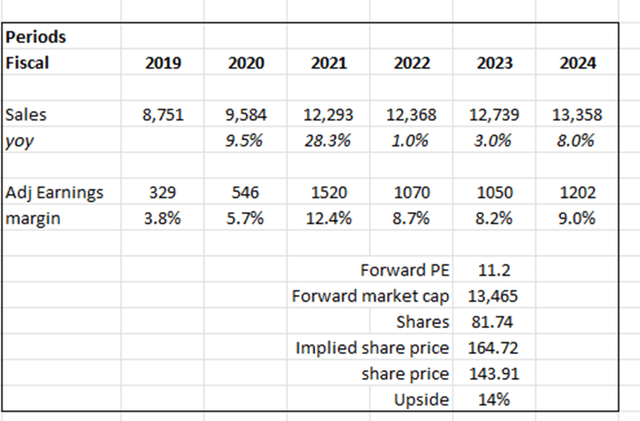

Based on the author's own calculations

Based on my business view, DKS should see growth and recovery over the next two years. Inflation has gradually declined to 3.4% from a high of over 6% last year, and the Fed is also considering rate cuts to reduce the cost of capital for businesses, so I think we are gradually entering a recovery phase. I am. Both of these paint a positive picture of the economy and have a direct positive impact on retail. Given DKS' industry experience and execution capabilities (as evidenced by Academy Sports & Outdoors and Hibbett's negative growth since the beginning of the year, unlike DKS, which has generated positive growth), the company has We should be able to continue to grow beyond this.

My growth forecast is based on DKS' performance during the subprime era. At that time, the growth rate showed an equally significant drop from his 25% growth in 2007 to his 6% growth in 2008, but then recovered slowly in 2009 and then in 2010. It accelerated even more. I think DKS is making a similar move. The growth rate declined significantly from 28% in FY2021 to 1% in FY22. A gradual recovery was seen in FY2011, and is expected to accelerate further in FY2024. My assumption of 8% in FY25 is based on pre-coronavirus business performance (about 8% growth on average from FY2014 to FY2018). DKS has historically traded at a premium to peers such as Academy Sports & Outdoors Inc. and Hibbett Inc., which trade on forward P/E ratios of 8x and 7x, respectively. We expect this premium to continue as DKS maintains its position as the largest player (highest his EBITDA margin). I value DKS's forward P/E ratio of 11.2x, which is the current trading level.

Risks and conclusions

Although DKS has experienced multiple cycles of economic downturn, there can be no assurance that DKS will be able to weather this cycle in a similar manner. For all we know, this could be a much bigger recession than what we're seeing today. In a full-blown recession, consumer retailer DKS will definitely feel the heat, and there's a good chance its growth rate will turn negative.

Overall, I recommend purchasing DKS. Despite the depressed consumer spending environment, I believe DKS is well positioned due to its affordable pricing strategy, product assortment, and experience navigating such environments. Recent results also suggest that DKS' products and pricing resonate with consumers from all income groups. Margins should improve going forward as previous inventory issues are resolved and management is working on plans to optimize the business.