(Bloomberg) — Asset managers are selling bonds and increasing their cash holdings, worried that year-end stock gains on hopes for a soft landing are too optimistic.

Most Read Articles on Bloomberg

Bond allocations to fund regulators are down 17 percentage points from the same time last month, according to the Bank of America Corporation Fund Manager Survey released this week. The amount held in money market funds and other cash vehicles increased by 13 percentage points over the same period.

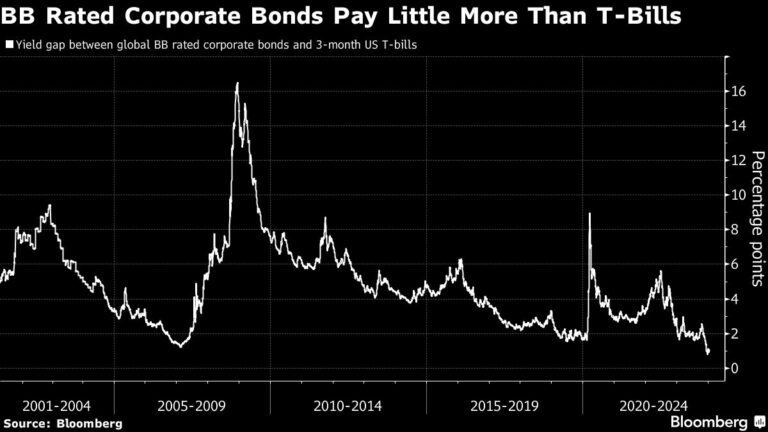

Making profits on bonds now makes sense. Because short-term interest rates are very high compared to medium- and long-term yields, the yield on junk bonds is not much higher than on Treasury bills. Financial officials have also warned that the market is too confident that a rate cut is imminent. Traders have largely softened their views on the number of interest rate cuts the central bank will make this year.

“Rather than aggressively chasing risk, this is a month to sell risk and move up,” said Adam Darling, a high-yield bond fund manager at Jupiter Fund Management, who is increasing his allocation to cash. I'm alone. He said, “If the data shows anything other than a soft landing, there will be a huge panic in the market.”

It's becoming increasingly difficult for executives like Mr. Darling to justify holding bonds that could plummet if interest rates don't fall as much as expected or if fears of a recession start to mount. ing. Geopolitical tensions, including attacks on commercial ships in the Red Sea by Houthi militants, could cause inflation to start rising again, complicating the outlook for monetary easing.

Click here to listen to the podcast on private credit growth

Interest rate traders are now pricing in at least five 25 basis point rate cuts in the euro zone and the United States this year, and at least four cuts by the Bank of England, according to data compiled by Bloomberg.

European Central Bank President Christine Lagarde said this week that easing is likely to come in the summer, warning that aggressive bets “will not help in the fight against inflation.”

Henrietta Packment, head of global fixed income and sustainability at the firm, said AllSpring Global Investments is among asset managers that still believe there is an investment opportunity in fixed income because yields are high enough to offset inflation. Said to be one. However, she said there could still be debt pressure this year.

“I would be surprised if we didn't see at least one decline in spreads this year,” said Jupiter's Dahlin. “The economic environment is so volatile that even the slightest bit of bad news can cause a sell-off.”

Click here to watch the latest edition of Bloomberg Real Yields

1 week review

-

UBS Group has deviated from Credit Suisse's original plan to sell its $250 million troubled loan business to a single bidder after failing to garner sufficient interest and instead disposed of the assets separately. I'm planning to.

-

U.S. high-quality corporate bond trading volume hit a record high last year and is set to rise again in 2024 as investors look to acquire bonds while yields remain relatively high and the supply of new corporate bonds lags. there's a possibility that.

-

Global leveraged loan sales are strong as issuers take advantage of strong buyer demand ahead of interest rate cuts and election-induced volatility later this year.

-

U.S. high-grade and junk-bond markets are rushing to borrow money as companies look to take advantage of recent declines in yields, with sales of high-quality bonds nearing their highest January level since 2017. There is.

-

Demand for European bond sales is rising at a record pace as investors scramble to secure attractive yields before central banks start cutting interest rates.

-

Until recently, real estate was a prime example of the problems that can arise when interest rates rise rapidly. But now bond prices are soaring, and investment banks such as Goldman Sachs Group Inc. are backing this difficult space.

-

The global speculative-grade default rate has risen to its highest level since May 2021, due to rising funding costs, inflation and tighter loan conditions, according to a note from Moody's Investors Service.

-

Borrowing costs in China's renminbi-denominated bond market, used by low-rated corporates and local government lenders, are at their lowest level in nearly 20 years, following a series of government policies to clean up bad loans and stimulate the economy. It declined to .

-

China's leading financier Ping An Bank has put 41 developers on its list of builders eligible for financial support, a boost to the real estate sector in crisis following government pain relief measures. This is a move toward expanding financing.

-

JPMorgan Chase & Co. is in talks to secure commitments of $2.5 billion to $3 billion from third parties to expand its private credit strategy.

-

Royal Canada Bank has restarted a lunatic bond market similar to bonds issued by Credit Suisse Group AG, which disappeared last year.

-

Dish Network Inc.'s debt swap ambitions have caused turmoil among traders who have bought a type of insurance that would pay out if the troubled satellite TV company defaults.

move

-

Five Credit Suisse portfolio managers are leaving the bank to form a new global macro fund on the Lombard Odier Investment Managers alternative platform.

-

Kevin Burke, a longtime banking executive and early figure in the leveraged loan business, has died after a battle with pancreatic cancer.

-

Paul Gibbs, currently co-head of EMEA loans and leveraged finance at Citigroup, will be given a larger role, including the region's debt capital markets.

-

The Carlyle Group has appointed Peter McKee as global head of credit distribution, replacing outgoing Andrew Currie.

-

David Hirschman and Ariadna Stefanescu have been appointed co-heads of Permira Credit following the departure of former head James Greenwood in 2023.

-

StoneX Group Inc. is looking to grow its ailing sales and trading business as larger companies exit the market.

–With assistance from Dan Wilchins.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP