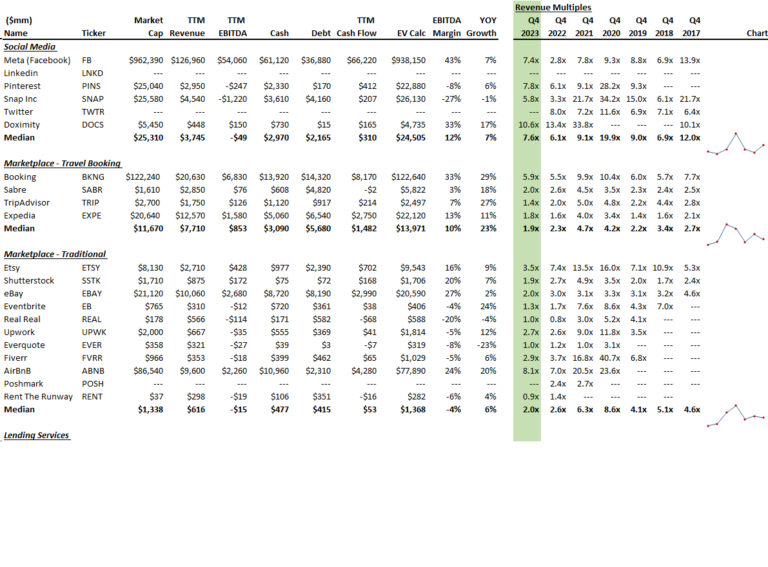

Below are earnings multiples for publicly traded consumer technology companies (B2C). Industries, and therefore their multiples, vary widely.

Social Media is trading at 7.6x. Multiples rose steadily throughout 2020, reaching a median of 22.7x in Q1 2021. The median year-over-year growth in this space is just 7%, with Doximity leading the way.

The travel market is 1.9x. The multiple reached 10.6x in Q2 2021. He trades at 5.9x on Booking.com.

Traditional marketplace multipliers vary widely. Before Q3 2018, there were only two companies in this space; now there are 10. The median multiple is currently 2.0x, but AirBnB stands out at 8.1x.

Labor intensive spaces. The only reason we include these companies in our analysis is because investors like SoftBank insist on calling these service businesses high-tech companies. Obviously not. The lesson here is don't believe the hype. Technology-enabled services are not technology and have lower multiples that suit business models in this area.

Rideshare multipliers vary. Currently, Lyft trades at 1.0x revenue and Uber trades at 3.8x revenue. Keep in mind that food delivery saved his Uber's life in 2020, and that line of business is important. Bird appears to be on the verge of bankruptcy.

subscription. B2C subscriptions are a great business model with 4.0x revenue. Match and Sirius have excellent margins (about 29%).

game. The median earnings multiple is a strong 5.6x. SciPlay was acquired in October and is currently not traded.

E-commerce is diverse. This sector is the least attractive to investors, with a median earnings multiple of 0.6x. There is a big difference between so-called premium e-commerce like Coursera, Warby, LegalZoom, and Amazon and the rest. Note that e-commerce margins are abysmal, with a median EBITDA margin of -1% and year-over-year growth of 1%. We characterize Amazon as an ecom, but all the value is coming from his AWS, which trades at 3.0x his. BlueApron was acquired for $103 million, a 137% premium to his September 2023 valuation when the acquisition was announced.

Hardware is 1.3x. Roku fell the most. Of course, Apple really stands out at 7.6x.

For more information on SaaS data and blogs, visit blossomtreetventures.com.