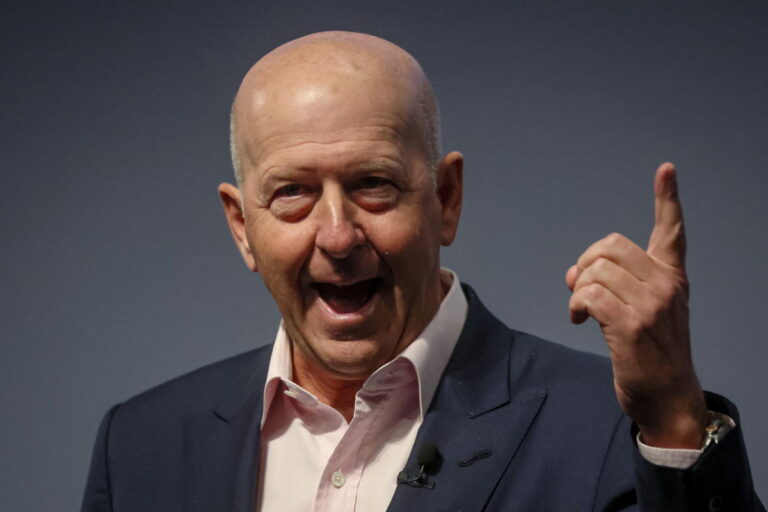

Goldman Sachs profits (G.S.) rose 28% in the first quarter as investment banking revenue soared, giving CEO David Solomon the momentum he needed to start 2024.

Net income was $4.1 billion, exceeding analyst expectations. Revenue jumped to $14.2 billion from a year earlier, due in part to a 32% rise in investment banking fees. Asset and wealth management revenues soared, as did trading.

Goldman stock rose more than 5% in early trading Monday.

The results come after Solomon's most challenging year since 2019, his first full year at the helm.

Deal-making slowed across Wall Street, and Mr. Solomon faced a costly exit from consumer banking and a series of high-profile departures from the company.

“I have said previously that historically low activity levels will not last forever,” Solomon told analysts on Monday. “It is clear that we are in the early stages of reopening capital markets. ” he added.

The pressure on Solomon continues in 2024. Two prominent proxy advisory firms advised shareholders this month to vote to limit Solomon's powers, and the results will be tallied at the company's annual meeting on April 24.

The shareholder proposal, approved by Institutional Shareholder Services (ISS) and Glass, Lewis & Company, would split the roles of CEO and chairman, which are currently held by Mr. Solomon. A similar proposal last year failed to pass with just 16% of the vote.

Separately, Glass Lewis is recommending that shareholders also vote against Goldman's executive compensation plan, citing the “significant disconnect between pay and performance.” ISS provided “thoughtful support” to the executive compensation plan.

Mr. Solomon's 2023 compensation increased 24% to $31 million, despite a similar decrease in profits.

Not only is this amount higher than the $25 million he earned in 2022, but it's also higher than the $25 million he earned in 2022, as well as rivals Brian Moynihan, Charles Scharff and Jane Fraser, who are also known for their investments in Bank of America (BAC) and Wells Fargo (WFC). , and more than he earned at Citigroup (C). .

The first quarter results could help Mr. Solomon as he prepares to meet with shareholders later this month. The jump in investment banking includes a 24% increase in advisory fees, a 38% increase in bond underwriting fees, and a 45% increase in equity underwriting fees.

Bond and stock trading income both increased by 10% from the previous year.

“We feel very good about our first quarter results,” Solomon told analysts. “This performance was supported by the rapid actions we took last year to sharpen our strategic focus and develop our core strengths.”

Much remains in flux at Goldman as key executives depart, ultimately raising new questions about the race to succeed Solomon.

One person who will unexpectedly retire in 2024 is Jim Esposito, who was co-head of Goldman's global banking and markets division after nearly 30 years. Mr. Esposito was seen on Wall Street as one of Mr. Solomon's possible successors.

Another person who left in March was Stephanie Cohen, global head of platform solutions.

Even Goldman's board of directors is changing. Former Goldman CFO David Binial was named lead director on the board, replacing Adebayo Ogunlesi, who announced earlier this year that he would step down after selling his infrastructure investment firm to BlackRock.

For the latest stock market news and in-depth analysis of price-moving events, click here.

Read the latest financial and business news from Yahoo Finance