The Icahn Effect: Miles could be lost due to JetBlue's management turmoil

JetBlue is looking for revenue wherever it can be made. They're struggling, not only with their business plans derailed by a flurry of antitrust rulings, but also by corporate raider Carl Icahn. He has acquired a 10% stake in the airline, whose stock price has plummeted, and holds two seats on the board of directors. He could buy more shares in the company.

As a result, some readers are concerned about their mileage. I don't have inside information on what the airline plans to do with the points, but he has two basic ideas here.

- Devaluation will hurt them even more. They are looking for additional income from credit cards. Only Delta Air Lines has been able to consistently reduce the value of points without hurting co-branded billings and revenue, and even Delta Air Lines has announced this fall that the market's ability to bear program changes is limited. I learned.

It would be foolish to devalue their miles. JetBlue isn't seeing the benefits of its frequent flyer program as much as its competitors. Their greatest opportunity is to embrace the opportunity rather than dismiss it.

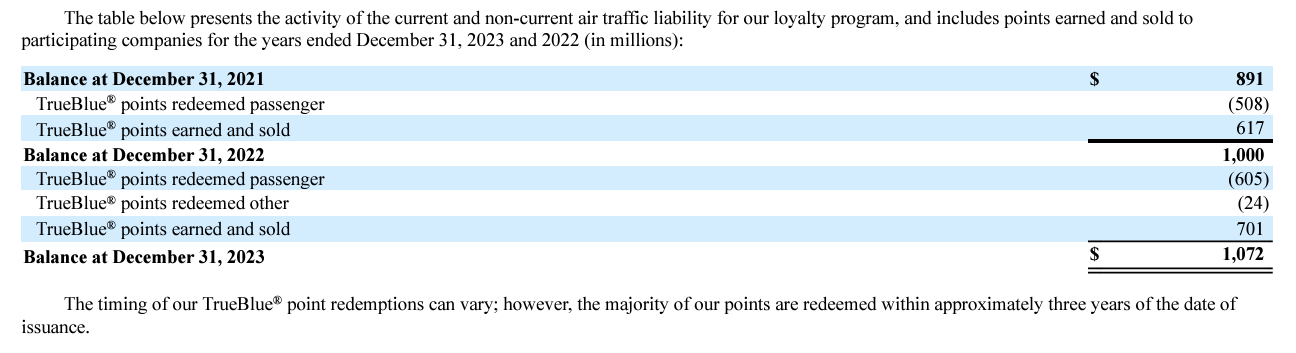

- Still, you can save money quickly and easily. If you're looking to cut costs, one place to consider on the balance sheet is TrueBlue's future travel liability. Carl Icahn's involvement is a bit of a wild card, and more of a short-term balance sheet fix than anything that actually benefits the business.

This is JetBlue's 2023 Form 10-K filed with the SEC in February. It has approximately $1 billion in debt, and if that is reduced, revenue will only be recognized once.

There is no concrete information about an impending valuation cut, only concerns that Mr. Icahn's involvement could lead to short-term cost savings that could hurt the business in the long term.

However, I'm not sure it matters either way. Your strategy should be the same. It's almost impossible that your miles will be worth more in the future than they are today. It's never a good idea to save points for something far in the future, like a travel IRA.

Arbitrage sometimes takes place. America West Flight Fund points likely got a new lease of life when the airline acquired his US Airways, opening up the opportunity for redemption into Star Alliance. If Alaska Airlines successfully acquires Hawaiian Airlines and HawaiianMiles are converted to his 1:1 mileage plan, the value of HawaiianMiles will increase.

When these arbitrage opportunities materialize, it's best to redeem them rather than save them for a future that involves devaluation.

Generally, it's best to redeem sooner rather than later – JetBlue points seem less likely to be earned more Unless they end up joining a global alliance, it's worth it.