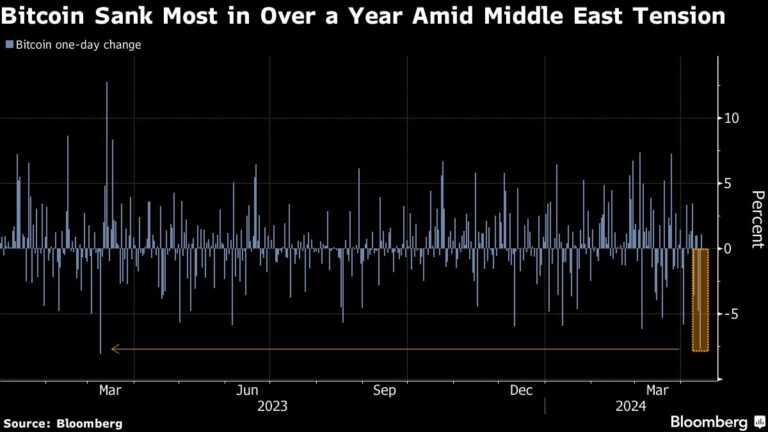

(Bloomberg) — Bitcoin gains traction after posting its biggest decline in more than a year as rising geopolitical tensions in the Middle East spur risk aversion and part of a broader slide in crypto markets. I had a hard time.

Most Read Articles on Bloomberg

The largest cryptocurrency fell 7.7% on Saturday, its biggest decline since March 2023. As of 11:36 a.m. Sunday in Singapore, the token had pared some of the decline and traded at around $63,230. Most of the other major coins such as Ether, Solana, and meme crowd favorite Dogecoin endured 24-hour losses.

Iran has launched drones and missiles against Israel in apparent retaliation for an attack in Syria that killed a senior Iranian military official, pushing the region's conflict into a dangerous new phase. Digital assets trade over the weekend, giving investors an idea of the potential mood when traditional markets reopen on Monday, but a lot can change between now and the reopening. There is a possibility.

Read more: Israel comes under Iranian attack as Middle East enters dangerous new phase

Zaheer Ebtikar, founder of crypto fund Split Capital, said whether the decline in cryptocurrencies continues “probably depends on further escalation,” adding: “People will be seriously watching to see how the market does on Monday. ” he added.

Tensions hurt stocks Friday, pushing bonds and other safe havens like the dollar higher as Israel braced for an attack. About $1.5 billion in bullish crypto bets through derivatives were liquidated on Friday and Saturday, according to Coinglass data, making it one of the largest two-day liquidations in at least the past six months. .

Ebtikar said the digital asset's leverage has been “completely overwhelmed in the last three days, which has caused a significant deterioration in prices.”

Bitcoin is down about $10,000 from its mid-March record of $73,798. Demand for the dedicated U.S. exchange-traded fund, which debuted in January, drove the token to all-time highs, but net inflows into the product have slowed in recent days.

Cryptocurrency speculators are awaiting the so-called Bitcoin halving, when the new supply of tokens will be cut in half, expected around April 20th. Historically, halvings have been a tailwind for prices, but there are growing questions about whether they are likely to repeat. Given that Bitcoin recently reached a historic peak.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP