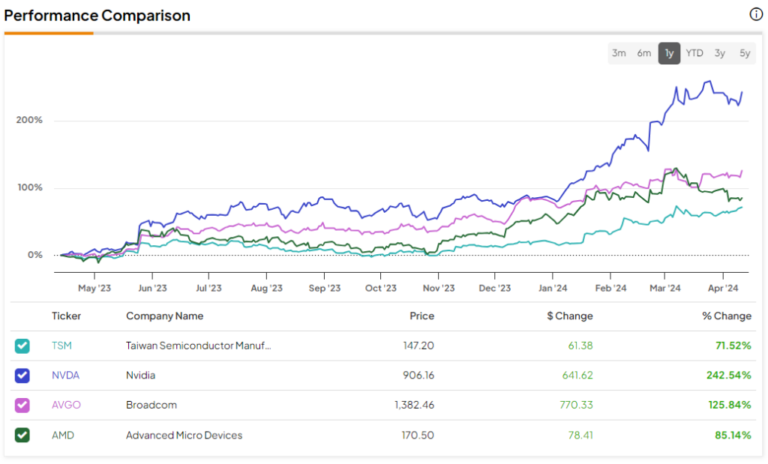

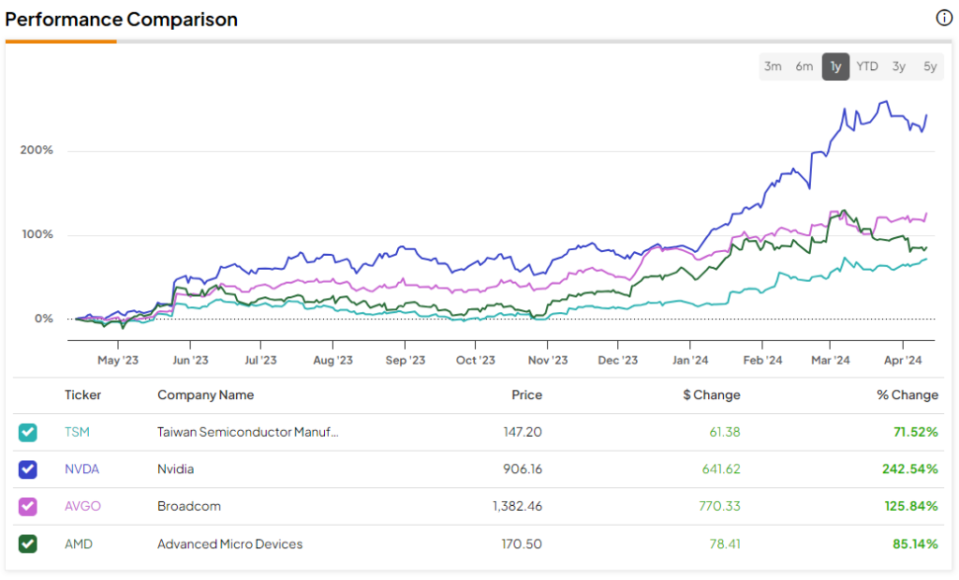

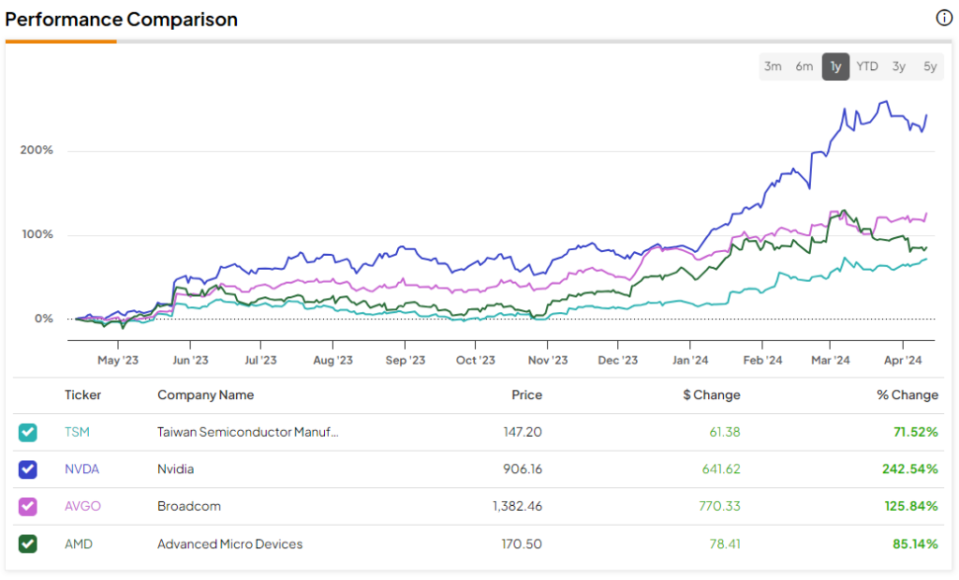

Taiwan Semiconductor Manufacturing (New York Stock Exchange:TSM) The world's largest chipmaker recently announced impressive sales figures for March. In particular, Nvidia (NASDAQ:NVDA) is up 242.5% over the past year and relies on TSM for chip manufacturing. However, TSM's share price performance (up 71.5% over the same period, see comparison image below) has been relatively weak. The question now arises: Will TSM be able to reproduce NVDA's superior performance? The answer is probably yes.

With the ongoing AI boom, increasing U.S. funding, and an attractive valuation, TSM now looks like an attractive acquisition target.

Pre-earnings numbers indicate a positive outlook for future performance

On April 10, TSM announced impressive sales figures for March, with 34.3% year-on-year growth, the highest month-on-month growth rate since November 2022, totaling NT$195.2 billion (approximately $6.1 billion). became. Additionally, first-quarter revenue is expected to reach NT$592.6 billion (approximately $18.4 billion), an increase of 16.5% year-on-year.

It is worth noting that TSM expects sales to grow by mid-20% in FY2024, driven by strong demand for the latest nanochips amid the AI explosion. Additionally, the company reaffirmed in January 2024 that AI revenue is growing rapidly at approximately 50% annually. This reaffirmation is particularly encouraging after reporting a decline in revenue in 2023..

TSM manufactures and supplies chips to major technology companies such as Nvidia and Advanced Micro Devices (NASDAQ:AMD), Apple (NASDAQ:AAPL). Ahead of its first quarter earnings release scheduled for April 18th, let's take a look at what the future holds for TSM.

AI revolution fuels TSM growth

The AI revolution has taken the world by storm. I am confident that that growth trajectory will be permanent. The AI industry is still in its infancy and is expected to see impressive expansion across various industries and applications.according to Next step strategy consultingthe industry is expected to rapidly grow to a $1.85 trillion behemoth by 2030, compared to about $208 billion in 2023.

TSM's customers rely heavily on the company to produce the chips it designs. The exploding demand for all things AI has created a huge demand for AI chips.

In addition to the AI growth spurt, TSM received approval for $11.6 billion worth of direct federal funding under the U.S. government's CHIPS Act, further strengthening its manufacturing operations. The company will receive a $6.6 billion grant to expand its manufacturing facility in Phoenix, Arizona. Additionally, TSM makes him eligible for an additional $5 billion loan.

TSM has already invested in building two factories at this location and plans to use the funds to build additional factories. The company's total investment in all three plants is estimated at $65 billion. According to a press release, this will be “the largest foreign direct investment in a greenfield project in U.S. history.”

TSM plans to produce 2-nanometer technology chips at its second factory starting in 2028. Over the next few years, TSM should benefit from significant investments that will significantly strengthen its manufacturing operations and bring in the latest technological advances.

TSM Chairman Mark Liu expressed optimism, saying: Our U.S. operations also expand our ability to pioneer future advances in semiconductor technology. ”

To date, the majority of TSM's manufacturing capacity is based in Taiwan, which presents geographic risks (potential threats such as Chinese invasion, earthquakes, etc.). With this expansion announcement, that risk will be reduced. Increased manufacturing in the U.S. will likely allow TSM to more efficiently serve top-tier U.S.-based customers such as Nvidia, AMD, and Apple. On top of that, record cryptocurrency prices are driving demand for chips, making TSM even more in demand. Growth outlook.

TSM is trading at a cheap valuation

From a valuation perspective, TSM looks cheap. The company currently trades at an attractive forward P/E of 23x, compared to much higher multiples for its peer group. Semiconductor company Advanced Micro Devices trades at a higher forward P/E ratio (49x), while AI genius Nvidia trades at a forward P/E ratio of 36.4x.

Wall Street analysts expect TSM's EPS to reach $9.02 in fiscal 2026. If TSM maintains the same forward P/E ratio by then, the stock would be worth around $207, a 45% premium to its current price. Therefore, considering the high growth potential in the AI space, it makes sense to consider buying TSM stock at current levels.

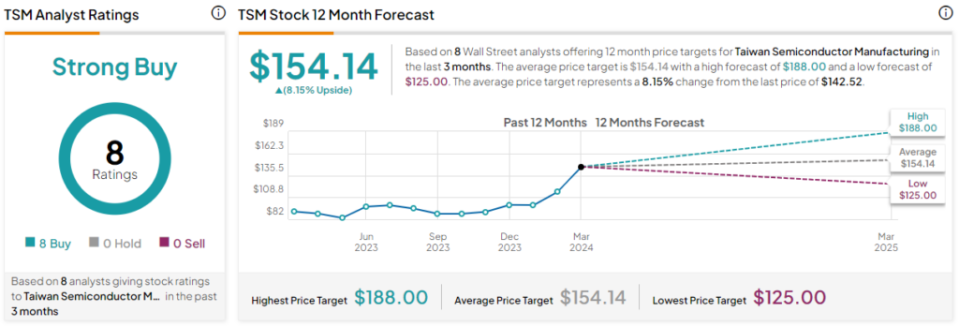

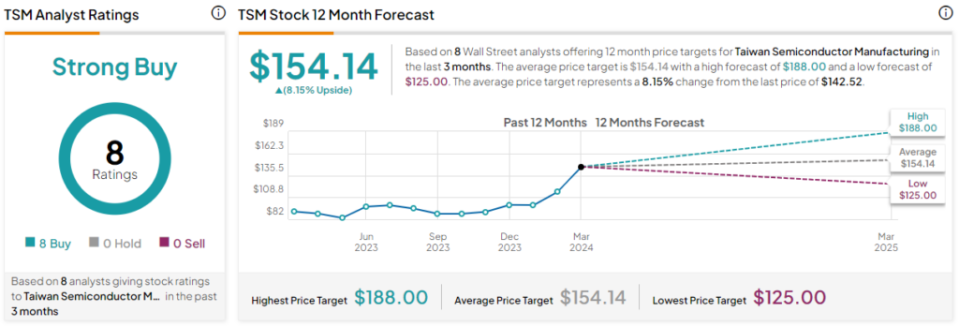

Is TSM stock a buy, according to analysts?

The Wall Street community is clearly optimistic about Taiwan Semiconductor Manufacturing stock. Overall, the stock earns a consensus rating of Strong Buy, based on 8 unanimous Buys. TSM stock's average price target of $154.14 suggests an 8.2% upside potential from current levels.

Bottom line: TSM has strong opportunities for long-term growth

The semiconductor industry is experiencing significant growth, primarily driven by the AI boom. TSM, along with its AI-focused counterparts, stands to benefit from this continued demand. With strategic investments and expansion plans to meet future demand, TSM appears well-positioned for sustained growth. Considering these factors, I tend to buy the stock at current levels in hopes of long-term gains from its AI potential.

disclosure