Stay up all night putting together PowerPoint presentations. Enter numbers into an Excel spreadsheet. Refining the language of difficult financial statements that others may never read.

These menial jobs have long been a rite of passage in investment banking. Investment banking is an industry at the top of the corporate pyramid that lures thousands of young people every year with the promise of prestige and rewards.

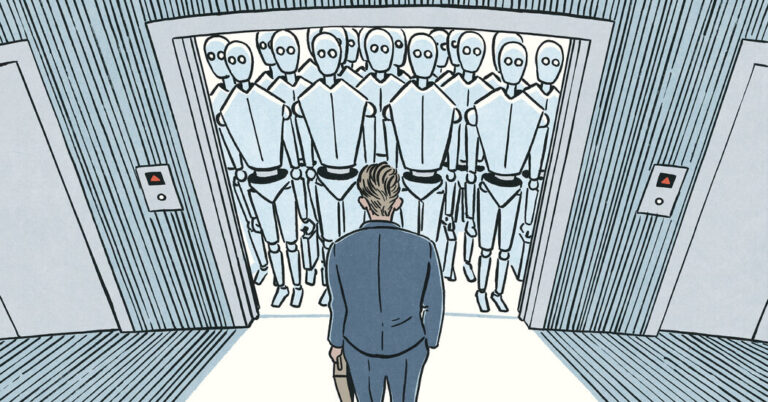

until now. Generative artificial intelligence, a technology that is transforming many industries with its ability to generate and process new data, has arrived on Wall Street. And investment banks, long accustomed to cultural shifts, are rapidly turning into Exhibit A of how new technology can not only complement, but replace the entire workforce.

Those most directly exposed to risk are the jobs of analysts at the lower echelons of investment banking, who spend endless hours learning the components of corporate finance, including the intricacies of mergers, public offerings, and corporate debt transactions. I'm wasting my time. Now, AI can do much of that work quickly and without too much whining.

“The structure of these jobs hasn't changed much in at least 10 years,” says Julia Dahl, head of BCG's Behavioral Science Lab and a consultant to major banks experimenting with AI. . The inevitable question is, in her words, “Do we have what it takes?” Are there fewer analysts? ”

Some of Wall Street's largest banks are also testing AI tools that could nearly replace armies of analysts by performing tasks in seconds that currently take hours or an entire weekend. I have the same question. The software, which has been deployed within banks with codenames such as “Socrates,” could not only change the arc of Wall Street careers, but also essentially negate the need to hire thousands of new graduates. There is sex.

Leaders at banks such as Goldman Sachs and Morgan Stanley are discussing how much they can cut their new analyst classes, according to people involved in the ongoing discussions. Those within these banks and others have suggested investment banks could cut hiring of junior analysts by up to two-thirds and reduce salaries for those hired because the work is less demanding. are doing. As usual.

Christoph Ravenseifner, chief strategy officer for technology, data and innovation at Deutsche Bank, said that while “a simple idea would be to replace junior employees with AI tools,” human involvement would still be needed. added.

Representatives from Goldman, Morgan Stanley and Deutsche Bank said it was too early to comment on specific personnel changes. However, consulting giant Accenture estimates that AI could replace or supplement nearly three-quarters of banker hours across the industry.

Goldman is “experimenting with technology,” said Nick Calcaterra, a bank spokesman. “In the short term, we do not expect any changes to the new analyst class.”

JPMorgan Chase CEO Jamie Dimon said in his annual letter to shareholders this week that AI “has the potential to eliminate certain jobs and roles,” adding that the technology It ranks at the top of the list of most important issues facing the nation's largest banks. Dimon likened the impact to “the printing press, the steam engine, electricity, computing, the Internet, etc.”

Investment banking is a hierarchical industry, and banks typically hire young talent through two-year analyst contracts. Tens of thousands of 20-somethings (in both undergraduate and MBA programs) are applying for about 200 spots in each major bank's program. Salaries start at $100,000 or more, excluding year-end bonuses.

If you persevere, you will be promoted to associate, director, and managing director. Only a handful end up running the department. The life of a senior banker can be tough, but it can also be glamorous, such as traveling the world pitching to clients or working on big-money corporate merger deals. Many who complete the two-year analyst program have gone on to become giants in the business world – billionaires Michael Bloomberg and Stephen Schwartzman started their careers in investment banking – but , the majority will retire before or after the end of the two-year period, bank representatives said.

There's a joke among junior bankers that the most common job involves dragging icons from one side of a document to the other, and you end up being asked to replace them over and over again.

“It's 100 percent monotonous and boring,” said Gabriel Stengel, a former bank analyst who left the industry two years ago. Val Srinivas, a senior bank researcher at Deloitte, said much of the work involved “gathering material, vetting it, and converting it into different formats.”

Gregory Larkin, also a former bank analyst, said the new technology will “shake up power within Wall Street's biggest firms by shifting power to the engineers who program the AI tools, rather than the bankers who use them.” He said it would lead to a civil war. Tech giants like Microsoft and Google license much of their AI technology to banks for hefty fees.

Jay Hollein, co-head of JPMorgan's investment banking division, said of analysts' jobs that “AI allows them to do tasks that would take 10 hours in 10 seconds.'' “My hope and belief is that it will make the job more interesting.”

The impact of AI on finance is just one aspect of how technology is reshaping the workplace for everyone. Artificial intelligence systems, including large-scale language models and question-and-answer bots like ChatGPT, can quickly synthesize information and automate tasks. Virtually every industry is beginning to grapple with this problem to some degree.

Deutsche Bank is uploading large amounts of financial data to its proprietary AI tools, which instantly answers questions about public companies and creates summary documents on complementary financial trends that could benefit customers. It is profitable for the bank.

Horine said AI could help investment bankers use AI to identify customers who may be ripe for bond issuance, a kind of bread-and-butter deal in which customers are charged millions of dollars. He said there is.

Goldman Sachs includes software that can transform so-called “corpus” information – vast amounts of text and data collected from thousands of sources – into page presentations that mimic the bank's typeface, logo, style and graphs. We assigned 1,000 developers to test the AI. . One company executive informally called this a “Kitty Hawk moment,” a moment that changed the company's future direction.

This is not limited to investment banking. BNY Mellon's CEO said during a recent earnings call that research analysts are now able to wake up two hours later than usual because AI can read overnight economic data and draft analysis. said.

Morgan Stanley's head of technology, Michael Pizzi, told employees in a private meeting in January that the company was “bringing AI into every area of what we do,” including asset management. The video was viewed by The New York Times. Banks employ thousands of employees to determine the right mix of investments for wealthy savers.

Many of these tools are still in the testing phase and need to be cleared by regulatory authorities before they can be deployed at scale in real-world operations. Bank of America's CEO said last year that technology was already making it possible for the company to cut jobs.

Among Goldman Sachs' broader AI efforts is converting long PowerPoint documents into formal “S-1” documents packed with legalese for initial public offerings required of all publicly traded companies. There are tools in development that can do this.

The software takes less than a second to complete the job.

audio creator Patricia Zurbaran.