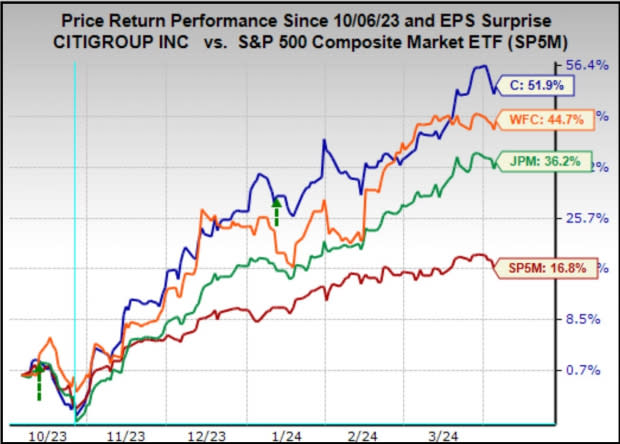

Citigroup C shares have been a star performer recently, with the stock handily outperforming the S&P 500 index (+19.8% vs. +6.3%) this year, as well as JPMorgan JPM (up +16.1%) and Wells & Co. It also leads Fargo WFC (up +16.1%). 16.7%).

As the chart below shows, if you go back a few months, say the last six months, Citigroup's lead over its peers widens even further.

Image source: Zacks Investment Research

It's good to see a perennial laggard like Citigroup show this kind of energy and momentum. But beleaguered Citigroup shareholders believe the current stock price trajectory is more durable than the period from October 2020 to June 2021, when the stock similarly seemed to be finally gaining footing. One would hope that this would prove to be the case.

Over the past five years, Citigroup has lost -6.8% in value, while JPMorgan and the S&P 500 index have gained +86.8% and +77.7%, respectively. Needless to say, this was a blow to Citigroup's shareholders.

Citigroup is a turnaround story, and the market appears to be evaluating new management's turnaround plan. Analysts covering the stock praise the planned organizational and business strategy changes, which they believe will result in greater efficiency and accountability.

We'll have a further update on the progress of the company's repositioning when it reports its first quarter results on Friday, April 12th.thalong with JPMorgan, Wells Fargo, and others.

Citigroup is expected to report earnings of $1.41 per share (-24.2% year over year) on revenue of $20.3 billion (-5.5%). pre-announced restructuring costs (which we and other companies find very “recurring” and therefore difficult to exclude), increased FDIC assessments, increased reserve additions, and relatively A combination of flat to slightly down trading conditions contributed to the year-over-year decline. – Years decrease.

The hope in the Citigroup story is that this year marks a promising turning point, especially on the cost front, with the full benefits of the restructuring starting to materialize next year and beyond.

JPMorgan, scheduled to report along with Citigroup on Friday morning, is expected to bring in revenue of $40.8 billion, up 6.3% year-over-year, and earnings of $4.22 per share, up 2.9% year-over-year.

Analysts have modestly raised their first-quarter forecasts for JPMorgan, citing broad positive trends across the industry on the deposit side, a steepening yield curve, and positive loan demand trends that are expected to improve net interest income. It is expected that there will be an upside. JPMorgan's trading activity remained flat at best, but its investment banking division is likely to show some growth on the back of increased activity in equity and debt capital markets.

Management has been talking about “green shoots” for some time when it comes to M&A and IPOs, and we'll hear more about that on Friday's call. Given the Fed's overall optimism on the back of a soft landing, it's natural to be optimistic about the outlook for these activities.

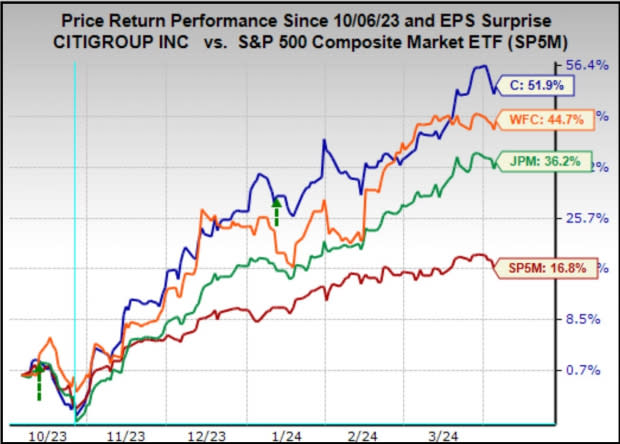

The Zacks Major Banks industry, which includes Citigroup, JPMorgan, and Wells Fargo, is expected to report a -1.6% decline in revenue and a -20.1% decline in revenue in the first quarter of 2024. Note that this industry contributed approximately 50% of the Zacks Finance sector's total returns over the subsequent four quarters.

Image source: Zacks Investment Research

As seen above, the Zacks Finance sector's Q1 earnings are expected to increase +3.6% year over year on revenue growth of +2.4%.

If you're wondering where the positive growth in revenue for this sector will come from while big banks are expected to see a year-on-year decline, the table above will answer that question for you: What is expected from the insurance industry? You can see. (The insurance industry accounts for about one-third of the industry's total revenue).

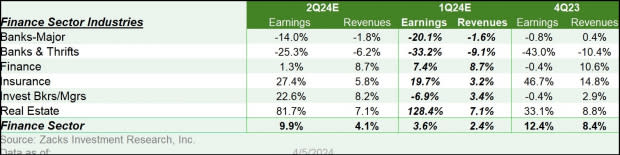

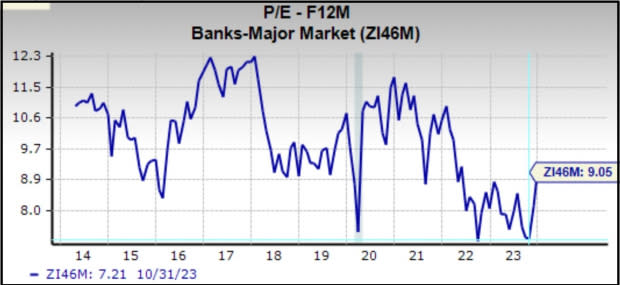

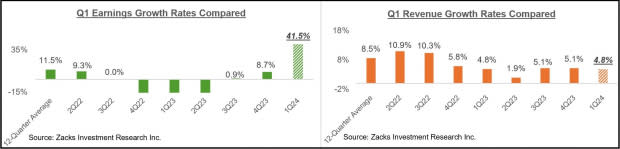

Despite the recent outperformance of big bank stocks, they remain cheap by most traditional valuation metrics. The chart below shows his 10-year history of the Zacks Major Bank industry on a trailing 12-month P/E basis.

Image source: Zacks Investment Research

Admittedly, the industry is not as cheap as 7.2x last October. However, the current multiple of 9.1x compares with a high multiple of 12.3x, a low multiple of 7.1x, and a median of 9.1x over the past 10 years.

In comparison to the broader market, the Zacks Major Banks industry is currently trading at 43% of the S&P 500's forward 12-month P/E multiple. As the chart below shows, over the past decade, stocks in this industry have traded at a high of 73%, a low of 39%, and a median of 55%.

Image source: Zacks Investment Research

With the S&P 500 index at or near record levels, discounted valuations in the financial sector must be one of the most attractive investment spots on the market.

This is especially true for investors who believe the economy is headed for a soft landing, with all sorts of beneficial spillovers to economically sensitive areas in terms of credit losses and loan demand.

This week's earnings report

We review the results of 10 members of the S&P 500, including the aforementioned quarterly reports from JPMorgan, Citigroup, and Wells Fargo. Other notable reports this week include Delta Air Lines, Constellation Brands, and Fastenal.

These are not the first Q1 earnings reports. Companies with fiscal quarters ending in February have already reported their results, and all those reports are counted as part of the first quarter tally. Until Friday, April 5ththwe have confirmed these February quarter results from 20 S&P 500 members.

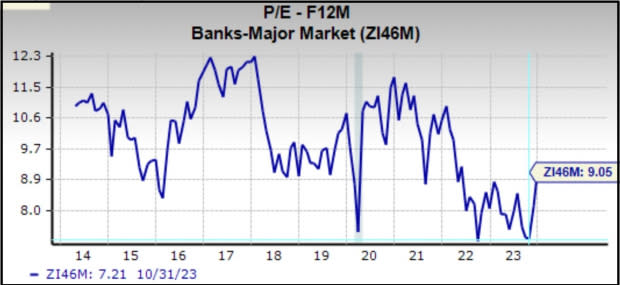

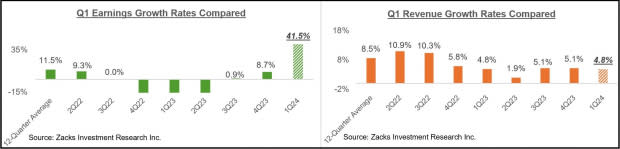

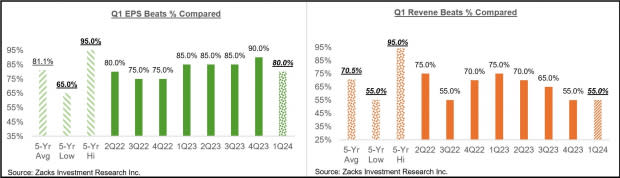

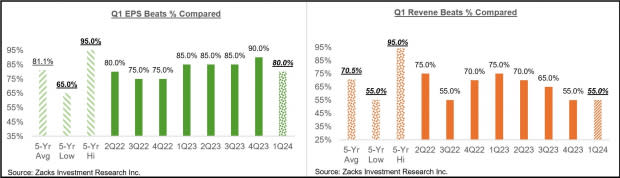

Combined first quarter earnings for these 20 index members increased +41.5% year over year, revenue increased +4.8%, 80% beat EPS estimates and 55% beat revenue estimates.

Although it is too early to draw firm conclusions, we nevertheless compare the earnings and revenue growth of these 20 index members to other recent periods.

Image source: Zacks Investment Research

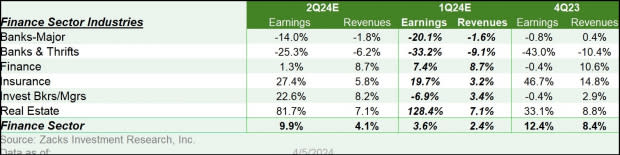

The comparison chart below shows first quarter EPS and sales percentages based on historical conditions.

Image source: Zacks Investment Research

The sample is too small to draw any conclusions, but it seems difficult to generate positive surprises at this stage.

Overall picture of profits

For the full first quarter, S&P 500 total revenue is expected to increase +2.3% year over year on +3.4% revenue growth, which is +6.7% compared to +3.9% revenue growth in the prior year. This will follow revenue growth. period.

The chart below shows current earnings and revenue growth expectations for Q1 2024, based on the past four quarters of growth and current expectations for the next three quarters.

Image source: Zacks Investment Research

As we've pointed out all along here, Q1 estimates declined as the quarter began, but the decline in Q1 estimates is relatively small compared to what was seen in comparable periods in previous quarters. It was good.

Q1 forecasts were revised downward overall, with most of the negative revisions concentrated in the energy, automotive, basic materials, and transportation sectors. On the other hand, expectations for the retail, consumer discretionary, and technology sectors rose slightly, with notable positive revisions.

As the chart below shows, the current first quarter earnings and revenue forecasts include a slight year-over-year decline in net income.

Image source: Zacks Investment Research

This chart shows that the extreme margin pressure seen in 2022 and early 2023 is now a thing of the past.

Net income margins for the first quarter of 2024 are expected to be below year-ago levels in nine of the Zacks' 16 sectors, with the Energy, Basic Materials, Automotive, and Medical sectors expected to experience the largest declines. Net profit margins are expected to be above year-ago levels in five of his 16 Zacks sectors, with the Technology and Utilities sectors seeing the largest increases.

The technology sector is now firmly back in growth mode, and this trend is expected to continue.

Technology segment revenue for Q1 2024 is expected to increase +19.3% year over year on +8.4% revenue growth. This follows the sector's +27.5% profit increase on +8.8% revenue growth in Q4 2023.

The sector experienced a post-COVID-19 adjustment period in 2022 and early 2023, during which it weighed on overall growth.

Remember that technology is not just another field. It is the largest revenue contributor to the S&P 500 index. The sector is currently expected to deliver 28.8% of the index's total return over the next four quarters, with the second and third largest contributors being finance and healthcare at 17.7% and 12.5% respectively. .

This means that the growth profile of the technology sector has a huge impact on the overall picture, both negatively and positively.

The tech sector pushed down the aggregate growth outlook for 2022 and the first half of 2023, but now appears poised to resume its historic positive growth role.

This growth profile can be seen in the graph below. It also shows that his 2023 Q4 2023 total profit of $158.5 billion for this sector is a new quarterly record.

Image source: Zacks Investment Research

Note that the technology sector helped keep total growth in positive territory in the first quarter. Excluding this sector's significant contribution, the rest of the index would have seen a -3.3% year-over-year decline in Q1 revenue (+2.3% overall).

Looking at the overall earnings picture on an annual basis, total earnings for S&P 500 companies in 2024 are expected to increase +8.3% with an earnings growth rate of +1.7%.

Image source: Zacks Investment Research

For more information on the overall earnings picture, including expectations for future periods, check out our weekly earnings trends report. >>>> Bank earnings outlook: what to expect

Want the latest recommendations from Zacks Investment Research? Today you can download 7 Best Stocks for the Next 30 Days.Click to get this free report

Wells Fargo & Company (WFC): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research