The cryptocurrency market is always vibrant, with Wormhole, Ethena Labs, and Waves currently making headlines.

Santiment data shows that these altcoins exhibit trends with unique market activity.

Wormhole’s native token, W, gained interest through a token generation event (TGE) and a massive airdrop of over 670 million tokens. In February, Wormhole described airdrops as an important step toward decentralization.

This event initially increased the value of W. However, the token has fallen 26% from its peak. At the same time, phishing scams related to airdrops are also on the rise.

moreover, controversy There was some debate within the community as to whether the exploiter who had previously stolen $320 million worth of Ethereum from the wormhole was mistakenly included in the airdrop.

“Wormhole forgot to exclude exploiters from airdrops,” says DeFi analyst Prand. I have written.

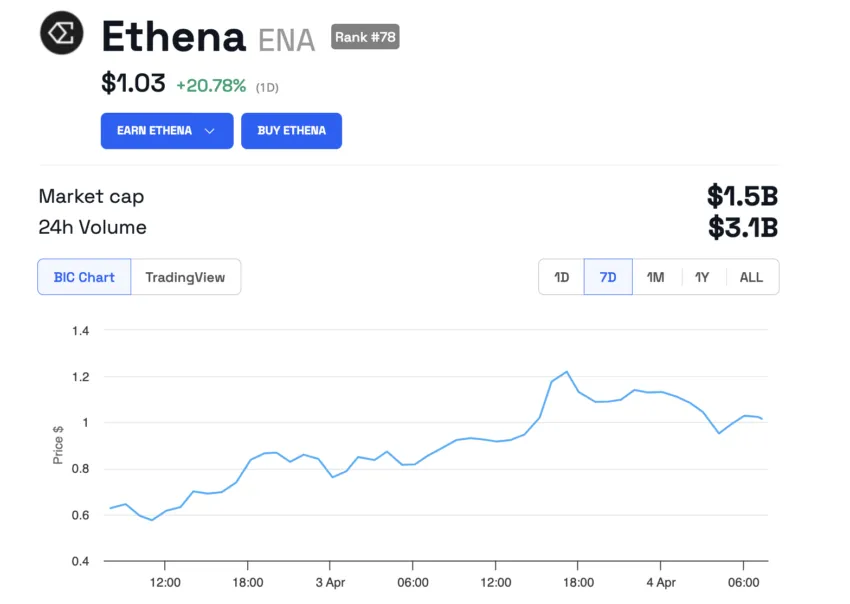

Meanwhile, Ethena’s token ENA is on an upward trajectory, increasing in price by more than 200% since its listing. It has risen more than 20% in just 24 hours and is currently trading at $1.03.

Read more: What is the Ethena protocol and its USDe synthetic dollar?

The gathering has drawn scrutiny from DeFi architect Andre Cronje. He expressed concerns about Athena's stablecoin USDe, suggesting potential risks similar to those seen during past market downturns. Cronje’s insights reflect the volatile nature of DeFi and highlight the high-risk elements of Ethena’s financial products.

“Right now things are going well because the market is positive and everyone is happy to be long, so the funding rate for short sellers is also positive, but eventually the funding will go negative and margin and collateral will be liquidated. , you're left with unbacked assets,” Cronje said.

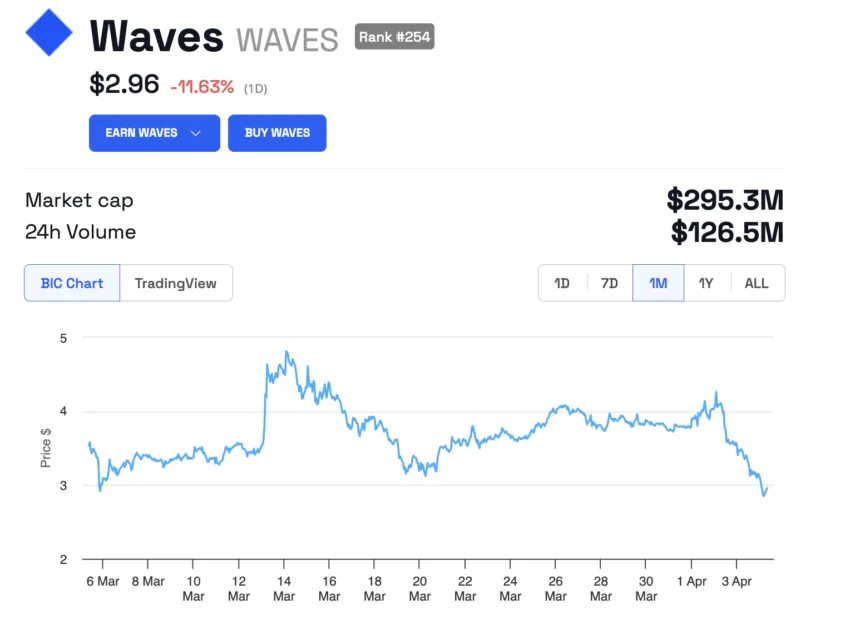

Additionally, Waves has been in the news for its investment strategy. The protocol proposed using the treasury funds of the Neutrino Index (XTN) to invest in the WavesIndex (WIND) pool and buy tokens with his WAVES from the Neutrino reserves.

However, this development has coincided with a slight decline in price, which has fallen by 11% in the past day. In addition to the volatility, Binance has placed Waves under a watch tag indicating increased risk and volatility compared to other tokens.

Read more: Which are the best altcoins to invest in in April 2024?

Tokens with surveillance tags are at risk of being delisted by Binance.

“Tokens tagged with a monitoring tag exhibit significantly higher volatility and risk compared to other publicly traded tokens. These tokens are closely monitored and regularly reviewed. Please note that tokens no longer meet our listing criteria and are at risk of being delisted from the platform,” Binance explained.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.