To find multibagger stocks, what are the fundamental trends in a company? Ideally, you'll see two trends in a business.grow first return One is capital employed (ROCE) and the second is increasing. amount of capital employed. Simply put, this type of business is a compound interest machine, meaning you are continually reinvesting your earnings at an ever-higher rate of return.With that in mind, the ROCE Kuze (TSE:2708) looks very good, so let's see what the trend tells us.

About Return on Capital Employed (ROCE)

In case you aren't familiar, ROCE is a metric that measures how much pre-tax profit (as a percentage) a company earns on the capital invested in its business. To calculate this metric for Kuze, use the following formula:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.20 = 2.1 billion yen ÷ (27 billion yen – 17 billion yen) (Based on the previous 12 months to December 2023).

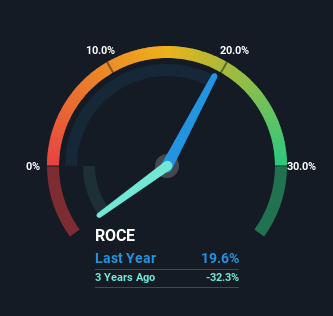

therefore, Kuze's ROCE is 20%. This is a very high absolute profit margin and better than the consumer retail industry average of 8.8%.

Check out our latest analysis for Kuze.

Although the past does not represent the future, it can be helpful to know how a company has performed historically. That's why I created this graph above. If you would like to know more about Kuze's past, please click here. free A graph covering Kuze's past earnings, revenue, and cash flow.

What can we learn from Mr. Kuze's ROCE trend?

We like the trends we're seeing from Kuze. According to the data, the return on capital has increased significantly to 20% in the past five years. Essentially, the business is earning more money per dollar of invested capital, and on top of that, it's now using 34% more capital. So we're very inspired by what we're seeing at Kuze because of the ability to profitably reinvest capital.

On a separate, but related note, it's important to know that Kuze's current liabilities to total assets ratio is 61%, which we consider to be quite high. Note that this effectively means that your suppliers (or short-term creditors) are financing a large part of your business, so this can introduce some elements of risk. This is not necessarily a bad thing, but a lower ratio can be advantageous.

The conclusion is…

In summary, Kuze has proven that he can reinvest in his business and generate higher returns on the capital he employs. This is great. His impressive 148% total return over the past five years shows that investors expect even better things to happen in the future. With that in mind, we think this stock is worth further consideration, as it could have a bright future ahead if Kuze can maintain this trend.

One last thing to note. two warning signs I found them on Kuze (including one important one).

Kuze is not the only stock that is generating high profits.If you want to know more, check here free A list of companies that achieve high return on equity due to solid fundamentals.

Valuation is complex, but we help make it simple.

Please check it out Kuze Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.