My favorite holding period is forever. Imagine owning a piece of a timeless business, growing profits year after year, and slowly creating life-changing wealth for you and your loved ones. Of course, finding such companies is not easy. Most stocks do not earn lifetime membership in an investor's portfolio.

but, Amazon (NASDAQ:AMZN) and hershey (New York Stock Exchange: HSY) I was able to qualify. We'll explain what's special and why it's worth buying now and holding forever.

Three-headed wealth-creating machine

There's a good chance that Amazon has some kind of impact on your life. The company is the dominant e-commerce company in the US, with a whopping 38% of the market. Amazon Web Services, the company's cloud division, powers much of the Internet.

And if you're a soccer fan, Amazon is a media giant that streams National Football League games along with thousands of movies and shows, generating billions of dollars in advertising revenue.

Not only is Amazon's presence in these three industries impressive, but the size of these markets has also given Amazon the virtual real estate to grow into a multi-trillion dollar business. Currently, the company generates more than $570 billion in revenue and $85 billion in operating income, which is reinvested into the company.

The company's advantage over its competitors starts with its e-commerce business. This business has become so large that it is difficult to replicate. The company's supply chain handles nearly a quarter of all packages shipped in the United States. Its size, combined with its aggressive culture of innovation, makes it hard to see Amazon disappearing anytime soon.

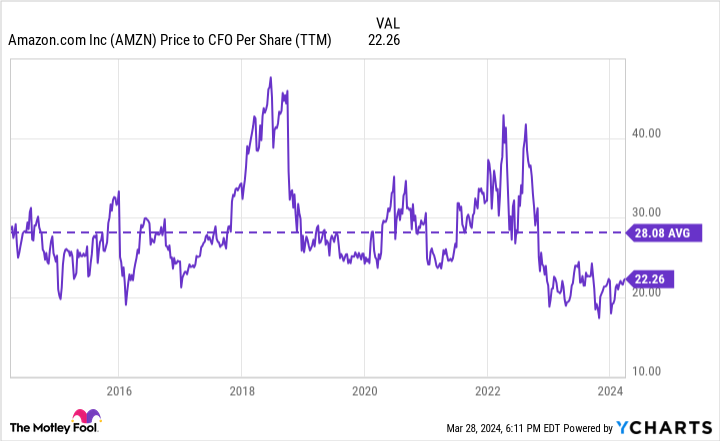

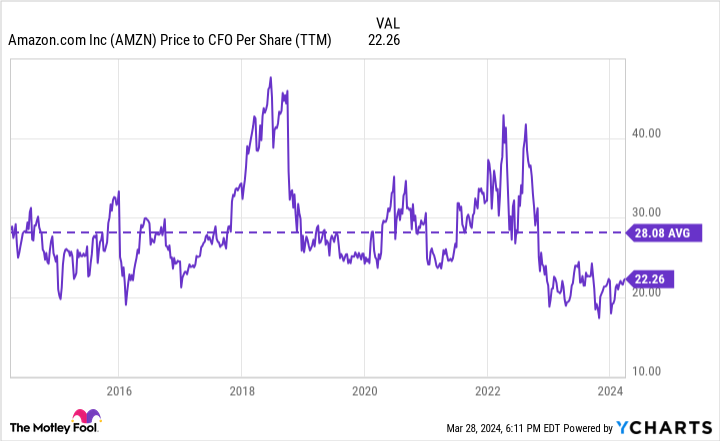

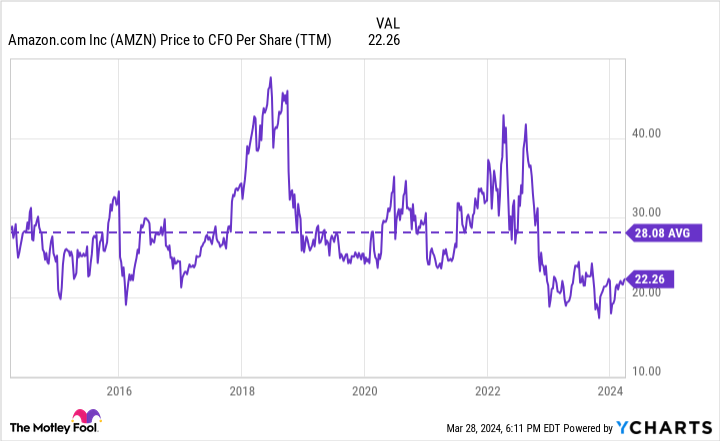

Even at its current size, Amazon is investing heavily in growing its business, so I like to value stocks on operating cash flow. Comparing the stock price and operating cash flow per share, the stock price remains cheap compared to its long-term average.

Investors can add Amazon to their portfolios with confidence. Unless there is an unforeseen disaster, don't let it go.

Sweets never go out of style.

Hershey is on a completely different end of the spectrum. You can make chocolate and salty snacks. It's not a complex business model, but that may be a good thing.

It's the brand that makes Hershey special. Although there are other confectionery companies on the market, Hershey's name dates back more than a century, and its brand has always been one of America's year-round favorites. Who doesn't love Hershey Bars, Kit Kats, Twizzlers, Heath Bars, Jolly Rancher Hard Candy, and Reese's Peanut Butter Cups?

The company's popularity means it has the best shelf space in stores. coca cola and pepsico I work in the beverage industry. Hershey has an estimated 24% share of the U.S. confectionery market, an impressive number considering that any company can make chocolate bars. A brand that makes magic happen.

That also applies to finance. Hershey is a simple and profitable business, earning him an impressive 22% return on invested capital. That means that for every dollar Hershey puts into the business, he gets $1.22 back. This shows Hershey has pricing power and is helping the company cope with soaring cocoa prices that threaten to squeeze profit margins.

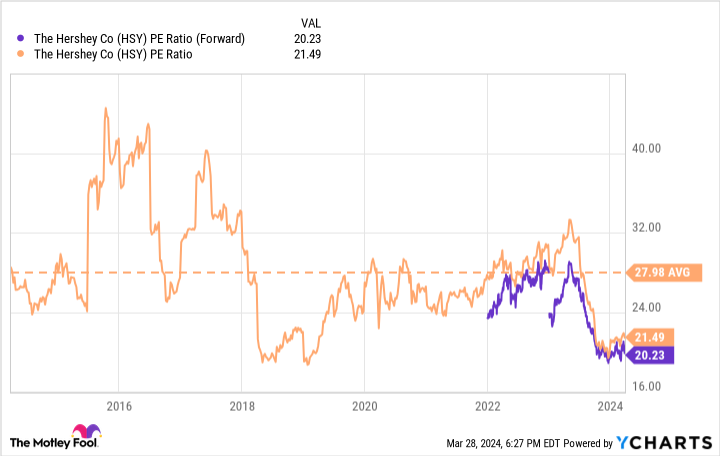

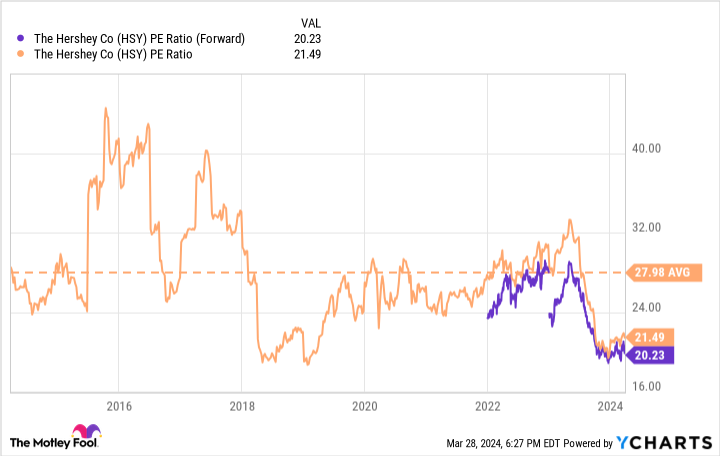

This is bad news for the company, but an opportunity for long-term investors. The stock price fell to a price-to-earnings ratio of 20 times, below the company's long-term average.

Over time, we should adjust to the higher cocoa prices, and there is a good chance that the shortage will end and prices will normalize again. In other words, take advantage of the short-term problem and buy this blue-chip stock, then enjoy the dividends and stock price appreciation for years to come.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Amazon wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 25, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool's board of directors. Justin Pope has no position in any stocks mentioned. The Motley Fool owns a position in and recommends Amazon. The Motley Fool recommends Hershey. The Motley Fool has a disclosure policy.

2 Great Stocks to Buy Now and Hold Forever was originally published by The Motley Fool.