(Bloomberg) — Chinese stocks rose the most in a month on new signs of economic recovery, providing a bright spot for Asia. Gold has soared to an all-time high.

Most Read Articles on Bloomberg

Benchmarks in mainland China and South Korea rose, but Japanese stocks fell after a report showed confidence in Japan's big manufacturers fell slightly for the first time in four quarters. US futures edged higher in Asia as markets in Australia and Hong Kong were closed for public holidays.

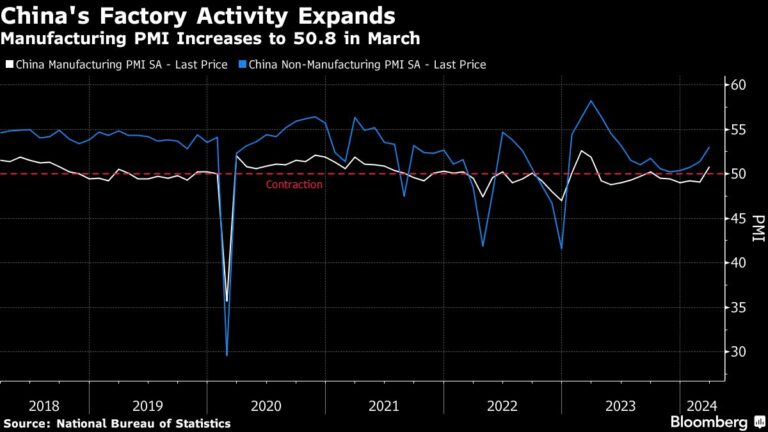

China's CSI 300 index rose as much as 1.8%, its highest level since February 29, as hopes grew that the country's economic recovery was starting to gain momentum as a rebound in manufacturing activity.

“The reality is that there is a growing optimism about China,” said Vishnu Varasan, chief economist for Asia ex-Japan at Mizuho Bank in Singapore. He said the move could gain momentum given “optimism in other parts of Asia that coincides with an upturn in global manufacturing.”

Global stocks have risen more than 18% over the past two quarters, driven by interest rate cuts and hopes for artificial intelligence stocks. These themes will remain front and center in investors' minds as the market moves into a new era.

U.S. Treasury yields and the dollar's Bloomberg index rose after Federal Reserve Chairman Jerome Powell said Friday that the central bank's recommended inflation measure is “mostly in line with our expectations.” decreased little by little. Powell added that cutting interest rates would not be appropriate until officials were confident that inflation was under control. Investors expect the U.S. central bank to make its first rate cut in June.

The core personal consumption expenditure price index, which excludes volatile food and utility costs, rose 0.3% in February following the previous month's rise, marking the largest increase in a year. The figure is up 2.8% from a year ago and remains above the Fed's 2% target.

“Right now the Fed is relying heavily on data,” said Matthew Ruzzetti, chief U.S. economist at Deutsche Bank. “Until we get corroboration or a different view of what the data is going to be, it's a little hard to tell exactly what the situation is going to end up being from a Fed policy perspective.”

In Asia, Japanese auto stocks, led by Toyota Motor Corp., fell as weak industry confidence data dampened sentiment and investors booked profits for the new financial year.

Taro Kimura of Bloomberg Economics said in a note on the Bank of Japan's Tankan survey that the drop in auto production due to the suspension of Daihatsu Motor Co., Ltd.'s suspension has dragged down related sectors. Major automakers' sentiment measures led the decline, dropping 15 points.

Among primary commodities, iron ore fell to a 10-month low as China's long-running real estate crisis continued to weigh on prices. Gold has soared to record highs as the Fed approaches interest rate cuts and geopolitical tensions deepen.

Elsewhere, Bitcoin fell after rising above $71,000 in the previous session. The largest digital currency has rallied almost 70% this year on strong demand for U.S. exchange-traded funds that hold the tokens.

This week's main events:

-

US construction spending, ISM manufacturing, Monday

-

Bank of Canada releases survey on economic outlook and consumer expectations on Monday

-

Eurozone S&P Global Manufacturing PMI, Tuesday

-

France S&P Global Manufacturing PMI, Tuesday

-

Germany S&P Global / BME Manufacturing PMI, CPI, Tuesday

-

India HSBC/S&P Global Manufacturing PMI, Tuesday

-

Mexico's international reserves, Tuesday

-

Korean CPI, Tuesday

-

Spain unemployment rate, Tuesday

-

UK S&P Global/CIPS Manufacturing PMI, Tuesday

-

US factory orders, light vehicle sales, JOLTS job openings, Tuesday

-

Brazilian industrial production Wednesday

-

Eurozone CPI, unemployment rate, Wednesday

-

Hong Kong retail sales Wednesday

-

US ISM Service, Wednesday

-

Eurozone S&P Global Services PMI, PPI, Thursday

-

India releases PMI on Thursday

-

U.S. new jobless claims, trade, Thursday

-

Eurozone retail sales Friday

-

French industrial production, Friday

-

Order from German factory, Friday

-

Hong Kong PMI, Friday

-

India interest rate decision Friday

-

Japanese household expenditure, Friday

-

Philippine Consumer Price Index, Friday

-

Russian GDP, Friday

-

Singapore retail sales Friday

-

South Korea's current account balance, Friday

-

U.S. unemployment rate, nonfarm payrolls, Friday

The main movements in the market are:

stock

-

S&P 500 futures were up 0.4% as of 2:53 p.m. Tokyo time.

-

Nasdaq 100 futures rose 0.6%

-

Japan's TOPIX fell 1.7%

-

The Shanghai Composite rose 0.8%.

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0785.

-

The Japanese yen was almost unchanged at 151.38 to the dollar.

-

The offshore yuan was almost unchanged at 7.2524 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6517.

-

The British pound was almost unchanged at $1.2627.

cryptocurrency

-

Bitcoin fell 2.3% to $69,247.6.

-

Ether fell 3.3% to $3,513.26.

bond

merchandise

-

West Texas Intermediate crude rose 0.4% to $83.49 per barrel.

-

Spot gold rose 1.5% to $2,262.66 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from John Cheng and Aya Agatsuma.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP