Most readers will already know that the Vita Life Sciences (ASX:VLS) share price has increased by a significant 36% over the past three months. Considering the company's impressive performance, we decided to take a closer look at its financial metrics, as a company's financial health over the long term usually drives market results. In particular, I would like to pay attention to Vita Life Sciences' ROE today.

Return on equity or ROE tests how effectively a company is growing its value and managing investors' money. In other words, this reveals that the company has been successful in turning shareholder investments into profits.

Check out our latest analysis for Vita Life Sciences.

How do you calculate return on equity?

Return on equity can be calculated using the following formula:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, Vita Life Sciences' ROE is:

21% = AU$9.1 million ÷ AU$43 million (based on the trailing twelve months to December 2023).

“Revenue” is the income a company has earned over the past year. Another way to think of it is that for every A$1 worth of shares, the company was able to earn him A$0.21 in profit.

What relationship does ROE have with profit growth?

So far, we have learned that ROE is a measure of a company's profitability. Now we need to evaluate how much profit the company reinvests or “retains” for future growth, which gives us an idea about the company's growth potential. Generally, other things being equal, companies with high return on equity and profit retention will have higher growth rates than companies without these attributes.

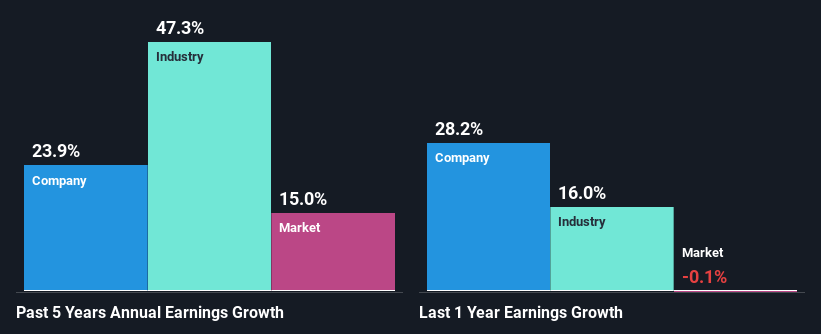

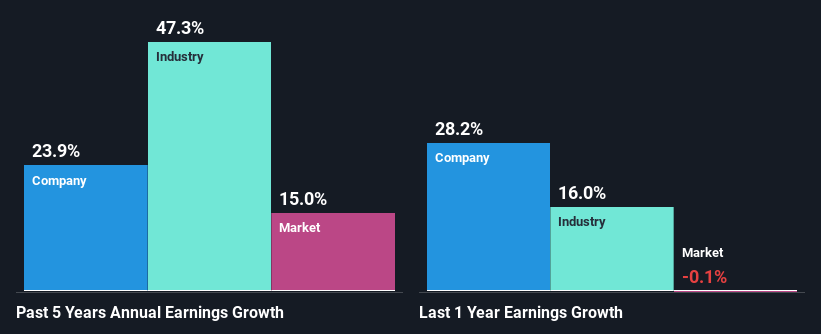

A side-by-side comparison of Vita Life Sciences' earnings growth and ROE of 21%.

Firstly, Vita Life Sciences seems to have a respectable ROE. Also, when we compare it to its industry, we find that its industry has a similar average ROE of 21%. As a result, we believe this laid the foundation for Vita Life Sciences' impressive net profit growth of 24% over the past five years. However, there may also be other factors behind this growth. For example, the company's management may have made some good strategic decisions, or the company may have a low dividend payout ratio.

Next, when we compare it to the industry's net income growth, we find that Vita Life Sciences' reported growth rate is lower than the industry's growth rate of 47% over the past few years. This is what we don't want to see.

The foundations that give a company value have a lot to do with its revenue growth. It's important for investors to know whether the market is pricing in a company's expected earnings growth (or decline). This can help you decide whether to position the stock for a bright or bleak future. What is his VLS worth today? Free research report's intrinsic value infographic helps you visualize whether VLS is currently mispriced in the market.

Does Vita Life Sciences reinvest its profits efficiently?

Vita Life Sciences' median three-year payout ratio is 41%, which is rather low. The company will hold the remaining 59%. This suggests that the dividend is well covered, and given the high growth discussed above, Vita Life Sciences appears to be reinvesting its earnings efficiently.

Furthermore, Vita Life Sciences is determined to continue sharing its profits with shareholders, as inferred by its long history of paying dividends for at least 10 years.

conclusion

Overall, we feel that Vita Life Sciences is performing very well. In particular, we like that the company is reinvesting heavily in its business and has a high rate of return. It's no surprise that the result is a significant increase in revenue. If the company continues to grow its revenue as it has, this could have a positive impact on the stock price, given how earnings per share affect the stock price over the long term. Don't forget that business risk is also one of the factors that affect stock prices. Therefore, this is also an important area that investors need to pay attention to before making decisions about the business. Our risks dashboard shows the two risks he has identified regarding Vita Life Sciences.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.