key insights

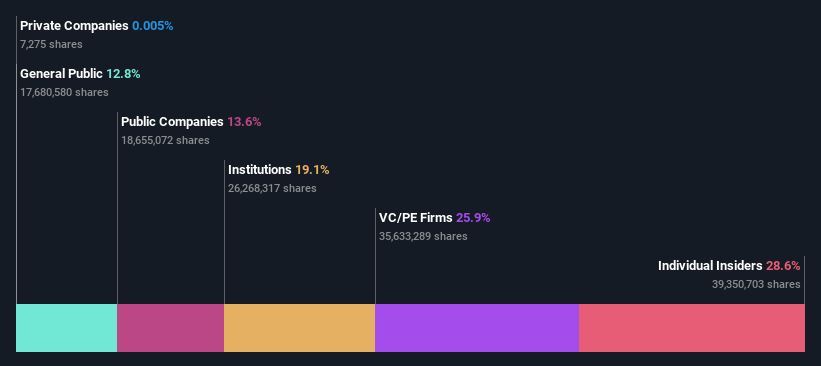

To know who really controls Atul Lifestyle Holdings Limited (NASDAQ:ATAT), it's important to understand the business's ownership structure. With a 29% stake, individual insiders hold the largest stake in the company. That is, if the stock price rises, the group will gain the most (or if the stock price falls, it will suffer the maximum loss).

Atul Lifestyle Holdings' insiders therefore have a lot at stake, and every decision they make regarding the company's future is important from a financial perspective.

The chart below zooms in on the different ownership groups for Atul Lifestyle Holdings.

Check out our latest analysis for Atul Lifestyle Holdings.

What does institutional ownership tell us about Atul Lifestyle Holdings?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they usually consider buying larger companies that are included in the relevant benchmark index.

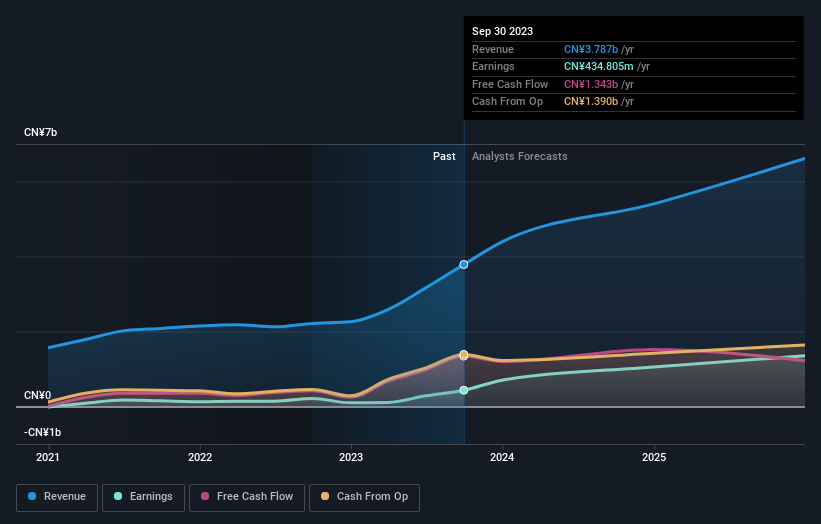

We can see that Atul Lifestyle Holdings does have institutional investors. And they own a significant portion of the company's stock. This may indicate that the company has some credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They also sometimes make mistakes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. If such a trade goes wrong, multiple parties may compete to sell stock quickly. This risk is higher for companies without a history of growth. You can see Atour Lifestyle Holdings' historical earnings and revenue below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in Atul Lifestyle Holdings. CEO Haijun Wang holds 19% of the shares, making him the largest shareholder. Legend Capital Management Co., Ltd. is the second largest shareholder owning 15% of the common stock, and Trip.com Group Limited owns approximately 14% of the company's stock.

On further investigation, we found that 59% of the shares are owned by the top 4 shareholders. In other words, these shareholders have a significant say in the company's decisions.

While researching institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. . There are a significant number of analysts covering this stock, so it might be useful to know their aggregate forecast for the future.

Insider ownership in Atour Lifestyle Holdings

The definition of a company insider can be subjective and varies by jurisdiction. Our data reflects individual insiders, and at least captures board members. The answers of company management to the board of directors and the latter must represent the interests of shareholders. In particular, top-level managers may serve on the board themselves.

Insider ownership is positive when it signals leaders are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative depending on the situation.

Our information suggests that insiders own a significant stake in Atul Lifestyle Holdings Limited. It's very interesting to see that insiders say he owns US$748m worth of shares in this US$2.6b business. Most people would be happy to see the board investing alongside them. You may want to access this free chart of recent insider transactions.

Open to the public

With a 13% stake, the general public (mainly retail investors) has some influence over Atul Lifestyle Holdings. While this size of ownership may not be enough to sway policy decisions in their favor, they can still collectively influence company policy.

private equity ownership

The private equity firm holds a 26% stake and could influence the Atour Lifestyle Holdings board of directors. Some investors may be encouraged by this, as private equity may be able to encourage strategies that help the market recognize a company's value. Alternatively, those holders may withdraw from their investment after the initial public offering.

Public company ownership

We can see that public companies hold 14% of Atul Lifestyle Holdings's outstanding shares. Although we can't say for sure, this suggests that they have intertwined business interests. It's worth keeping an eye on any changes in ownership in this area, as this could be a strategic stake.

Next steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Atul Lifestyle Holdings better, you need to consider many other factors. For example, we discovered that 1 warning sign for Atour Lifestyle Holdings. What you need to know before investing here.

If you want to know what analysts are predicting in terms of future growth, don't miss this free Report on analyst forecasts.

Note: The numbers in this article are calculated using data from the previous 12 months and refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the full year annual report figures.

Valuation is complex, but we help make it simple.

Please check it out Atour Lifestyle Holdings Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.