Sylvania Platinum (LON:SLP) has had a tough three months, with its share price down 17%. However, the company's fundamentals appear to be pretty decent, and its long-term financial position is generally in line with future market price movements. Specifically, we decided to examine Sylvania Platinum's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder as it indicates how effectively their capital is being reinvested. In other words, ROE shows the profit generated per dollar of a shareholder's investment.

Check out our latest analysis for Sylvania Platinum.

How is ROE calculated?

Return on equity can be calculated using the following formula:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, Sylvania Platinum's ROE is:

6.9% = USD 16 million ÷ USD 229 million (based on trailing twelve months to December 2023).

“Earnings” is the amount of your after-tax earnings over the past 12 months. That means for every £1 of shareholders' equity, the company generated £0.07 of his profit.

Why is ROE important for profit growth?

So far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits a company reinvests or “retains”, and how effectively it does so, we are then able to assess a company's earnings growth potential. Assuming all else is equal, companies with both higher return on equity and higher profit retention typically have higher growth rates when compared to companies that don't have the same characteristics.

Sylvania Platinum's revenue growth and ROE6.9%

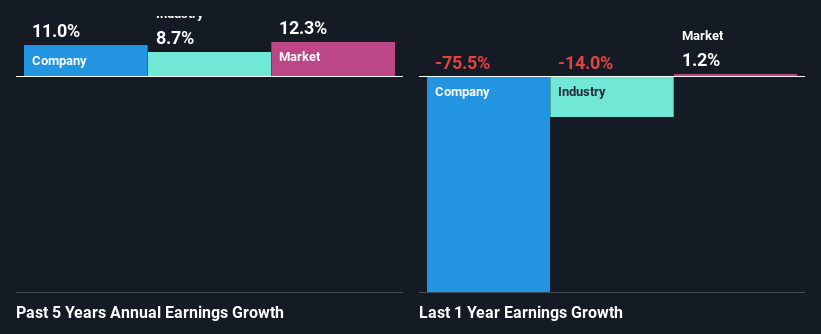

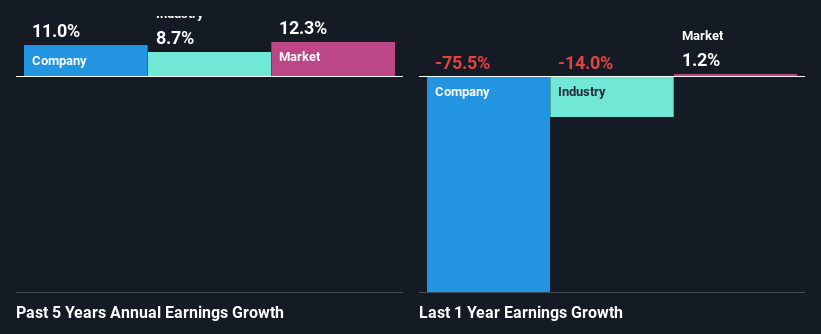

At first glance, Sylvania Platinum's ROE doesn't seem to be all that interesting. However, considering that his ROE for the company is in line with the industry average for his ROE of 8.4%, this is somewhat of a no-brainer. Still, Sylvania Platinum has seen a respectable 11% increase in net income. Considering the moderately low ROE, it's quite possible that other aspects are positively impacting the company's earnings growth. Maintaining high profits and efficient management, etc.

As a next step, we compared Sylvania Platinum's net income growth with its industry. And we're happy to see that the company's growth rate is higher than the industry average growth rate of 8.7%.

Earnings growth is an important metric to consider when evaluating a stock. Investors should check whether expected growth or decline in earnings has been factored in in any case. This will help you determine whether the stock's future is bright or bleak. If you're curious about Sylvania Platinum's valuation, check out this gauge of its price-to-earnings ratio compared to its industry.

Is Sylvania Platinum using its profits effectively?

Sylvania Platinum's median three-year dividend payout ratio is 47%, meaning it retains the remaining 53% of its profits. This suggests that the dividend is well covered, and given the company's steady growth, it appears that management is reinvesting earnings efficiently.

Furthermore, Sylvania Platinum is determined to continue sharing its profits with shareholders, as evidenced by its long history of dividend payments over five years. Based on the latest analyst forecasts, the company's future dividend payout ratio over the next three years is expected to remain stable at 46%.

conclusion

Overall, there appear to be some positive aspects to Sylvania Platinum's business. Despite the low ROE, the company was able to achieve strong earnings growth due to its high reinvestment rate. That said, the company's earnings are expected to accelerate, according to the latest industry analyst forecasts. Learn more about the company's future revenue growth forecasts here. free Create a report on analyst forecasts to learn more about the company.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.