The stock market as a whole continues to rise. but, Dow Jones Industrial Average This year it's down.

In descending order of performance, boeing (NYSE:BA), intel (NASDAQ:INTC), Nike (NYSE:NKE)and apple (NASDAQ:AAPL) –This may come as a surprise since the broader semiconductor industry and many big tech growth stocks are surging.

Here's what's driving each blue-chip stock down and why it could get worse before it gets better.

Boeing must solve major problems even at the expense of short-term performance

2024 was not a good year for Boeing. On January 5th, a door plug on a Boeing 737-9 MAX came off during flight. Since then, Boeing has worked hard to restore trust and ensure safety.

On January 24, the Federal Aviation Administration (FAA) announced it would halt production expansion of the Boeing MAX and investigate Boeing's maintenance and quality control.

On March 4, the FAA “…found multiple instances in which companies allegedly failed to comply with manufacturing quality control requirements.'' We have identified the problem.”

Boeing announced on March 20 that it would slow production and waste more cash to improve quality.

This is never a good thing, especially when safety is involved. As for the company, Boeing's 2025/2026 mid-term goals are in jeopardy. Boeing had targeted annual free cash flow of $10 billion during that period, but it likely won't be able to meet that goal now.

Boeing continues to encounter speed bumps along increasingly uncertain runways. The coronavirus pandemic halted travel and caused stock prices to plummet. It has lagged far behind the overall market rally and remains down more than 57% from its all-time high.

Boeing used to be the most heavily weighted Dow stock. But now it's closer to the median. Investors' patience is running thin, and stocks may struggle to turn things around.

Intel is moving in the right direction

Intel had a great year, surging 90% in 2023. This recovery is largely due to investor optimism that Intel is finally back on track. But that doesn't mean valuable wasted opportunities have been completely forgotten.

Intel is a great example of why the top of a dynamic industry can lose its throne in a relatively short period of time. Intel lost share in the CPU market and missed the AI-driven GPU boom. Intel believes it can unlock growth in its foundry business and become the No. 2 foundry by 2030.

The difference is not only in size. With government funding, Intel is building foundries across the United States to produce semiconductors domestically. This presents an opportunity for U.S. chipmakers to reduce the geopolitical risks of over-reliance on Taiwan. granted, taiwan semiconductor manufacturing The company is also investing in US fabs.

Intel stock was left for dead, but now there is hope. After last year's rally, it's understandable why the stock is pulling back, considering much of the potential growth is years away.

Big challenges for Nike

Nike faces two major threats. The first is the slowdown in growth from China. In its 2024 second-quarter earnings report, Nike revised its full-year earnings forecast to just 1% growth compared to 2023. This revision was primarily due to weakness in China, Europe, the Middle East, and Africa.

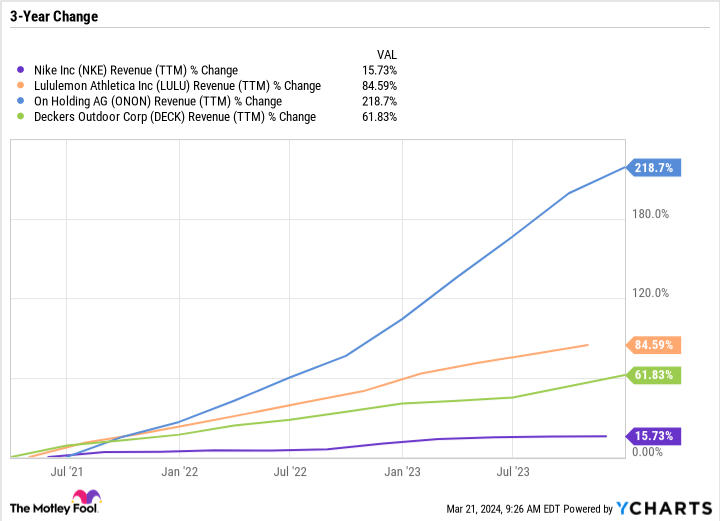

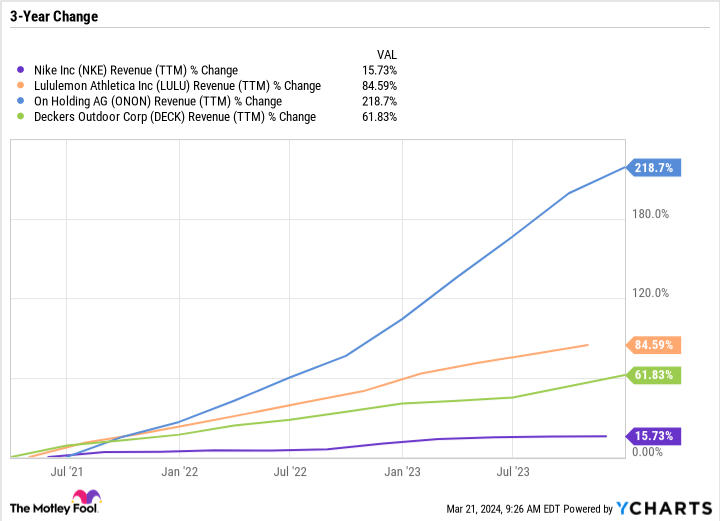

Nike has always been competitive, but that competition seems to have intensified in recent years. lululemon It has continued to grow tremendously and is now worth nearly 40% of Nike.small shoe and apparel brands On hold and Hoka took the market by storm.Who owns Hoka? deckers outdooralso owns UGG and Teva.

Nike is a bigger company, so moving the needle is more difficult. But that still pales in comparison to Lululemon, On, and Deckers, with trailing 12-month revenue up just 15.8% over the past three years.

Nike relies heavily on its huge marketing spend and its brand. When it comes to charging a premium price for what is ultimately just a product, perception is everything.

The good news is that ratings have gone down. Nike currently trades at just 29.3x, well below its five-year median of 34.6x.

Nike is too good a company to trade at a discount to the market. Eventually value investors will step in and send the stock skyrocketing, but most of Nike's sell-offs thus far have been justified.

Apple is rescinding suspension to offset slowing growth

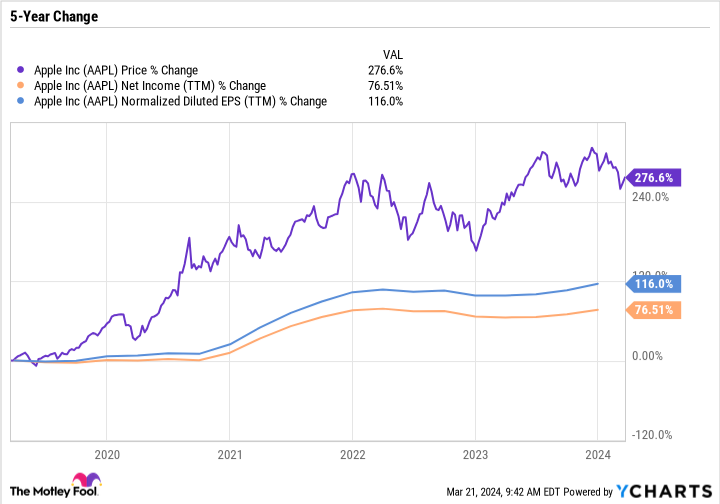

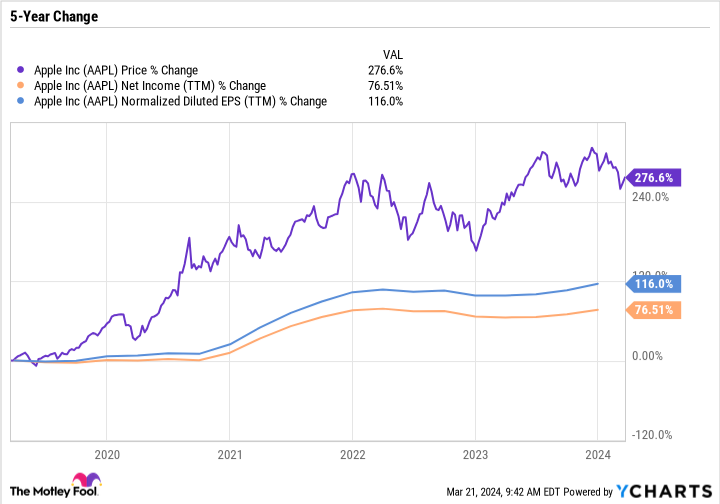

Selling Apple is also natural. The growth rate of stock prices is far exceeding the growth of profits, making the stock price expensive.

Apple is dealing with slowing growth from China and modest growth elsewhere. But optimistic investors are hoping Apple has a hidden backlog in the form of customers who own older iPhone models and are slow to upgrade. This pent-up demand could help Apple get back on track. But the fact remains that iPhone sales growth has slowed dramatically and Apple's business model remains heavily dependent on the iPhone. And recent developments require attention. The Justice Department filed a lawsuit accusing Apple of illegally suppressing competition and violating antitrust laws by making customers dependent on the iPhone and less likely to switch to another device.

To its credit, Apple's high-margin services division is growing and continues to deliver record results. Apple also repurchased a significant amount of its own stock, and earnings per share (EPS) growth outpaced net income growth. The impact of stock buybacks does not necessarily appear in the short term. However, given the pace of Apple's share buybacks, we start to see a divergence over the medium term.

Returning to the graph, consider that Apple's net income has increased 76.5% over the past five years, but thanks to share buybacks, EPS has increased 116%. Apple's robust stock buybacks have boosted its stock value even as growth has slowed.

Of all the companies on this list, Apple is the best long-term investment. That's because parts of the business are doing well, with a strong balance sheet and plenty of cash to make acquisitions to fuel growth if needed. And we will continue to be the market leader. In the meantime, Apple could continue to underperform the broader market until its fundamentals improve.

Should you invest $1,000 in Boeing right now?

Before buying Boeing stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Boeing wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

Daniel Felber has no position in any stocks mentioned. The Motley Fool has positions in and recommends Apple, Lululemon Athletica, Nike, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and On Holding and recommends the following options: Long January 2023 $57.50 Call on Intel, Long January 2025 $45 Call on Intel, Long January 2025 $47.50 Call on Nike, Short May 2024 $47 Call on Intel It's Cole. The Motley Fool has a disclosure policy.

The 4 Worst-Performing Dow Stocks of 2024 (And It Could Get Even Worse Before It Gets Better) was originally published by The Motley Fool.