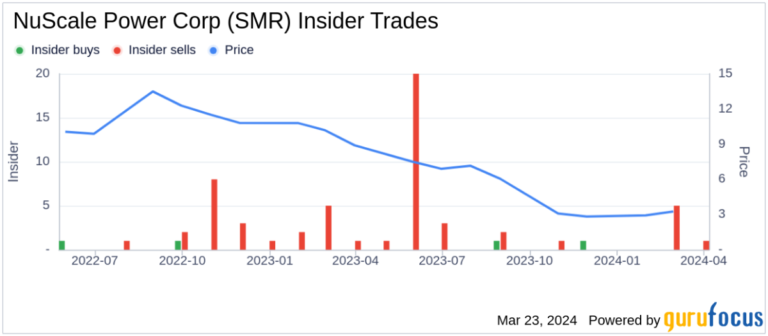

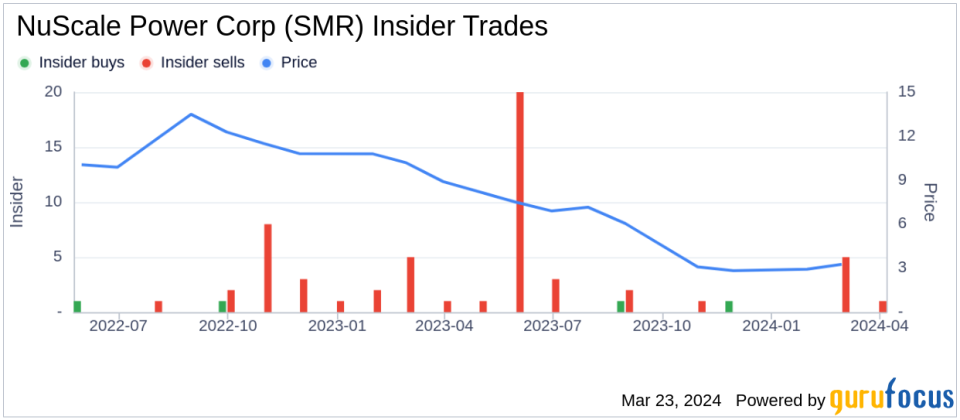

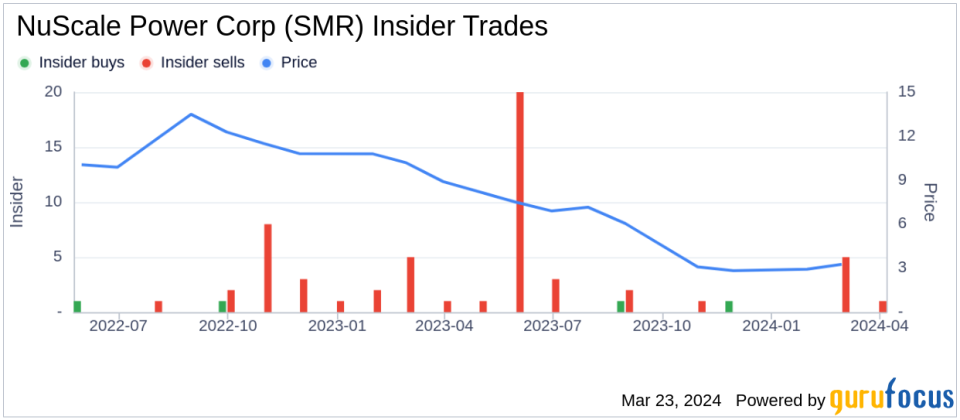

According to its latest SEC filings, NuScale Power Corp (NYSE:SMR) reported insider selling. CEO John Hopkins sold 59,768 shares of the company's stock on March 22, 2024. The transaction was disclosed in a legal filing with the Securities and Exchange Commission, which is available in this SEC filing of his. NuScale Power Corp is a company specializing in small modular nuclear reactors. (NYSE:SMR) Technology. The company is focused on delivering scalable, advanced nuclear technologies for the production of electricity, heat and water to meet growing global energy demands. Over the past year, insiders have sold a total of 88,305 shares, but bought no shares. Company stock. The recent sale by John Hopkins is a significant part of these transactions. NuScale Power Corp's insider trading history shows a pattern of insider activity. Over the past year, there have been 2 insider buys and 33 insider sells. This trend can be visualized in the following insider's image of his trend.

In terms of valuation, on the day of the most recent insider sale, NuScale Power Corp's stock was trading at $4.2 per share, giving the company a market capitalization of approximately $339,196,000. For investors who monitor insider activity, such transactions can provide valuable insight into the company's movements. An insider's view of financial health and stock value. However, it is important to consider a wide range of factors when assessing the impact of insider trading activity.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.