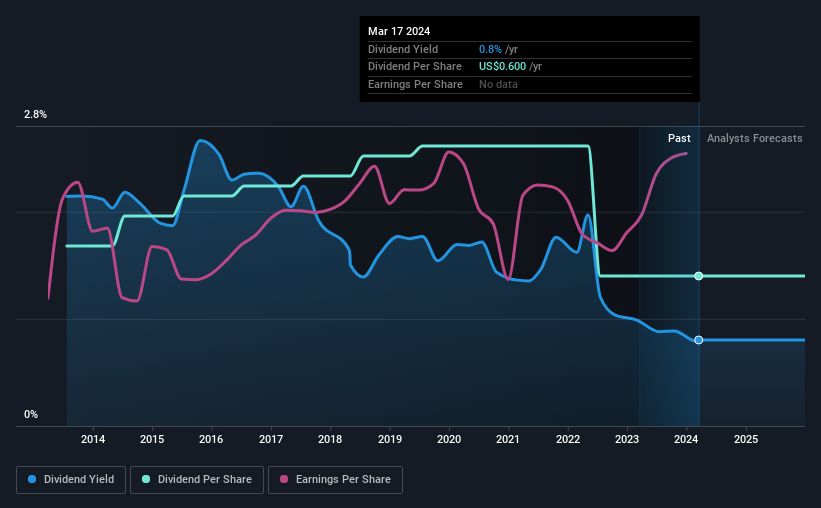

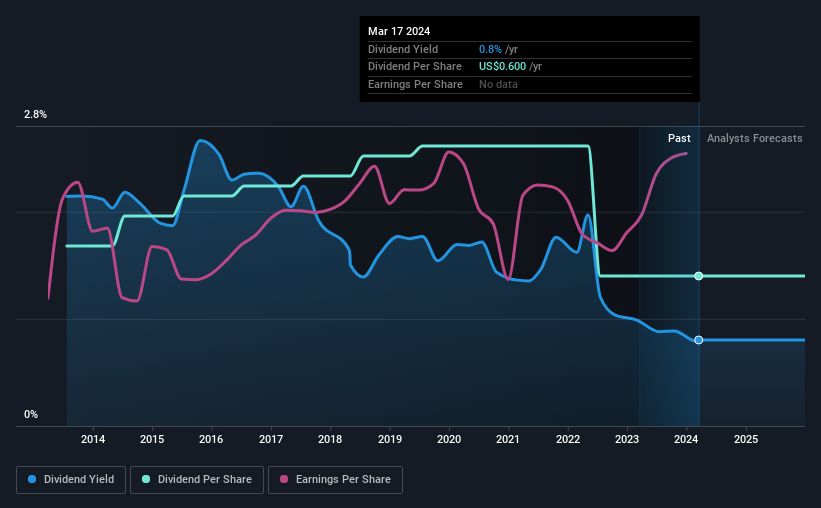

Encompass Health Corporation (NYSE:EHC) announced that it will pay a dividend of $0.15 per share on April 15th. This means the annual payout will be his 0.8% of the current stock price, which is lower than the industry average.

Check out our latest analysis for Encompass Health.

If Health's earnings are included, distributions can be easily covered.

It's good to see a high yield, but you also need to see if the higher dividend level is sustainable. However, prior to this announcement, Encompass Health's dividend was comfortably covered by both cash flow and profit. This means that most of the money the company earns is spent on growing the company.

EPS is expected to increase by 31.8% next year. If dividends continue in line with recent trends, the dividend payout ratio is expected to be 13%, which is within a sufficiently satisfactory range for dividend sustainability.

Dividend volatility

The company's dividend history has been characterized by instability, with the dividend cut at least once in the past 10 years. Since 2014, dividends have totaled $0.72 to $0.60 per year. Dividends declined at approximately 1.8% per year during this period. Generally, it is undesirable to see dividends decreasing over time, as it can reduce shareholder returns and indicate that the company may be in trouble.

Dividend increases may be difficult to achieve

With a relatively unstable dividend, it is even more important to assess whether earnings per share are growing, which could indicate future dividend increases. Over the past five years, earnings have grown at 4.0% per year, which is admittedly a bit slow. If Encompass Health struggles to find a viable investment, there is always the option of increasing its dividend payout ratio to increase its payout to shareholders.

In summary

Overall, we think Encompass Health is a solid choice as a dividend stock, even though the dividend did not increase this year. Although the dividend payout ratio seems good, unfortunately the company's dividend track record is not that great. Considering all this, the dividend looks viable going forward, but investors should keep in mind that the company has pushed the boundaries of sustainability in the past and could do so again. there is.

Investors generally prefer companies with consistent and stable dividend policies over companies with irregular dividend policies. Still, investors need to consider more factors than dividends when analyzing a company. I took the discussion a little further and found the following: 1 warning sign for Encompass Health That means investors need to be conscious moving forward. If you are a dividend investor, check out this article as well. A carefully selected list of high dividend stocks.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.