When investors think about stocks, Dow Jones Industrial AverageOne might think that this index contains more than its share of boring industrial companies that are unlikely to generate more than nominal profits and ignore their constituents. Maybe.However, in recent years, Dow's parent company S&P Global It replaced old economic enterprises such as alcohol and general electric The index includes more dynamic stocks that better represent the new economy.

This still-relevant index still contains some stocks with significant upside potential. His two components of the Dow that remain relevant are: Amazon (NASDAQ:AMZN) and Nike (NYSE:NKE). Let's take a closer look at these two stocks of his and why he's set to soar in 2024 and beyond.

1.Amazon

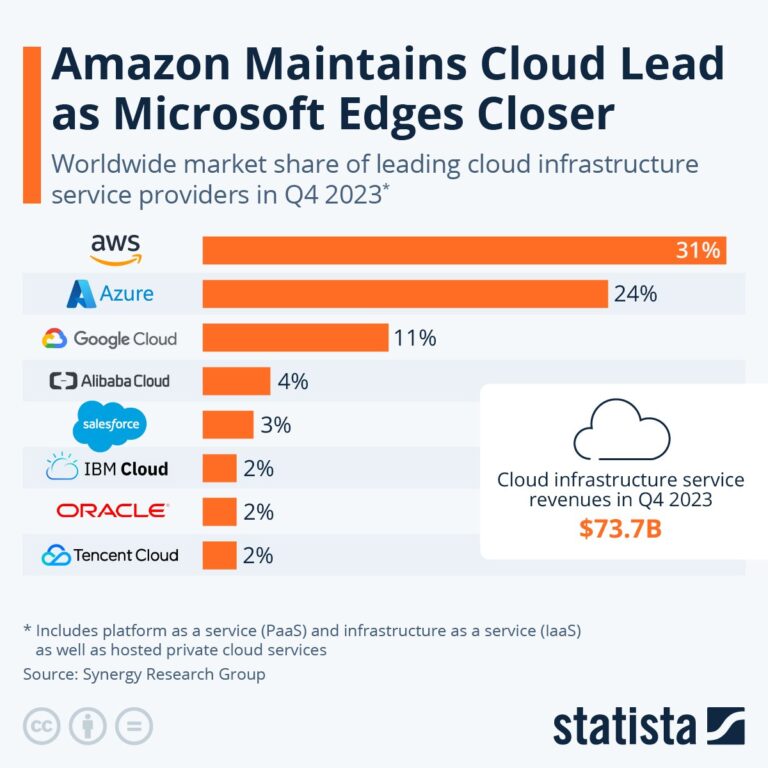

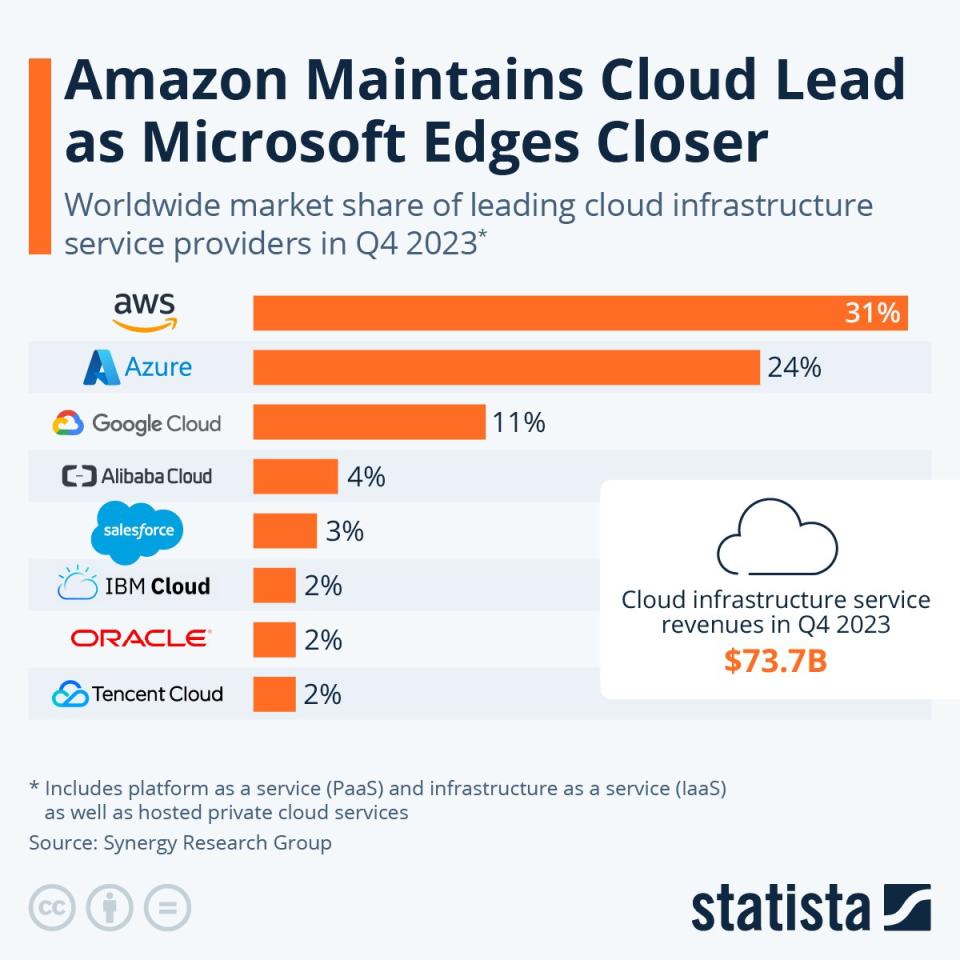

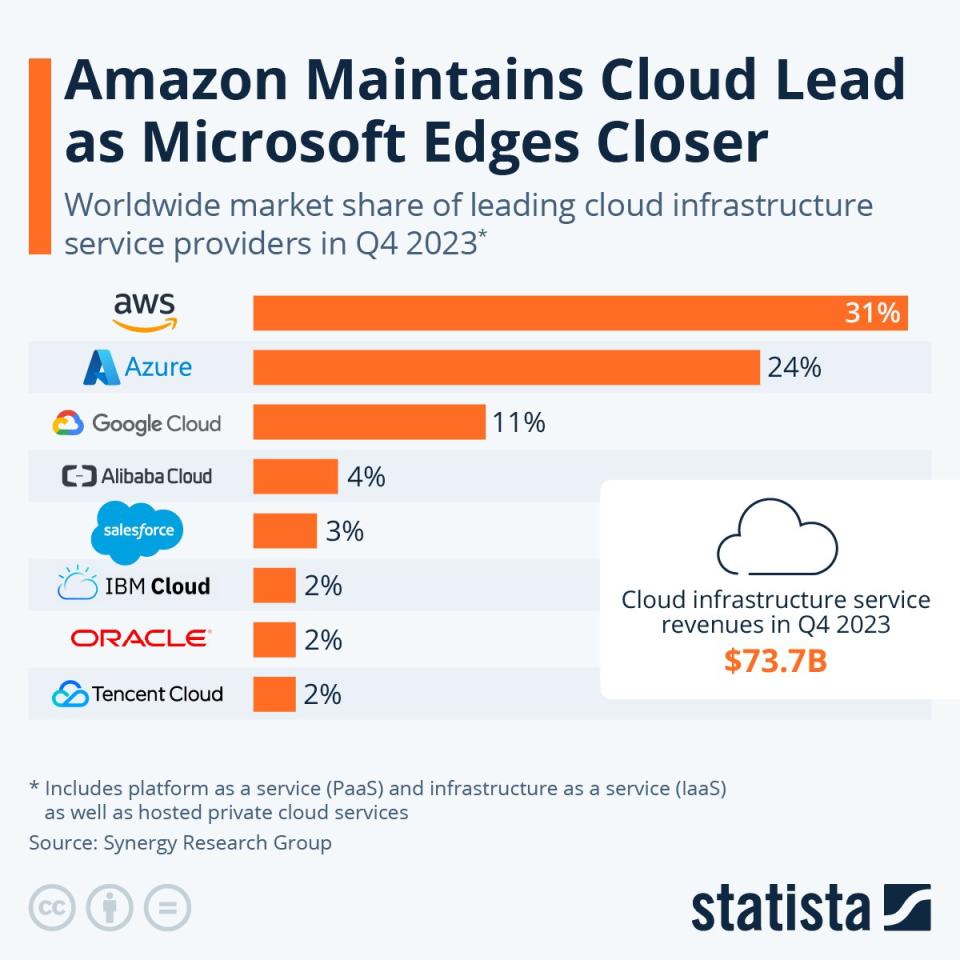

Most people are most familiar with Amazon's e-commerce site and various Prime subscription services. However, its potential as a growth stock lies primarily in its Amazon Web Services (AWS) sector. As a cloud provider, AWS plays an important role in supporting all types of third-party applications and services, including those powered by artificial intelligence (AI).

AWS has been the largest cloud provider for many years, and we want to leverage that leadership into a “full stack” approach to AI. This means providing a simple front end that allows you to build customized chips, create software layers, train models, and conveniently connect to various AI services.

In 2023, only 16% of the company's revenue came from AWS. But it also provided two-thirds of Amazon's operating profit that year.

The company's other segments include fast-growing businesses such as advertising, subscriptions, and third-party seller services. The largest segment is online sales. It is also currently the slowest growing segment with the narrowest margins.

Still, Amazon's segment diversity allows it to grow quickly despite already having a massive $1.8 trillion market capitalization. Analysts expect net profit to rise 44% this year and 26% in 2025. The company also trades at a forward price-to-earnings ratio of 42 times, allowing investors to benefit from Amazon's AI-driven growth without paying too much. premium.

2. Nike

Nike has achieved what seems impossible in the consumer space. Developed a competitive advantage in the sports apparel and sporting goods business. In addition to owning one of the world's most famous brands, his well-managed global supply chain allows him to reduce production costs while building a worldwide following. . Additionally, Nike spends a lot of money on research and development to innovate in their respective areas of expertise, and invests heavily in marketing and maintaining a substantial social media presence.

A big investment in marketing is celebrity endorsement by popular athletes from multiple sports. And although this strategy focuses on current athletes, it works just as well for retired athletes (perhaps the best example of this strategy is Michael Jordan's still-running athlete, more than 20 years after his NBA retirement). Jordan Brand continues to be popular).

Unfortunately for Nike, the company's results have been weak in recent quarters due to the economic downturn. Net income for the first half of fiscal 2024 (ending November 30, 2023) was just over $3 billion, an 8% increase from the same period last year.

The stock has struggled to gain momentum since reaching its peak in late 2021 due to the pandemic. It is currently being sold at a 45% discount from that high price.

But it could be poised for a comeback. Refreshing a popular brand in time for the spring and the upcoming Summer Olympics could be a marketing win for the company.

Analysts also expect profits to rise 18% by next year. Such growth could soften the forward P/E of 28 and spark a long-awaited comeback for Nike stock.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Amazon wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool's board of directors. Will Healy has no position in any stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nike, and S&P Global. The Motley Fool recommends the following options: His January 2025 $47.50 long call against Nike. The Motley Fool has a disclosure policy.

These two Dow stocks are set to soar in 2024 and beyond. Originally published by The Motley Fool.