Revazere/iStock via Getty Images

Note:

We interviewed Ark Co., Ltd. (NASDAQ:ARQ) I've said this before, so investors should consider this my latest update. Previous article At work.

On Wednesday, the stock price of activated carbon products maker Arq, Inc., or “Arq,” followed suit, rising nearly 50%. strong 4th quarter report and subsequent enthusiastic management results. Conference call.

company presentation

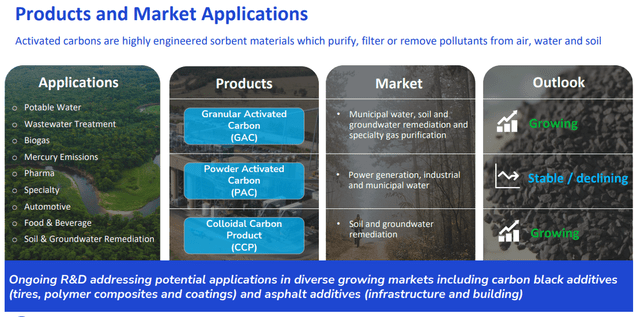

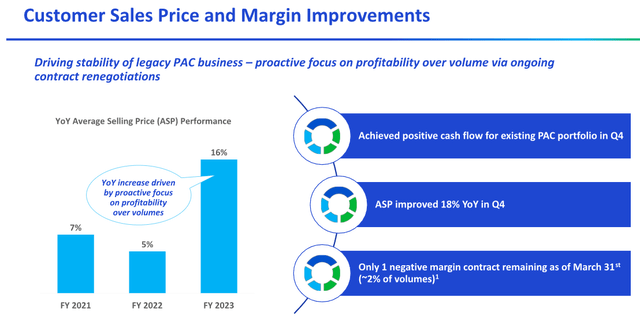

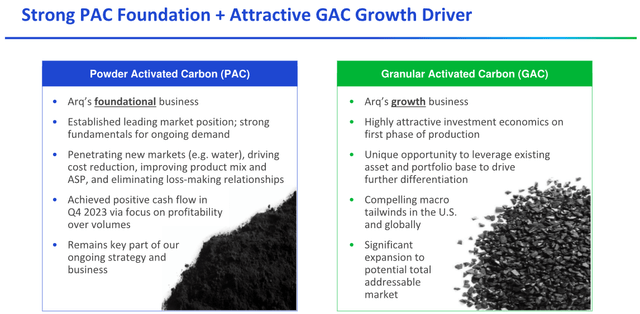

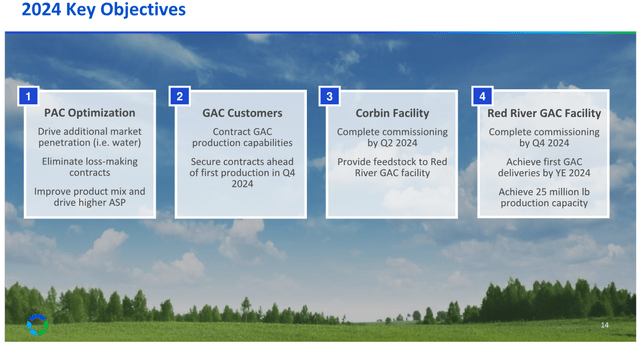

While the company's foray into the granular activated carbon (“GAC”) market is still underway, margins in its traditional powdered activated carbon (“PAC”) business have improved significantly in recent quarters.

Regulatory submissions

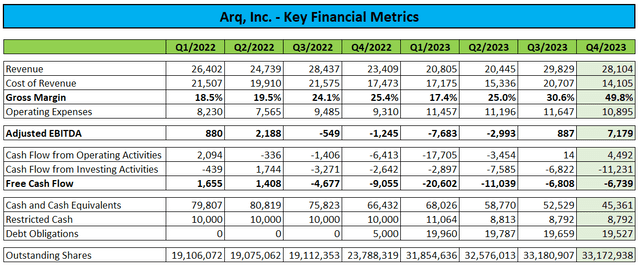

Gross margin increased from 17.4% in the first quarter to 49.8% in the fourth quarter as a result of a number of initiatives, including prioritizing profitability over volume, controlling costs, improving product mix and eliminating unfavorable contracts. Increased.

company presentation

However, the fourth quarter's results include a large amount related to one-time benefits. Enter into take-or-pay agreements (minimum quantity or “MQ agreements”) with customers (emphasis added by author):

In accordance with the MQ Agreement's revenue recognition policy, the Company exercised its rights under certain MQ Agreements in December 2023. Recognized $4.7 million in supplies revenue and recorded unbilled accounts receivable.

Factoring in one-time benefits, product revenue would have been down more than 20% sequentially and gross margins would have been down about 1,000 basis points.

While low natural gas prices continue to impact customer demand, the company has made significant gains in improving margins and cash flow.

In the fourth quarter, Arq generated approximately $4.5 million in operating cash flow, but the company's continued investment in its GAC facility resulted in negative free cash flow of $6.7 million in the quarter.

company presentation

The company ended the year with $45.4 million in unrestricted cash and cash equivalents. Taking into account the $5 million minimum liquidity covenant governing the company's related party term loan, year-end liquidity was $40.4 million.

During the conference call, management projected the PAC business as follows:Generate net cash in 2024After spending $16.7 million in 2023.

Although Arq has done a great job of rebuilding its legacy operations, the company has had to increase its capital expenditure forecast for the GAC expansion at its Red River facility twice within two months ( (Emphasis added by the author).

Capital expenditures for the full year 2024 are expected to total between $55 million and $60 million, with Red River Phase 1 capital expenditures expected to be between $45 million and $50 million.

Latest capital expenditure forecast for Red River Phase 1 reflects midpoint Approximately 36% increase compared to our previous forecast as of January 2024.

Approximately 45% of this increase was due to more accurately accounting for construction cost inflation and the impact of the transition to a shorter six-day work week. Approximately 45% is due to increased equipment costs associated with design changes to improve efficiency and production and correcting inaccurate estimate inputs previously provided by third-party consultants. The remaining approximately 10% is due to various items such as engineering fees.

Despite the increase from the Red River expansion, Arq management believes the economics of the project remain attractive, with a return on investment expected to be less than three years. Construction of the Red River GAC facility will begin in October 2023; Commissioning is scheduled by the fourth quarter of 2024.

Capital expenditures for the full year 2024 are expected to be as follows: Funding will be provided by cash on hand, cash generation, continued cost reduction efforts, potential customer advances on GAC contracts, and potential for planned refinancing and term loan expansion..

However, management expects to incur additional investments without raising new capital (emphasis added by author).

Despite this increase, the Company remains committed to the project due to its cash reserves, cash generation, continued cost reduction efforts, potential customer advances on GAC contracts, and the potential for planned refinancing and term loan expansion. We are in a position to provide funding. And importantly, there are no plans to issue stock.. Despite the increased costs, the project's investment economics remain attractive as it is expected to achieve a return on investment within three years while creating long-term stakeholder value.

During the conference call, management reiterated confidence in the company's ability to contract the company's initial GAC production capacity ahead of the start of commercial production, currently expected toward the end of the fourth quarter of 2024.

company presentation

Management also identified potential GAC opportunities related to increased regulation of per- or polyfluoroalkyl substances (“PFAS”), often referred to as “forever chemicals” due to their extremely high persistence in the environment. I emphasized.

company presentation

While the company's execution in expanding GAC leaves much to be desired, the recent turnaround in the PAC business has been nothing short of impressive.

Seven months ago, I outlined my concerns about the potential for a short-term equity raise following a disastrous first half of 2023, an unexpected CEO change, and the subsequent start of a full-scale business review. Legacy profitability has improved significantly. The PAC business should help secure additional funding without further diluting shareholders.

Having said that, a lot depends on Arq being able to complete the first phase of the GAC expansion on time and on budget, but with my main concerns clearly resolved, I The stock's rating has been raised from .sell“to”possession”.

conclusion

It's time to apologize to my readers for my poor judgment, as I simply did not anticipate the impressive turnaround in Arq's legacy business. As a result, our cash usage in 2023 was much lower than I had previously anticipated.

Although these positive developments are somewhat offset by further increases in capital expenditures required for the company's GAC expansion project, the company is able to close the financing gap with non-dilutive financing rather than raise additional capital. It should be possible.

Much of the future will depend on the company's early success in commencing commercial GAC operations on time and on budget, and in contracting initial capacity at a comfortable margin.

My primary dilution concerns turned out to be unfounded, so I'm raising my rating on the stock from '.'sell“to”possession”.