key insights

-

Given the significant stake in the stock by financial institutions, First Business Financial Services' stock price may be susceptible to trading decisions by financial institutions.

-

Top 16 shareholders own 50% of the company

-

Insiders have recently bought

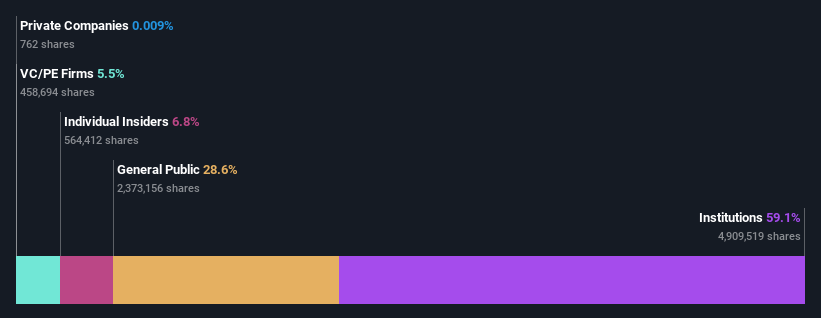

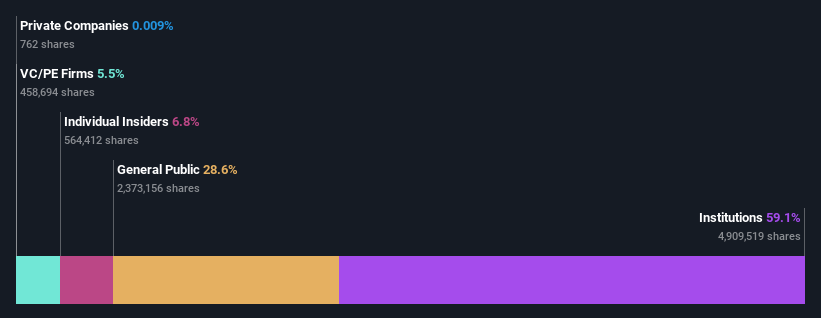

A look at First Business Financial Services, Inc. (NASDAQ:FBIZ)'s shareholders can tell us which group is the most powerful. We can see that institutional investors hold the majority, with his 59% ownership in the company. In other words, this group faces the greatest upside potential (or downside risk).

Given the vast amounts of capital and research power at their disposal, institutional ownership tends to be particularly heavy for individual investors. As a result, large amounts of institutional funds invested in a company are generally considered a positive attribute.

Let's delve deeper into each type of owner at First Business Financial Services, starting with the table below.

See our latest analysis for First Business Financial Services.

What does institutional ownership tell us about First Business Financial Services?

Many institutions measure performance based on indicators that approximate local markets. So they usually pay more attention to companies that are included in major indices.

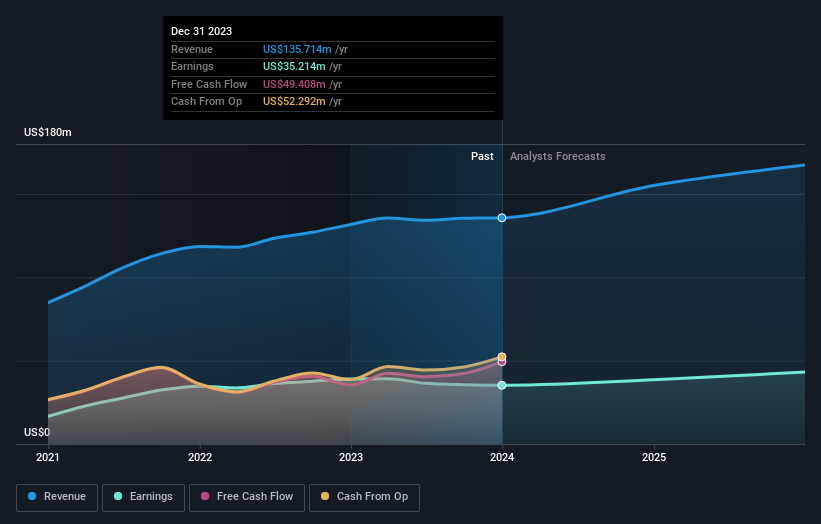

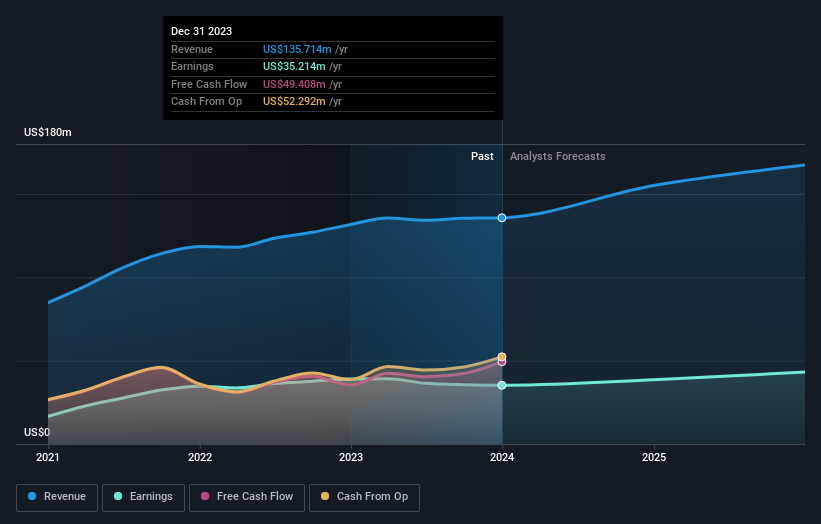

As you can see, institutional investors have a fair amount of stake in First Business Financial Services. This suggests some credibility among professional investors. But we can't rely on that fact alone because institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of First Business Financial Services, (below). Of course, keep in mind that there are other factors to consider as well.

Investors should note that institutional investors actually own more than half the company, so they can collectively wield significant power. Note that hedge funds don't have a meaningful investment in First Business Financial Services. BlackRock, Inc. is currently the largest shareholder with 8.3% of outstanding shares. Dimensional Fund Advisors LP and 1st & Main Growth Partners hold 6.3% and 5.5% of the outstanding shares, respectively, and are the second and third largest shareholders. Additionally, CEO Corey Chambas owns 1.9% of the company's stock.

If we take a closer look at our ownership numbers, we can see that the top 16 shareholders have a combined ownership of 50%, meaning that no single shareholder has a majority.

Researching institutional ownership is a good way to assess and filter a stock's expected performance. The same can be done by studying analyst sentiment. There are plenty of analysts covering the stock, so it might be worth seeing what they are predicting.

Insider Ownership of First Business Financial Services

The precise definition of an insider can be subjective, but almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be members of the board of directors. This is especially true if the manager is the founder or CEO.

Most consider insider ownership a positive, because it can indicate the board is well aligned with other shareholders. However, in some cases, too much power may be concentrated within this group.

Shareholders would probably be interested to know that insiders own shares in First Business Financial Services, Inc. The insiders individually own US$20m worth of her in the company, with a total value of US$288m. It's good to see insider investment, so it might be worth checking if those insiders have been buying.

Open to the public

The general public, typically retail investors, owns 29% of First Business Financial Services' shares. While this size of ownership may not be enough to sway policy decisions in their favor, they can still collectively influence company policy.

private equity ownership

Private equity firms hold a 5.5% stake in First Business Financial Services. This suggests that they can influence important policy decisions. Sometimes we see private equity stick around for the long term, but generally private equity has short investment horizons and, as the name suggests, doesn't invest much in public companies. After a while, they may consider selling their capital and redeploying it elsewhere.

Next steps:

I think it would be very interesting to see who exactly owns the company. But to really gain insight, you need to consider other information as well.

Many people find it convenient This is to find out more about how a company has performed in the past.You can access this Detailed graph Analysis of past earnings, revenue, and cash flow.

If you want to know what analysts are predicting in terms of future growth, don't miss this free Report on analyst forecasts.

Note: The numbers in this article are calculated using data from the previous 12 months and refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the full year annual report figures.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.