Even when a company is making a loss, it is possible for shareholders to make a profit if they buy a good company at an appropriate price. For example, biotechnology companies and mining exploration companies often lose money for years before achieving success with a new treatment or mineral discovery. But while history celebrates the rare successes, the failures are often forgotten. Does anyone remember Pets.com?

So the obvious question is, resonance health (ASX:RHT) shareholders should be concerned about the company's cash burn rate. In this article, we define cash burn as annual (negative) free cash flow. This is the amount of money a company spends each year to fund growth. Let's start by examining the company's cash compared to its cash burn.

Check out our latest analysis for Resonance Health.

How long is Resonance Health's cash runway?

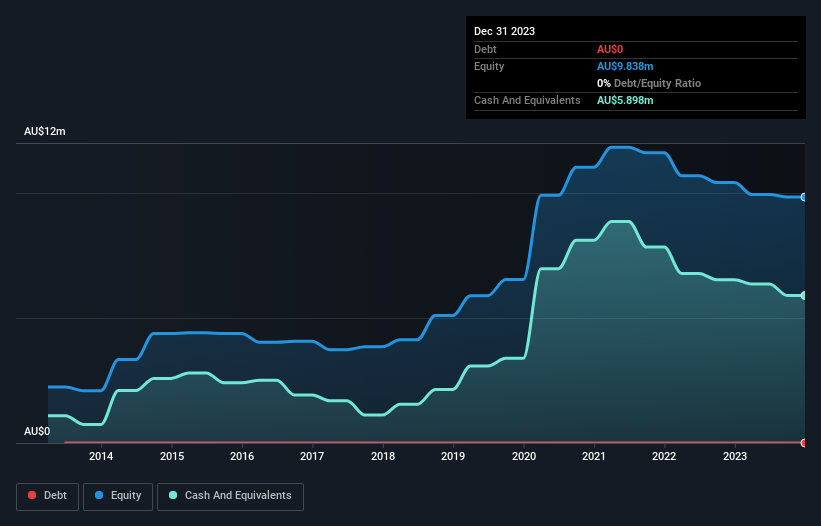

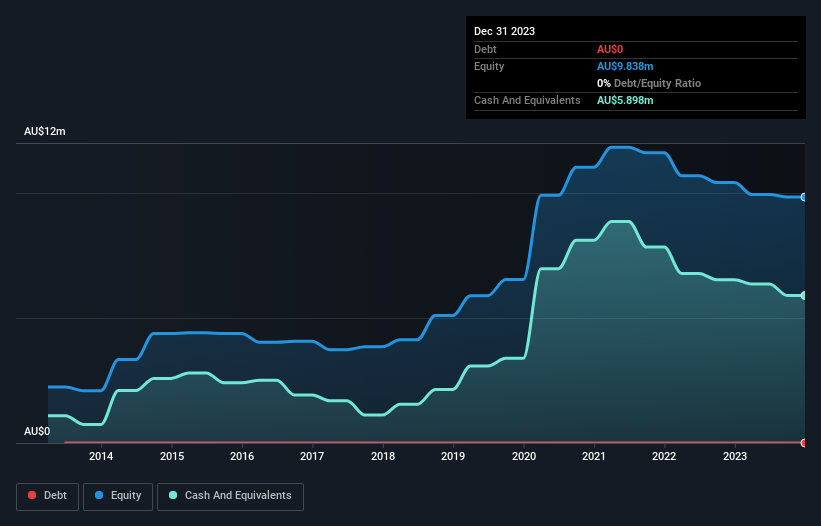

Cash runway is defined as the time it would take for a company to run out of cash if it continued to spend at its current cash burn rate. When Resonance Health last reported its December 2023 balance sheet in February 2024, it had zero debt and cash worth AU$5.9m. Looking at last year, the company used up his A$687,000. This means it had a cash runway of approximately 8.6 years from December 2023. This is just one measure of the company's cash burn, but thinking about such a long cash runway warms my belly in a pleasant way. You can see how its cash balance has changed over time in the image below.

How fast is Resonance Health growing?

It's quite positive to see that Resonance Health reduced its cash burn by 54% in the last year. On top of that, operating revenue was up 38%, an encouraging combination. It seems to be growing steadily. Of course, we've only taken a quick look at the stock's growth metrics here. This historical revenue growth graph shows how Resonance Health is building its business over the long term.

How easily can Resonance Health raise cash?

While Resonance Health appears to be in a decent position, we think it's still worth looking into how it could easily raise more funding if that proves desirable. Generally, listed companies can raise new cash by issuing stock or taking on debt. One of the main advantages of publicly traded companies is that they can sell stock to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalization, we can roughly estimate how many shares it would have to issue to run the company for another year (at the same burn rate).

Resonance Health has a market capitalization of AU$30m and burned through AU$687k in the last year. This corresponds to his 2.3% of the company's market value. This means it could easily issue a few shares to fund further growth, and could very well be in a position to borrow cheaply.

So should we be worried about Resonance Health's cash burn?

As you've probably noticed by now, we're relatively happy with how Resonance Health is running out of cash. In particular, we think the company's ability to raise funds stands out as evidence that it is spending well. And even the reduction in cash burn was very encouraging. Taking all the measures in this article together, I'm not worried about the speed of cash burn. The company appears to be well positioned to meet its medium-term spending needs. On a different note, we conducted a thorough investigation and identified the following: 3 Warning Signs for Resonance Health (1 could be serious!) You should be careful before investing here.

of course Resonance Health may not be the best stock to buy.So you might want to see this free A collection of companies with a high return on equity, or a list of stocks that insiders are buying.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.