(Bloomberg) — Asian stock markets struggled to regain momentum as China's stock market rally came to a halt and Toyota's wage negotiations raised expectations that the Bank of Japan may soon raise interest rates.

Most Read Articles on Bloomberg

Stock prices in mainland China fell as Country Garden Holdings' unpaid bond payments weighed on developers. The Hang Seng China Enterprise Index teetered on the verge of rising 20% from its lows. The subdued move contrasts with record gains in U.S., European and global stock indexes as traders shrugged off stronger-than-expected U.S. inflation trends.

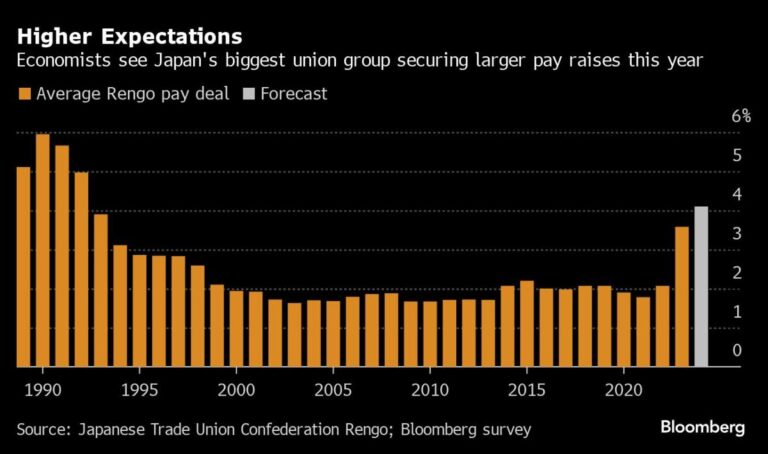

Toyota Motor Corporation's decision to meet labor union wage demands in full has reversed an earlier rally in Japanese stocks and strengthened the yen, reinforcing signs of a sustainable wage and price cycle. Investors will be watching this week's union pay deal to determine whether wage increases are strong enough for the Bank of Japan to raise interest rates next week.

Masahiro Yamaguchi, senior market analyst at SMBC Trust Bank, said in response to the report on Toyota, “Expectations for a revision in the Bank of Japan's policy have increased, leading to a stronger yen and a decline in overall stock prices.'' He added that the overall spring wage negotiations are likely to be affected, and that it is “unlikely to see any further news that would depress the market.”

U.S. Treasuries fell after the sale of $39 billion in 10-year bonds, but were firm. Bloomberg's dollar gauge was little changed after rising in the first session of March. Australian 10-year bond yields rose in early trading on Wednesday.

“Traders in Asian markets may be confused by the combination of better-than-expected inflation numbers and record highs in U.S. stocks, but Asian stocks remain optimistic on Wall Street,” said Hebe Chen, an analyst at IG Markets. It is highly likely that this reflects the same view.” . However, he said the CPI report will “certainly cause the Fed to choose its language particularly carefully at next week's meeting.”

The sense of relative calm in the face of intense inflation was unusual. In fact, the rise in stock prices marked a departure from the way stocks have been trading on CPI days since the Fed began raising interest rates.

Since March 2022, there have been only a handful of times when the S&P 500 index rose more than 1% on the day of the CPI release. But in most cases, the increase was due to a decline in core inflation, not an increase in core inflation.

The Fed is widely expected to keep interest rates unchanged for the fifth consecutive time at its policymakers' meeting on March 19-20. Much of the attention from investors will be on the Federal Open Market Committee's quarterly interest rate forecast, including whether new jobs and inflation data have caused any changes.

In the corporate world, China Vanke is in talks with banks about a debt swap that could help the cash-strapped developer avoid its first-ever bond default, people familiar with the matter said.

Elsewhere, oil prices rose after four days of declines after an industry report pointed to a decline in U.S. crude inventories, offsetting swinging production cuts from the Organization of the Petroleum Exporting Countries (OPEC). Gold prices ended their record rally and continued to fall as inflation rose faster than expected in the US.

This week's main events:

-

Eurozone industrial production, Wednesday

-

ECB Executive Board member Giannis Stournaras speaks on Wednesday

-

Volkswagen, Adidas financial results, Wednesday

-

US PPI, Retail Sales, New Unemployment Insurance Claims, Business Inventories, Thursday

-

Chinese real estate prices Friday

-

Japan's largest trade union federation announces results of annual wage negotiations on Friday ahead of Bank of Japan policy meeting

-

Bank of England releases inflation survey on Friday

-

US Industrial Production, University of Michigan Consumer Sentiment, Empire Manufacturing, Friday

The main movements in the market are:

stock

-

S&P 500 futures were little changed as of 11:49 a.m. Tokyo time.

-

Japan's TOPIX fell 0.4%

-

Australia's S&P/ASX 200 rose 0.2%

-

Hong Kong's Hang Seng rose 0.1%

-

The Shanghai Composite fell 0.6%.

-

Euro Stoxx50 futures fell 0.1%

-

Nasdaq 100 futures fell 0.1%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0926.

-

The Japanese yen rose 0.2% to 147.36 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.1933 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6610.

cryptocurrency

-

Bitcoin rises 1.3% to $71,957.34

-

Ether rises 2% to $4,029.27

bond

-

The 10-year government bond yield was almost unchanged at 4.14%.

-

Japan's 10-year bond yield fell 1 basis point to 0.760%.

-

The Australian 10-year bond yield rose 6 basis points to 4.01%.

merchandise

-

West Texas Intermediate crude rose 0.5% to $77.94 per barrel.

-

Spot gold rose 0.1% to $2,161.21 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Georgina McKay, Eddy Duan, and Rob Verdonck.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP