Get free access to our editors' top ideas and insights.

among them

The partnership aims to capitalize on the continuing theme that many credit unions are keen to offer auto loans.according to

“While there was still competitive appetite among credit unions to expand auto loans to borrowers in 2023, the market was certainly impacted by the rising interest rate environment,” said Darryl Jones, senior director at Cornerstone Advisors. ” he said. He said most financial institutions are anticipating interest rate easing and potential pent-up demand from consumers who may have put off purchasing cars in 2023 due to high interest rates. The company expects the financing environment to remain flat or improve slightly.

In states like California,

Erin Mendez, chief executive officer of Patelco Credit Union in Dublin, California, has been working with Origence since before the launch of FI Connect and is a pilot company for the new EV-focused partnership with Tesla. He promoted his organization to become one.

“California has been an early adopter of energy efficiency initiatives. [for some time]”Being involved in FI Connect, whether it's in the solar field, whether it's in the EV field, or frankly in the hybrid field, from an automotive perspective, and personally,” Mendez said. This is an important initiative from the perspective of our members.”

Richard Wada, Patelco's chief lending officer, said that even though loans were flat or saw only modest growth last year, auto loans accounted for a small portion of the credit union's total portfolio of $9.7 billion in assets, based on loan balances. accounted for approximately 25%. The credit union's direct auto loans totaled more than $1.7 billion last year, both new and used, according to data from the National Credit Union Administration.

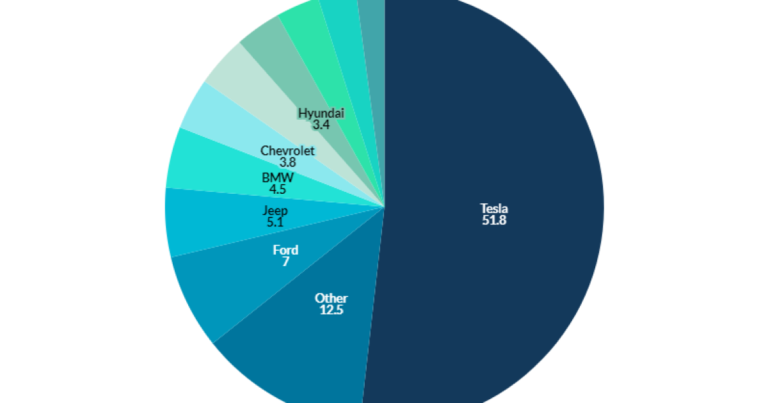

data from

In May, Origence officially launched its indirect financing subsidiary, FI Connect, and began work on integrating it into Tesla's allocation engine to distribute loan applications to partner financial institutions. Consumers looking to finance the purchase of an EV can choose from a variety of financing options at retail stores as well as at the point of sale on the company's website and mobile platforms.

After the company purchases the assigned loan from Tesla, FI Connect matches or sells the loan to an affiliated credit union. Consumers who are members of any institution that works with FI Connect will be automatically assigned to that credit union, and other consumers will be assigned to another eligible lender. When a consumer becomes a credit union borrower, he or she automatically becomes a member of that credit union.

Tony Butel, president and CEO of Origence, said building the allocation engine was no easy task as the platform needed to accommodate 1,000 credit unions through a streamlined integration with Tesla. explained. FI Connect currently partners with 21 credit unions across seven states and can process approximately $3.3 billion in annual EV lending capacity.

“Tesla has done a great job of helping consumers buy and finance cars from Tesla. [but] “What we needed to figure out was an easy way for credit unions to have the same experience without the headache of hundreds of integrations on the Tesla side,” Butel said.

Banks and other institutions looking to tap into the growing EV market are launching campaigns such as educational microsites and direct-to-consumer options.

Experts at companies like Credit Union Leasing of America work with credit unions to provide indirect auto financing options by bridging the gap between dealerships and lenders. said that affordability remains a key hurdle for potential Tesla and other model buyers.

Mark Chandler, CULA's vice president of business development, said the flexibility built into leases allows lessees to benefit from more favorable terms with lower monetary commitments, while financial institutions benefit from lower risk. He said he could benefit from it.

“As we look ahead to 2024, a ‘new normal’ is evolving where credit unions focus on managing liquidity. It allows us to maintain our portfolio and make loans,” Chandler said.