One of Warren Buffett's secrets to successful investing is holding stocks for the long term. Buffett may have “missed” certain stocks that skyrocketed overnight, but he also avoided big losses in some of the market's former high flyers.

chairman of berkshire hathaway His strategy has proven to be one that shareholders can count on to deliver superior performance over the long term. Under his leadership, Berkshire Hathaway generated nearly 20% compound annual returns over 58 years. S&P50010% increase in

It's no wonder investors are closely monitoring Buffett's every move. Here's one move Buffett won't be making anytime soon. The billionaire investor says he has no intention of selling two long-held stocks this year. In a recent letter to his shareholders, Buffett wrote that he intends to keep his shares intact. coca cola (NYSE:KO) and american express (NYSE:AXP) Unspoiled.

Read on to find out why Buffett plans to maintain his position in these two companies and whether you should add them to your buy list.

powerful moat

Coca-Cola and American Express have become household names over the years. The former is the world's largest non-alcoholic beverage maker, selling its namesake drink along with many others. The latter is a world leader in payment services. All of these companies have grown double-digit profits over the past five years, and over time they've built another thing Buffett loves: strong moats, or competitive advantages.

Coca-Cola's moat is its brand power. The company sells certain beverages that people crave (such as Coca-Cola), but they generally don't replace them with alternatives. American Express's moat is the benefits and security it provides to its card members. When they shop, they know they can easily get a refund if an item doesn't arrive or is damaged, and American Express offers generous benefits to card users. For these reasons, cardmembers remain loyal and are willing to pay their American Express card fees each year.

Over time, both Coke and AmEx (American Express), like their core products, became household names around the world. It is a timeless necessity for the world,” Buffett wrote in a recent letter to Berkshire. Hathaway shareholder.

These days, despite economic hardship, both companies are doing quite well. Last year, Coca-Cola's global unit case volume and revenue increased even as the beverage maker raised prices, and profits increased by double digits. The company also gained value share in the overall non-alcoholic beverage market. Coca-Cola accomplished this through innovation to maintain the products people know and love and to attract new customers.

American Express double-digit revenue increase

As for American Express, the company has made significant progress since announcing its growth plan in January 2022. Revenue rose more than 40% to $61 billion, and cardholder spending rose 37% to a record $1.5 trillion.

Like all credit card companies, American Express faces the risk of default and delinquency, where cardholders are unable to pay or are late, but with a premium customer base, this risk is likely to be lower. there is.

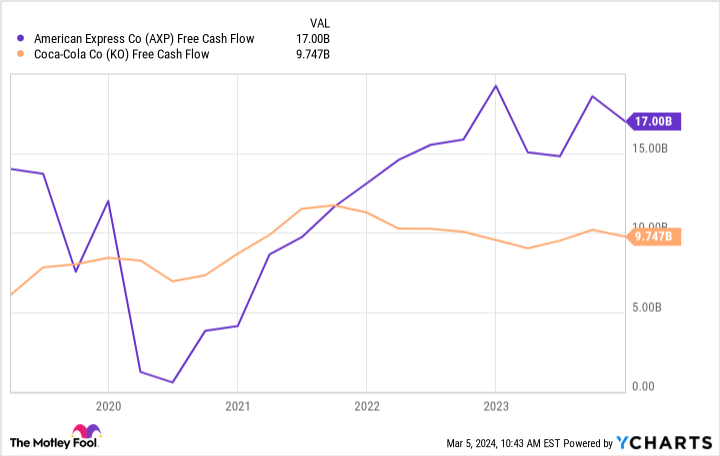

Buffett praises these two companies for their strong operations, steady revenue growth, and annual dividends that reward loyal shareholders. Both companies have the free cash flow to provide continued passive income, and Coca-Cola has raised its dividend for more than 50 years in a row.

Coca-Cola pays investors $1.94 per share per year for a dividend yield of 3.26%, while American Express pays a dividend of $2.40 per share for a yield of 1.09%. Buffett expects both companies to increase their dividends this year, and as a shareholder he stands to benefit from that.

Stable evaluation over a long period of time

Let's get back to our question. Should these stocks that Buffett is targeting keep on your buy list?

The valuations relative to earnings for these stocks have been stable over the years and are reasonable considering all the points mentioned above. Coca-Cola and American Express stock trade at approximately 24 times and 19 times trailing 12-month earnings, respectively.

Coca-Cola and American Express are great buys right now for investors looking to follow Buffett's lead and buy high-quality businesses that also provide passive income.

Should you invest $1,000 in Coca-Cola right now?

Before buying Coca-Cola stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Coca-Cola wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 8, 2024

American Express is an advertising partner of The Ascent, a Motley Fool. Adria Cimino holds a position at American Express. The Motley Fool has a position in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

2 Warren Buffett says, “I'm not selling.''What should I buy next? Originally published by The Motley Fool