Just because a company isn't making profits doesn't mean its stock price will go down. For example, if you've owned the stock since 2005, Salesforce.com, a software-as-a-service business, has lost money for years while its recurring revenue has grown, but if you've owned the stock since 2005, it's certainly a very It would have worked fine. That being said, there are risks involved, as unprofitable companies can burn through all their cash and go into distress.

So the obvious question is, Onconova Therapeutics (NASDAQ:ONTX) shareholders are debating whether they should be concerned about its cash burn rate. In this article, we define cash burn as annual (negative) free cash flow. This is the amount of money a company spends each year to fund growth. First, we compare its cash burn to its cash reserves to calculate its cash runway.

Check out our latest analysis for Onconova Therapeutics.

When will Onconova Therapeutics run out of money?

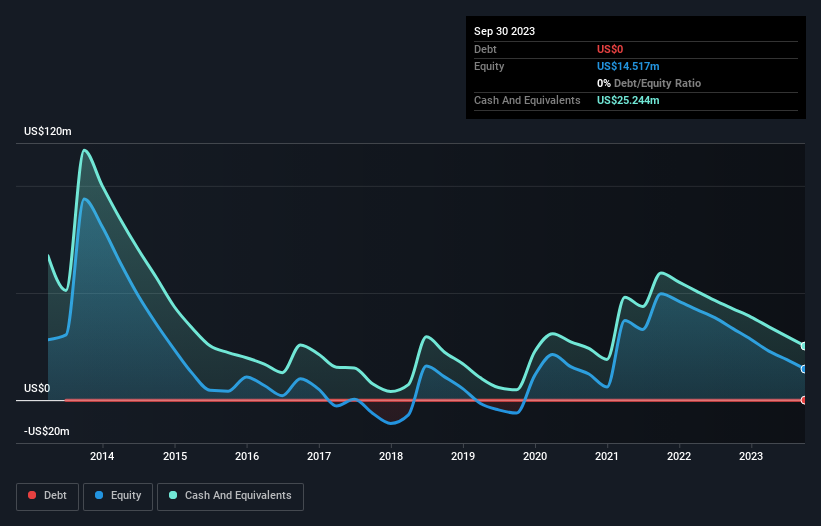

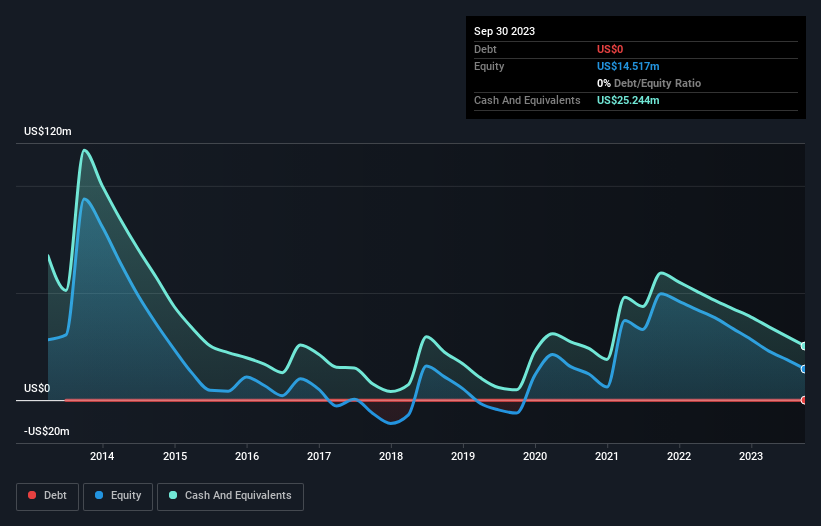

A company's cash runway is calculated by dividing its cash holdings by its cash burn. When Onconova Therapeutics last reported its September 2023 balance sheet in November 2023, it had zero debt and cash worth US$25m. Last year's cash burn was US$17 million. Therefore, we had a funding period of approximately 17 months from September 2023. That's not too bad, but it's safe to say the end of its cash runway is in sight unless its cash burn decreases significantly. The image below shows how its cash balance has changed over the past few years.

How has Onconova Therapeutics' cash burn changed over time?

In our view, Onconova Therapeutics hasn't yet generated significant operating revenue, as it only reported US$226k in the last twelve months. Therefore, in this analysis we will focus on how its cash burn is tracking. Its cash burn rate has increased by 4.3% over the last year, and it appears that the company is gradually increasing its investment in the business over time. However, if spending continues to rise, the company's actual cash runway will be shorter than implied above. The past is always worth studying, but it is the future that matters most. For this reason, it makes a lot of sense to see what analysts are predicting for the company.

How easy is it for Onconova Therapeutics to raise capital?

Onconova Therapeutics shareholders still need to keep in mind that it may need more cash in the future, as its cash burn has increased (albeit slightly). Companies can raise capital through debt or equity. One of the main advantages of publicly traded companies is that they can sell stock to investors to raise cash and fund growth. By looking at a company's cash burn compared to its market capitalization, insight into how much shareholders will be diluted if the company needs to raise enough cash to cover another year's cash burn. It can be obtained.

Onconova Therapeutics' cash burn of $17 million represents about 87% of its market capitalization of $20 million. This suggests that the company may be having cash flow difficulties, and we would be very cautious about this stock.

Are you worried about Onconova Therapeutics' cash burn?

We have to mention that we thought Onconova Therapeutics's cash runway was relatively promising, although its cash burn relative to market capitalization makes us a bit concerned. After considering this range of actions, we think shareholders should pay close attention to how the company uses its cash, as cash burn is unpleasant for us. Apart from this, we investigated various risks affecting the company and found the following: 5 warning signs for Onconova Therapeutics (Two of which you shouldn't ignore!) you need to know about.

of course, You may find a great investment if you look elsewhere. So take a look at this free List of interesting companies and this list of growth stocks (according to analyst forecasts)

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.