JHVE Photo

After a period of purgatory, Bristol-Myers Squibb Company (New York Stock Exchange:BMY) has finally returned to growth mode, albeit relatively slowly. Biopharmaceutical companies are facing an excruciating period when the LOE of major drugs such as Revlimid weighs on sales.my investment paper We remain bullish on biopharmaceutical stocks even after a solid rebound from the lows.

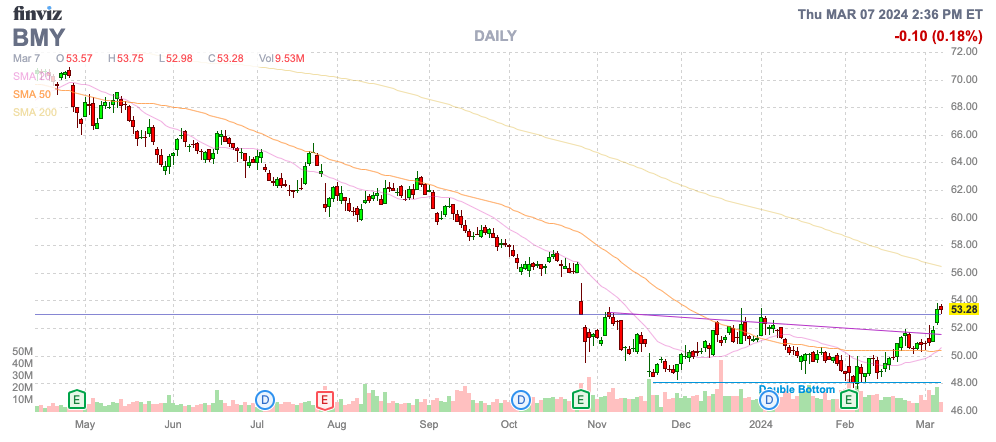

Source: Finviz

turnaround quarter

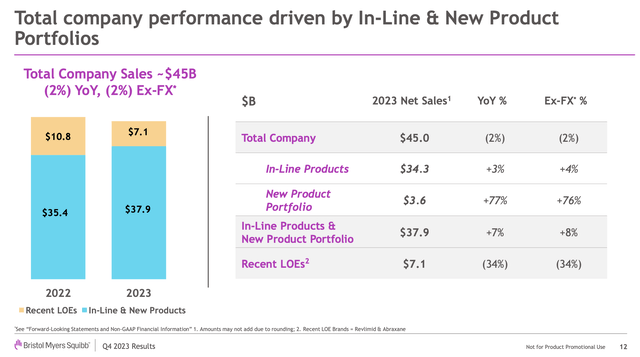

Bristol-Myers just reported a quarter in which its sales actually returned to growth after five quarters of year-over-year declines. The biopharmaceutical's annual sales were still down 2% to $45 billion, but importantly, there were signs that the business would eventually move beyond LOE's drug losses.

Source: Bristol-Myers Q4 2023 Presentation

The company expects core LOE drug revenue to decline to $7.1 billion in 2023 and remain at $1.7 billion in the fourth quarter.Revlimid sales fell 36% to just $1.45 billion in the fourth quarter, but new hematology products Sales of drugs such as Reblozyl and Breyanzi increased, with sales totaling $423 million in the fourth quarter.

Overall, Bristol-Myers' inline product portfolio is $34.3 billion and grew 3% last year. The new product portfolio increased by 77% in the year to $3.6 billion, and in the same quarter it reached nearly $1.1 billion.

As Biopharma ended the fourth quarter, the new product portfolio approached LOE's quarterly sales. As a result, the consensus forecast is for a return to growth mode, with sales reaching $46 billion in 2024 and aiming for ~2% growth, which is in line with the company's guidance for low single-digit growth this year. They almost match.

Like most major biopharmaceutical companies, Bristol-Myers is a cash machine with a 76% gross profit margin and operating expenses of about 40% of sales. In addition, the company is acquiring smaller biotechnology companies for research and development purposes in order to limit the cost of pursuing new drug development areas.

The end result was 2023 EPS of $7.51 and operating cash flow of $14 billion. Bristol-Myers will use this cash flow to fund growth starting in 2024.

dilutive hit

The stock price appears to have already bottomed out at $48 in early February, and Bristol-Myers is currently already trading at $53. Biopharmaceutical companies still face EPS pressure due to some dilutive acquisitions, but the market is clearly looking in a positive direction beyond these numbers.

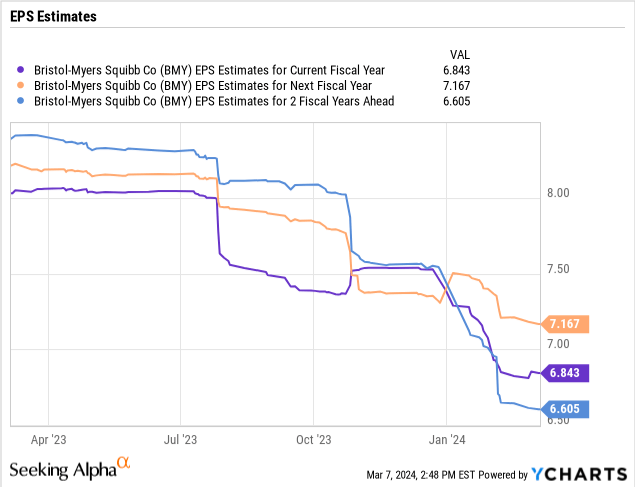

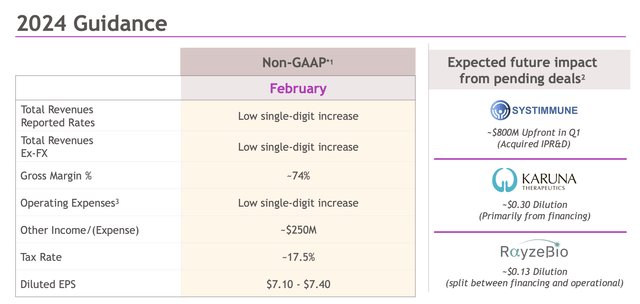

Bristol-Myers expects 2024 EPS to be in the range of $7.10 to $7.40 per share, excluding some pending dilutive transactions. Consensus estimates drop the EPS target to just $6.84.

The company provided 2024 EPS guidance that reflects recent acquisitions. Mirati Therapeutics closed in January 2024 for approximately $5 billion, but this figure does not include the impact of announced strategic acquisitions. Rays Bio and Karna Therapeutics (KRTX), expected to close in the first half of 2024. Bristol-Myers expects Karuna dilution to be $0.30 and RayzeBio dilution to be $0.13.

Source: Bristol-Myers Q4 2023 Presentation

Karuna's deal includes a $14 billion cash payment for its experimental schizophrenia drug KarXT. Analyst consensus forecasts suggest the biotech company's revenue could be minimal this year, jump to more than $250 million in 2025, and top $1 billion in revenue by 2027. It is expected that

The addition of these biotechs to a strong pipeline of drugs already on the market or in development should lead to a return to solid growth in the coming years. The market is now looking at a goal of EPS above $7 as Bristol-Myers overcomes EPS dilution and returns to growth mode.

Even if the stock recovers above $53, it still trades at only about 7 times its 2025 EPS target. Bristol-Myers had a high net debt of $27 billion at year-end, and will pay up to $23 billion in the three cash transactions mentioned above.

The company spends just under $5 billion in dividend payments and still maintains a 4.5% dividend yield. Bristol-Myers has up to $9 billion in operating cash flow to repay debt from these transactions, and these biotechs should ultimately contribute to future cash flow growth.

remove

Importantly for investors, the market favors growth biopharmaceutical stocks. Bristol-Myers just returned to growth after a slow year in 2023, leading to further upside potential for the stock. The company faces a volatile year as the next two dilutive transactions will be added to its financial targets once the deal closes. Investors should take advantage of any weakness to buy more stocks going forward.