block (NYSE:SQ) Shares soared last week after the company reported fourth-quarter results and provided guidance for 2024. Investors were pleased to see the company's cost-cutting efforts paying off and improved gross margins, and next year's outlook was an even bigger reason. For optimism.

Block is well-positioned with some key demographics, and the stock has the potential for explosive upside as the company gains control over expenses. Here's why Block is a no-brainer for today's investors.

Block's Dual Engine: Powering Payments and Personal Finance

Jack Dorsey and Jim McKelvey founded Block (then known as Square) in 2009 with the mission of helping small businesses accept credit card payments. At the time, solutions were clunky and expensive, so the company's products leveraged technology to create more convenient and accessible payment solutions. The company's Square payment solution has generated $3.1 billion in gross profit over the past year.

Another important part of Block's business is the Cash App. In its early days, Cash App simplified peer-to-peer payments and made it easy for users to send money. Since then, Block has expanded Cash App's services to provide users with banking and investment services. This segment of the company's operations generated $4.3 billion in gross profit last year.

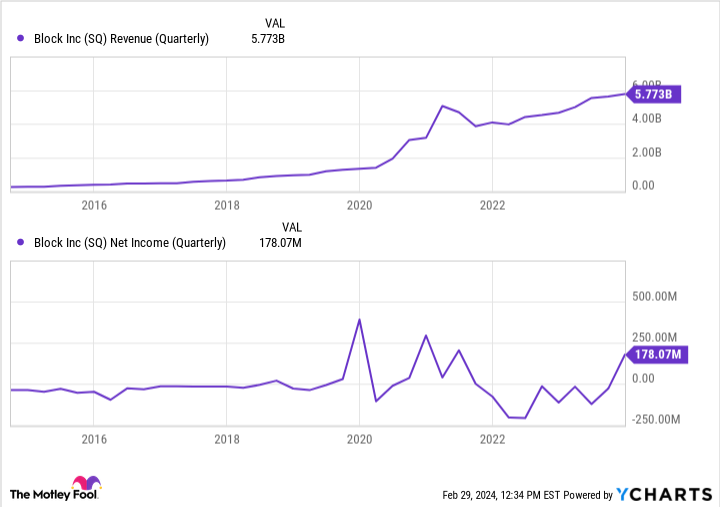

Block dealt with increased expenses

It hasn't always been smooth sailing for block investors. Block's net income in 2019 was $375 million. However, over the next few years, as the company expanded its scope and product offerings, expenses far exceeded revenues. As a result, net income declined every year until 2022, posting a loss of $541 million. Block faced increased scrutiny over these rising costs, and as a result, the company's stock price fell 87% from its peak price of $289 per share in August 2021 to October 2023.

The company announced plans in November to streamline operations and increase efficiency. CEO Jack Dorsey said in a letter to shareholders that the company will maintain its headcount cap at 12,000 “until we feel that business growth has meaningfully exceeded company growth.” .

Block immediately began cost-cutting efforts in the fourth quarter, posting net income of $178 million, with analysts expecting adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $562 million. exceeded. The company has seen impressive growth across Square and Cash App, with year-over-year gross profit increases of 18% and 25%.

The company's net profit situation has improved, and analysts have been impressed with Mr. Block's cost-cutting measures. Block's adjusted operating margin in 2023 was his 4%, but by the fourth quarter he had risen to 9%. Investors were most optimistic about Block's 2024 outlook on the company's earnings call. Block expects gross profit to be $8.65 billion, or 15% year-over-year growth. The company also expects its operating margin to be 13%, up from 9% in the fourth quarter.

What's next for the block?

In Block's letter to shareholders, Dorsey told investors the company is focused on growth and more impactful work. Block is reorganizing his Square team and taking steps to leverage artificial intelligence (AI) to help sellers manage more business and grow their customer base. Dorsey believes the company's “seller platform will be our superpower” to reinvigorate growth across the product.

Block is also working to make Cash App one of the top banking services offered to households with incomes of $150,000 or more. The company found that customers who directly deposit $2,000 or more in Cash App were six times more likely to use other features. To attract more customers, the company is offering a 4.5% yield on direct deposit savings accounts while better integrating Afterpay, a buy now, pay later solution, into its Cash App Card and its app. We plan to provide

The good news for Brock is that he is well placed among the younger generation. According to The Motley Fool's Generational Investing Tools Study, Cash App is the most used investing app across all generations, with 38% of respondents saying they use it. Usage is highest among Millennials and Gen Z, with 54% and 50% of respondents saying they use the app at least once a month.

Block stocks are a buy today.

Analysts were pleased with Block's fourth-quarter results and outlook, with several raising their price targets and upgrading the company's rating to “buy.” After recent gains, the company's stock trades at 2.2 times sales and 24 times expected earnings. The company needs to prove it can continue to implement cost efficiencies and improve profit margins, but it has done a solid job so far.

Given its position among the younger generation, its focus on improving efficiency, and integrating its Square and Cash App products, I think Block stock is a great stock to buy now and hold for years to come.

Should you invest $1,000 in Block now?

Before purchasing Block stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Brock wasn't one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

Courtney Carlsen has no position in any stocks mentioned. The Motley Fool holds a position in and recommends Block. The Motley Fool has a disclosure policy.

Why Block Stock is Easy to Buy Today was originally published by The Motley Fool