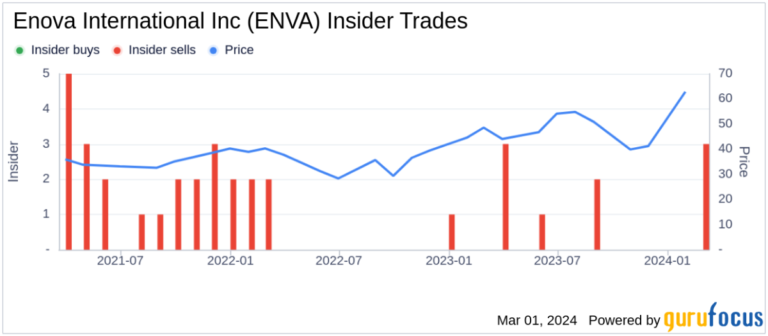

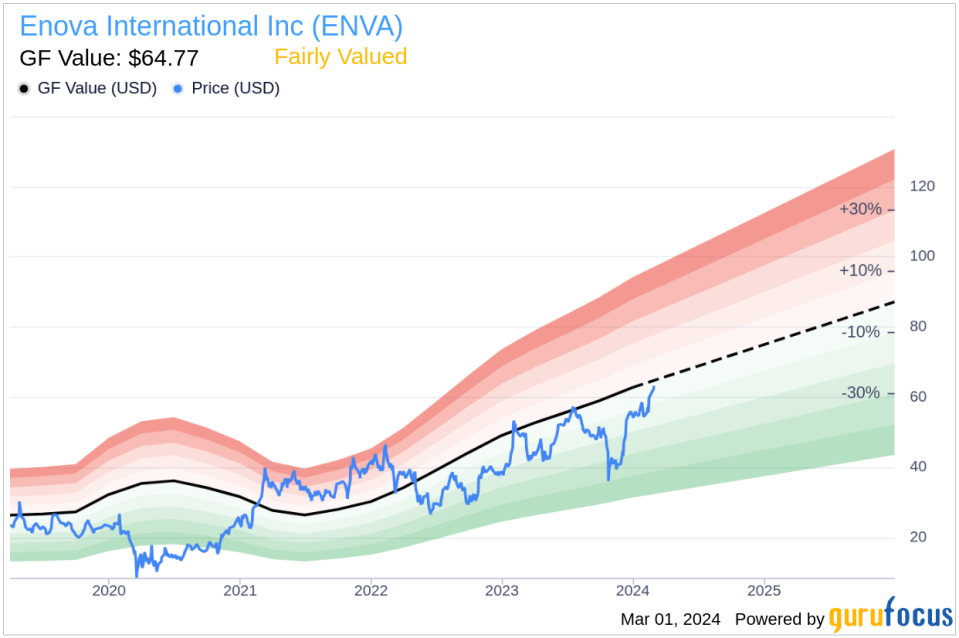

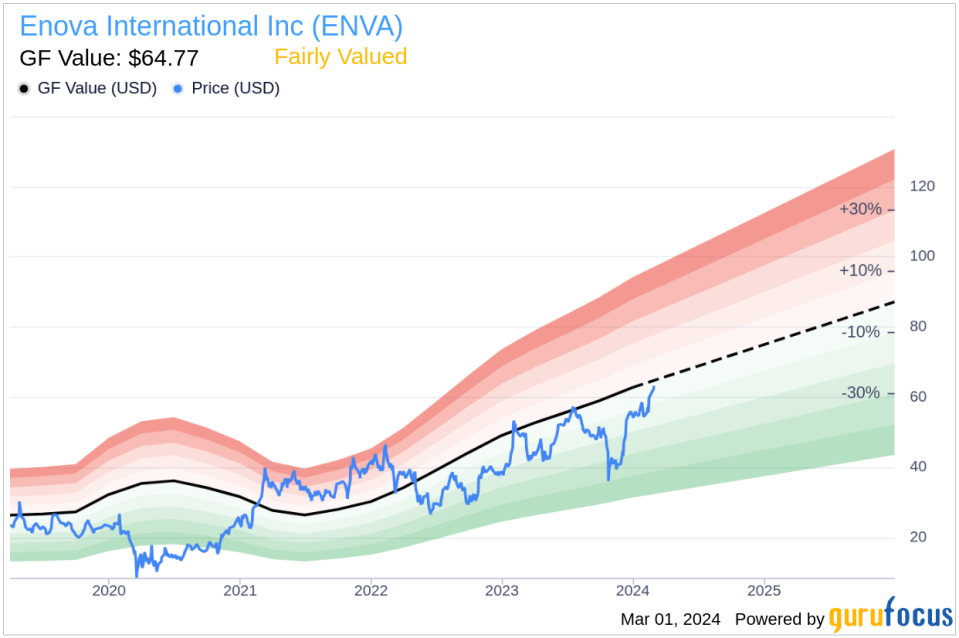

Enova International Inc (NYSE:ENVA), a financial technology and analytics company that provides loans and financing to consumers and small businesses, reported insider sales, according to a recent SEC filing. Director Linda Rice sold 5,000 shares of the company's stock on February 28, 2024. Linda Rice, who holds a position at the company, executed the sale at an average price of $62.12 per share, giving her a total transaction value of $310,600. Following this transaction, insider direct ownership in Enova International Inc. will be adjusted according to the company's latest filing with the Securities and Exchange Commission. Linda Rice has made several transactions involving the company's stock over the past year. The insider sold a total of 7,920 shares and made no purchases during the period. Enova International Inc.'s insider trading history reveals a pattern of insider sales over the past year, with a total of 9 insider sales recorded. Insiders don't buy. This may indicate an insider's perception of stock valuation or personal financial planning strategies. In terms of valuation, Enova International Inc.'s stock was trading at $62.12 on the most recent day of insider sales, giving the company a market capitalization of $1.782. a billion. The company's price-to-earnings ratio of 11.54 is below the industry median of 14.44, suggesting it may have a lower valuation compared to its peers. A comparison of the stock price to GuruFocus Value (GF Value) shows that Enova International Inc is fairly priced. You cherish. The current stock price is $62.12 and the GF value is $64.73, so the price to GF value ratio is 0.96.

GF Value is GuruFocus' proprietary estimate of intrinsic value, which includes historical trading multiples, GuruFocus' adjustment factors based on the company's past performance, and future estimates provided by Morningstar analysts. Performance estimates are taken into account.

Investors and analysts often monitor insider transactions as it can provide insight into what insiders think of a stock's current valuation and future prospects. However, it is also important to consider that insider selling can occur for a variety of reasons and does not necessarily reflect a negative outlook on a company's future performance.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.