-

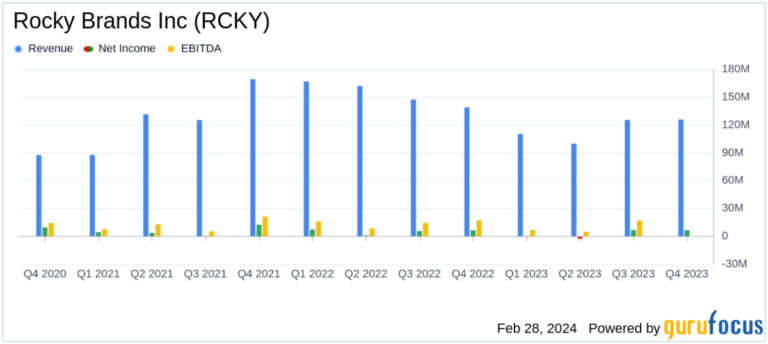

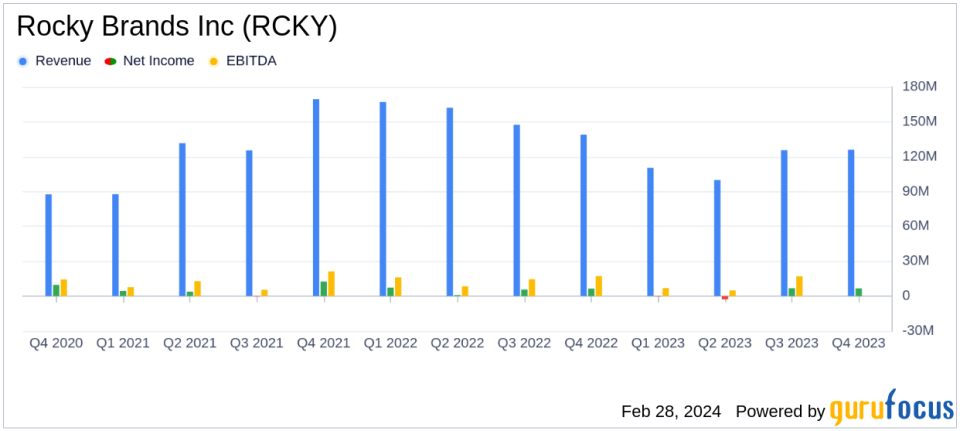

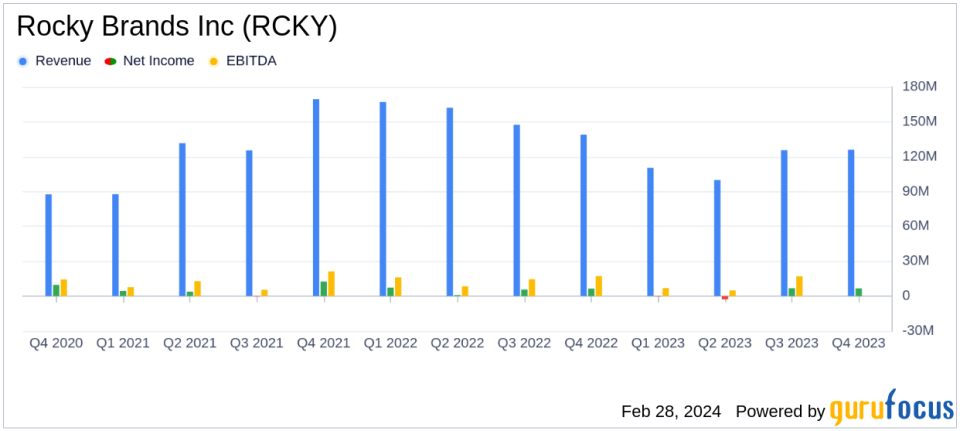

net sales: Full year net sales decreased 25.0% to $461.8 million, and fourth quarter net sales decreased 9.3% to $126 million.

-

Net income: Full-year net income decreased 49.1% to $10.4 million, and fourth-quarter net income increased 3.0% to $6.7 million.

-

debt reduction: Total debt significantly decreased by 32.6% to $175 million at year-end.

-

Inventory control: Year-end inventory decreased significantly by 28.1% to $169.2 million.

-

gross profit:For the full year, gross profit margin improved to 38.7% of net sales, an increase of 230 basis points.

-

Operating expenses: Operating expenses were reduced, contributing to an efficient cost structure.

On February 28, 2024, Rocky Brands, Inc. (NASDAQ:RCKY) released its 8-K report detailing both its fourth quarter and full year 2023 financial results. The company is known for its product design, manufacturing and marketing. The company, which deals in premium quality footwear and apparel, operates through wholesale, retail and contract segments, with the majority of its revenue coming from the wholesale segment.

Despite challenging market conditions, Rocky Brands overcame headwinds to deliver better-than-expected operating income in the fourth quarter. However, the picture completely changed for the full year, with operating income and net income declining significantly by 19.7% and 49.1%, respectively. CEO Jason Brooks acknowledged the challenges facing the wholesale sector, but remained optimistic about consumer demand for the company's brands.

Financial performance and balance sheet strength

Rocky Brands' 2023 financial results were characterized by significant reductions in both inventory and debt levels, which the company uses to strengthen its balance sheet and position it for future growth and increased shareholder value. This is seen as a strategic measure. Reductions in inventory and debt levels of $66.2 million and $83.8 million, respectively, reflect the company's commitment to efficient inventory management and financial stability.

The company's fourth quarter gross profit margin was 40.3% of net sales, a slight decrease year-over-year primarily due to the impact of customs duty refunds received in the fourth quarter of 2022. However, the gross profit margin improved significantly for the full year. The growth was driven by an increase in the sales composition of the retail division and an improvement in the wholesale division.

Operating expenses decreased to 28.6% of net sales in the fourth quarter, down from 31.0% in the prior year period, due to cost reduction initiatives and operational efficiencies. Adjusted operating income for the fourth quarter was 12.3% of net sales, up from 11.0% in the year-ago period.

“We are encouraged by our fourth quarter results, which overcame top-line headwinds and delivered operating income that exceeded expectations,” said Jason Brooks, chairman, president and CEO.

Challenges and prospects

Rocky Brands faced several challenges throughout 2023, including weak markets, delays in manufacturing and shipping schedules, and a transition to a distributor model in Canada. As a result of these factors, sales and net income decreased compared to the same period last year. However, the company's results in the fourth quarter suggest these declines are moderating, providing a more positive outlook for the future.

Looking to the future, Rocky Brands aims to leverage its strengthened balance sheet to drive profitable growth and invest in business initiatives that increase shareholder value. The company's focus on operational efficiency and inventory management is expected to support its ambitions for long-term success.

For a detailed analysis of Rocky Brands Inc. (NASDAQ:RCKY)'s financial results, including a complete income statement, balance sheet, and cash flow statement, investors are encouraged to review the company's 8-K filing. Recommended.

Rocky Brands will hold a conference call to discuss its fourth quarter results, providing an opportunity for investors and analysts to gain further insight into the company's performance and strategy.

For more information about Rocky Brands and its portfolio of brands, please visit RockyBrands.com.

For more information, please see the full 8-K earnings release from Rocky Brands Inc here.

This article first appeared on GuruFocus.